- Silver Tiger Metals (TSXV:SLVR) has filed a preliminary feasibility study for its El Tigre project in Sonora, Mexico

- The study projects a 10-year mine life with 43 million payable silver equivalent ounces or 510,000 payable gold equivalent ounces

- El Tigre’s after-tax net present value (5 per cent) is estimated at US$222 million with a 40 per cent internal rate of return and a 2-year payback

- Production start-up work ongoing with potential expansion through further assessments in 2025

Silver Tiger Metals (TSXV:SLVR) has solidified plans for its El Tigre silver and gold project in Sonora, Mexico, with a preliminary feasibility study (PFS).

The PFS outlines robust financial and operational metrics, forecasting an after-tax net present value (5 per cent) of US$222 million, an internal rate of return (IRR) of 40 per cent, and a 10-year mine life expected to yield 43 million silver equivalent ounces (AgEq) or 510,000 gold equivalent ounces (AuEq). Initial capital costs are estimated at US$86.8 million with an 18-month construction timeline.

Key operational highlights include a low operating strip ratio of 1.7:1 and all-in sustaining costs (AISC) of US$14/oz AgEq, positioning El Tigre as a competitive player in the global silver and gold markets. The mine is expected to achieve average annual production of 4.8 million AgEq ounces.

Silver Tiger plans to build on this momentum with a preliminary economic assessment in the first half of 2025, evaluating further opportunities to enhance the project’s economic value.

Greg Jessome, Silver Tiger Metals’ chief executive officer, stated, “This filing marks a significant milestone as we prepare to unlock El Tigre’s immense potential. The PFS demonstrates the project’s strong economic feasibility and positions Silver Tiger for sustained growth.”

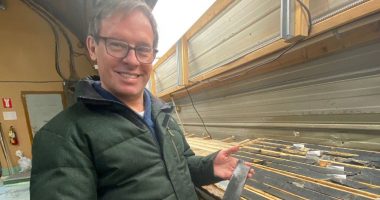

The historic El Tigre district, known for its rich epithermal deposits, has a storied legacy of high-grade silver and gold production.

About Silver Tiger Metals

Silver Tiger Metals is a Canadian mining company specializing in the exploration and development of silver and gold projects. The company’s flagship asset is the 100-per-cent owned El Tigre project in the historic El Tigre mining district in Sonora, Mexico.

Silver Tiger Metals stock (TSXV:SLVR) is unchanged trading at C$0.25 per share as of 10:01 am ET. The stock has added 38.89 per cent year-over-year.

Join the discussion: Find out what everybody’s saying about this silver and gold stock on the Silver Tiger Metals Inc. Bullboard and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of Silver Tiger Metals’ rehabilitation efforts at the El Tigre gold and silver project: Silver Tiger Metals)