Investing in a company with gold projects in Nevada can be a smart move for several reasons.

Nevada is renowned for its rich gold deposits and favourable mining regulations, making it one of the top gold-producing regions globally. One company that has been growing its reach in the area is Eminent Gold Corp. (TSXV:EMNT), who recently secured a 100 per cent interest in the state’s Celts gold project.

This acquisition marks a significant milestone for Eminent, enhancing its exploration portfolio with a project that boasts promising geological similarities to the successful Silicon discovery.

The Celts project: A solid-gold addition

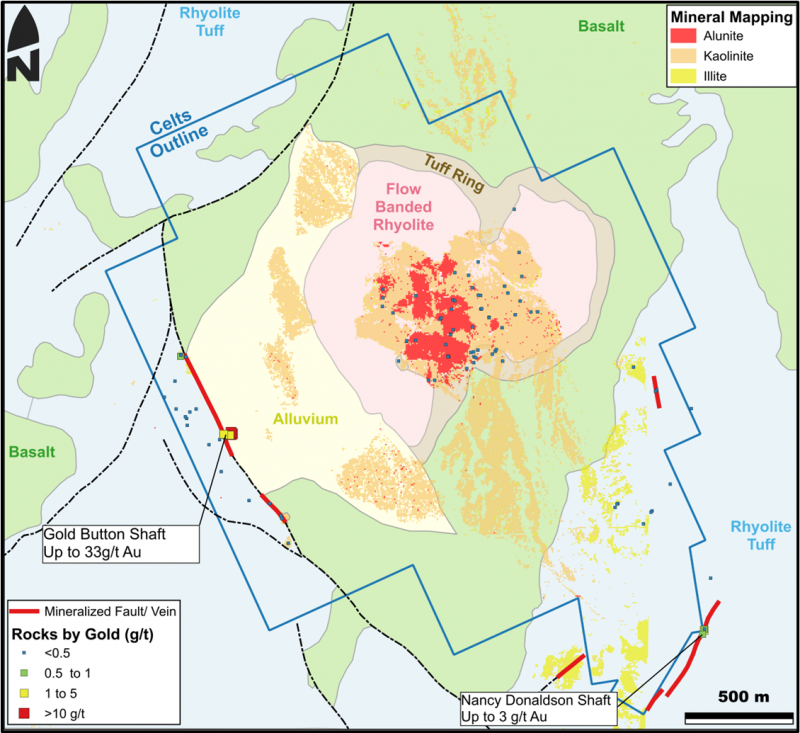

The Celts project, originally identified and staked by Orogen’s (TSXV:OGN) technical team, spans 67 unpatented claims over 5.6 square km. Located in southeastern Nevada, 13 km northeast of the historic town of Goldfields, the project is situated in a region with a rich gold endowment of approximately 5.5 million ounces.

The technical team behind the Celts project is the same group responsible for AngloGold Ashanti’s NYSE:AU) Silicon discovery, which boasts 3.4 million ounces of indicated gold resources and 800,000 ounces of inferred gold resources. Following the success at Silicon, AngloGold discovered an even more extensive deposit within Orogen’s area of interest, known as Merlin, with an inferred resource of 9.05 million ounces of gold. Given the similar geology and regional setting, the Celts project represents a significant addition to Eminent’s exploration portfolio.

Transaction highlights

The acquisition terms for the Celts project are structured to help ensure a balanced investment:

- Total payment: US$400,000

- At closing:

- US$30,000 in cash

- US$45,000 in Eminent common shares

- Within six months of closing:

- US$325,000 in cash or Eminent common shares (at Eminent’s discretion, subject to regulatory approval)

- Property claims:

- 3 per cent net smelter return (NSR) royalty

- Option to repurchase 1 per cent of the royalty for US$1.5 million (reducing the NSR to 2 per cent)

- Proceeds split:

- US$200,000 in cash and/or shares to each Orogen and a subsidiary of Altius Minerals Corp.

- 1.5 per cent NSR royalty to each Orogen and Altius

Leadership’s take

“The Celts project presents a substantial opportunity, where we can leverage the extensive groundwork already completed, and advance this project both efficiently and cost-effectively,” the company’s president and CEO, Paul Sun explained via a news release on the acquisition. “Our current drill program at Hot Springs Range is a significant step in this direction and will be ongoing depending on results. We are preparing final permits to drill Gilbert South and completing the final steps to advance Celts to a drill-ready, permitted stage in the first half of 2025.”

CEO Sun expanded further on the company’s strategy for next year in an exclusive interview with the Market Online’s Watchlist.

“As we do with all projects, we methodically will do surface work and geophysics and will hone to target areas to get ready for drilling,” he said. “We are creating a pipeline of opportunities to find world-class gold mines during what we think will be a long-term gold market. That’s our focus and using analogues to make discoveries and having diversified portfolios helps mitigate the risk but also increase our chances of success.”

Click the video below to watch the interview in full.

A promising future

The Eminent Goldteambelieves that the Celts project represents a strong exploration analogue to the recent Silicon discovery, located 100 km south. The acquisition aligns with Eminent’s goal to develop a pipeline of exploration projects with analogous features to world-class deposits in Nevada. The extensive groundwork already completed at Celts allows Eminent to advance this project efficiently and cost-effectively.

For investors, the Celts project offers a substantial opportunity to be part of a promising exploration venture in a region renowned for its significant gold endowment. Eminent’s disciplined approach and commitment to maximizing shareholder value through strategic exploration make this an exciting time to consider deepening your due diligence into Eminent Gold Corp.

Eminent Gold stock (TSXV:EMNT) has risen more than 72 per cent since the year began.

Join the discussion: Find out what everybody’s saying about this stock on the Eminent Gold Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Eminent Gold Corp., please see full disclaimer here.