- Disney stock (NYSE:DIS) has dropped by nearly $4 billion following the suspension of Jimmy Kimmel, triggering widespread backlash and boycotts across its platforms and upcoming releases

- The DOJ accuses Disney of violating COPPA, alleging it collected personal data from children under 13 on YouTube without parental consent and used it for targeted advertising

- Rosen Law Firm and The Schall Law Firm are investigating Disney, representing families and shareholders affected by the alleged privacy violations involving children’s content on YouTube

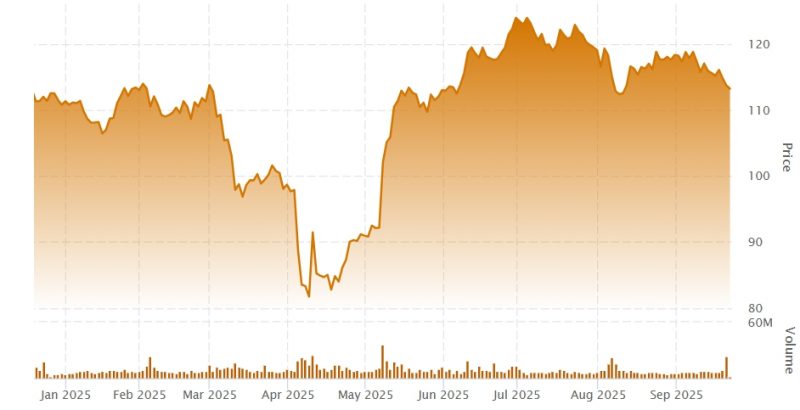

- Disney stock (NYSE:DIS) last traded at US$113.76

The Walt Disney Company (NYSE:DIS) is facing a storm of financial and legal challenges following the indefinite suspension of late-night host Jimmy Kimmel and mounting allegations of privacy violations involving children’s data on YouTube.

This article is a journalistic opinion piece which has been written based on independent research. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Disney’s market value has plunged by an estimated US$3.87 billion since ABC, a Disney subsidiary, suspended Jimmy Kimmel Live! over controversial remarks made by the host regarding the assassination of conservative activist Charlie Kirk. The backlash has been swift and widespread, with #BoycottDisney trending across social media platforms and major affiliate networks like Nexstar and Sinclair Broadcasting pulling the show from their airwaves.

The fallout has extended beyond television. Disney+ and Hulu have seen a wave of subscription cancellations, and boycotts are forming against upcoming releases such as Avatar 3 and Zootopia 2. The suspension has sparked protests, celebrity criticism, and concerns over Disney’s susceptibility to political pressure, with former President Barack Obama and other public figures defending Kimmel and condemning the move as an attack on free speech.

Meanwhile, Disney is under federal scrutiny for alleged violations of the Children’s Online Privacy Protection Act (COPPA). According to the Department of Justice (DOJ), Disney failed to label certain YouTube videos as “Made for Kids,” which allowed the company to collect personal data from children under 13 without parental consent. This data was allegedly used to serve targeted advertisements to young viewers, a direct violation of COPPA regulations.

Two prominent law firms have launched investigations into the matter:

- Rosen Law Firm, a global investor rights firm, is preparing a class action lawsuit on behalf of families affected by Disney’s alleged data collection practices. The firm claims Disney continued these practices even after being made aware of the violations.

- The Schall Law Firm, a national shareholder litigation firm, is investigating claims on behalf of parents whose children watched Disney content on YouTube. The firm emphasizes that families may have legal recourse if their children’s privacy rights were violated.

The DOJ’s complaint, filed in coordination with the Federal Trade Commission (FTC), has already led to a US$10 million settlement with Disney. As part of the agreement, Disney must implement a video-review program to ensure proper labeling of child-directed content and adopt age assurance technologies to prevent future violations.

As Disney grapples with both reputational damage and legal exposure, the company’s leadership remains under intense scrutiny. With Jimmy Kimmel’s contract set to expire in 2026 and ongoing investigations into its digital practices, Disney faces a critical juncture in its corporate governance and public trust.

Disney stock (NYSE:DIS) last traded at US$113.76 and has risen 2.16 per cent since the year began.

Join the discussion: Find out what the Bullboards are saying about Disney and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.