The global shift towards environmentalism is one of the strongest long-term tailwinds an investor can gain exposure to, making clean technology stocks a worthwhile consideration. There are three primary catalysts driving this multi-trillion-dollar shift:

- Consumers’ rapidly expanding awareness of the direct line between their choices and the health of the planet, driven by the socioeconomic effects of pollution, climate change and resource scarcity.

- Growing awareness among businesses that between the legacy and the environmental option, the latter is often the most cost-effective and competitively advantaged.

- Governments keying into the fact that industrial sustainability enhances national security, prompting a rise in incentives for environmentally oriented businesses and consumer purchases.

Companies whose value propositions carry an environmental component are then at an advantage when it comes to competing for investment dollars and garnering market share, unlike competitors still content to sidestep sustainability, as opposed to profiting from it.

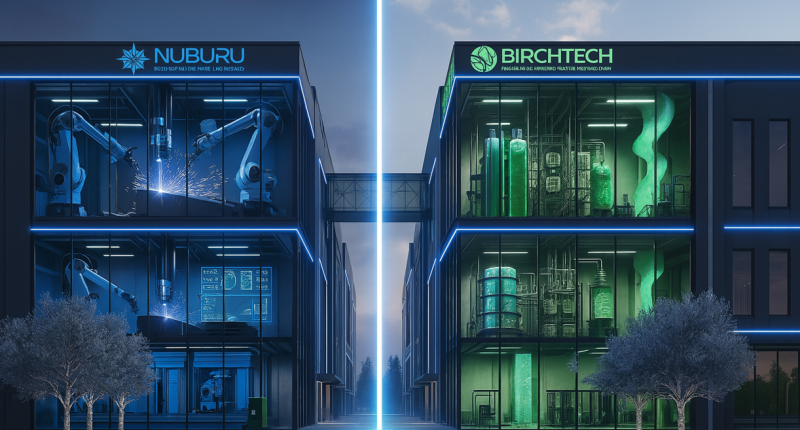

In the newest edition of Stockhouse’s Weekly Market Movers, I’ll run two promising clean technology stocks through due diligence, drawing a line between their differentiated technologies and their bottom lines.

Birchtech

Our first clean technology stock, Birchtech, market capitalization C$92.99 million, is a top provider of activated carbon technologies for air and water purification.

This article is disseminated in partnership with Birchtech Corp. and Nuburu Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

The company offers its patented SEA sorbent technologies for mercury emissions capture in the coal-fired utility sector, helping to prevent neurological disorders, heart disease, birth defects and developmental delays from over exposure. Coal-fired power plants accounted for about 16 per cent of all US energy in 2023 and are expected to play a meaningful role in the industry through 2050.

Birchtech’s smart carbon management and water treatment solutions are designed to target forever chemicals such as PFAS and PFOS in both potable and industrial water supplies, making inroads into a multi-billion-dollar opportunity – as per slide 12 of the September 2025 investor deck – while significantly decreasing consumers’ risk of cancer, immuno-deficiencies and pregnancy complications.

Management, aligned with 21 per cent insider ownership, expects its air business to ramp up to $40 million in revenue by 2026, which is more than twice total company revenue in 2024, as it deploys $57 million awarded from illegal use of its technology (final judgement pending) towards accelerating initial water treatment sales, following a $900,000 order booked in October, as well as advancing an activated carbon production facility in Texas with construction expected to break ground in 2025.

Birchtech stock (TSX:BCHT) last traded at C$0.96. The stock is down by 4 per cent since rebranding to the Birchtech name in October 2024.

Richard MacPherson, Birchtech’s founder, president and chief executive officer, spoke with Stockhouse’s Ricki Lee about the company’s strategy propelling its environmental technologies. Watch the interview here.

Nuburu

Another clean technology stock to watch, Nuburu, market capitalization US$64.26 million, specializes in value-added industrial blue laser technology with applications in defense, security and critical infrastructure.

Nuburu’s technology fits squarely into cross-industry demand for higher-performance, lower-emission manufacturing solutions to maintain a competitive edge, offering users up to eight times faster welding speeds with low to no defects, as well as up to 10 times larger and 7 times faster 3D printing capabilities, thanks to an absorption ratio multiples higher compared to infrared lasers across gold, silver, copper, aluminum, nickel and steel.

These efficiencies amount to an up to 29 per cent emissions reduction compared to infrared when producing automotive battery tabs, an up to 56 per cent reduction in additive manufacturing and an up to 76 per cent reduction in cell phone batteries, making Nuburu an indispensable name for industrial players to enhance margins and profitability.

Management believes it is well-positioned to win share in a manufacturing market expected to grow from less than US$10 billion in 2025 to US$32 billion by 2032 – as per slide 7 of the latest investor deck – backed by numerous strategic moves, including:

- A partnership with and ongoing acquisition of Tekne, an electronic warfare and cyber solutions company outfitting military vehicles that generates about US$50 million in annual revenue.

- A confidential partnership designed to advanced R&D and ISO-certified production in the defense technology industry, in addition to boosting Nuburu’s client base.

- A binding agreement to acquire Orbit, an Italian software company dedicated to strengthening mission-critical organizations. Orbit expects to grow revenue more than five times between 2026 and 2028.

Nuburu estimates that it will bill US$500,000 in revenue in Q4 2025, a robust rebound from US$150,000 in all of 2024, with further growth expected into 2026, as new acquisitions are integrated into the business and management deploys about US$6 million in cash into prospective long-term opportunities in defense, security and infrastructure, vying to harvest value only blue laser technology can unlock.

Nuburu stock (NYSEAM:BURU) last traded at US$0.51 and has given back 50.65 per cent year-over-year.

Alessandro Zamboni, Nuburu’s executive chairman and co-CEO, joined Ricki Lee for a discussion about the Orbit acquisition and how it fits within the company’s expanding presence in defense and security. Watch the interview here.

Thanks for reading! I’ll see you next week for a new edition of Weekly Market Movers, where I delve into companies that sat down with Stockhouse for an interview over the past week. Here’s the most recent article, in case you missed it.

Join the discussion: Find out what investors are saying about these clean technology stocks on the Birchtech Corp. and Nuburu Inc. Bullboards, and make sure to explore the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.