- Theralase’s (TSXV:TLT) Ruvidar and Rutherrin show strong potential in treating bladder cancer, solid tumors, and HSV-1—including drug-resistant strains—through light- and radiation-activated mechanisms that outperform current standards like acyclovir and radiation alone

- Peer-reviewed studies and conference presentations highlight Ruvidar’s antiviral efficacy without light activation and Rutherrin’s 100× tumor-kill synergy with radiation, supporting their advancement into clinical development

- Despite recent revenue declines and net losses, Theralase’s promising clinical data, regulatory momentum, and large addressable markets position it as a high-risk, high-reward opportunity for long-term biotech investors

- Theralase Technologies stock (TSXV:TLT) last traded at $0.20

Theralase Technologies (TSXV:TLT) is a Canadian clinical‑stage pharma company developing ruthenium‑based, light- and radiation-activated small molecules to destroy cancers, bacteria, and viruses. Its pipeline is anchored by two related compounds: Ruvidar (TLD‑1433), a photosensitizer delivered into the bladder and activated by green light for non-muscle invasive bladder cancer (NMIBC), and Rutherrin, a transferrin-formulated version of Ruvidar designed for radio-dynamic therapy with ionizing radiation in hard-to-treat solid tumours (e.g., glioblastoma, lung, colorectal, lymphoma). The company also markets low-level therapeutic lasers, but near-term value creation is expected to come from its drug–device platforms advancing through late-stage clinical and preclinical development.

Alongside oncology, Theralase is pursuing antiviral indications. Herpes Simplex Virus (HSV)—a common, lifelong infection transmitted primarily via skin‑to‑skin contact—remains treatable but not curable. HSV‑1 (oral herpes/cold sores) primarily spreads by oral contact and can also cause genital disease; HSV‑2 is mainly sexually transmitted and causes genital herpes. The World Health Organization estimates ~3.7–3.8 billion people under 50 carry HSV‑1 and ~491–520 million people aged 15–49 carry HSV‑2. The HSV treatment market is estimated at ~US$2.5–2.9 billion in 2024 with forecasts toward ~US$4.0–4.7 billion by 2030–2033, implying mid‑single‑ to high‑single‑digit CAGR, pointing to the commercial relevance should a novel therapy outperform today’s standards.

Ruvidar vs. Rutherrin—Same core, different missions

Ruvidar (TLD‑1433) is a ruthenium‑based photosensitizer administered intravesically for NMIBC and then activated by 520‑nm light using Theralase’s TLC‑3200 laser. Activation triggers reactive oxygen species (ROS) that selectively kill tumor cells. In a multicenter Phase II study of BCG‑unresponsive NMIBC (CIS), interim analyses reported ~62–64 per cent complete response (CR) at any time point, with durable responses at 12–36 months and no serious adverse events attributed to drug or device—data that helped secure FDA Fast Track and continued trial momentum.

Rutherrin combines the same active with recombinant human transferrin to enhance tumor selectivity and enable activation by ionizing radiation (radio‑dynamic therapy). Preclinical programs show tumor‑preferential uptake (including >10‑fold over healthy brain tissue in GBM) and synergy with radiation—mechanistically via ROS plus immunogenic cell death (ICD). These attributes position Rutherrin as a potential radiosensitizer / immune‑stimulating adjunct across multiple solid tumors.

Peer‑reviewed evidence: Ruvidar’s antiviral edge in HSV‑1 (even without light)

In September 2025, independent, peer‑reviewed preclinical data reported that Ruvidar demonstrated superiority against HSV‑1 compared with benchmark agents acyclovir (the gold standard) and metformin, even without light activation. Critically, once infection was established, acyclovir and metformin showed little to no effect, whereas Ruvidar produced a dramatic inhibitory effect post‑infection. Ruvidar also prevented spread by protecting uninfected cells and retained efficacy against acyclovir‑resistant HSV‑1 mutants, highlighting potential clinical benefit for patients suffering recurrent, drug‑resistant cold sores. Collectively, these findings support Ruvidar as a next‑generation antiviral candidate and justify advancement toward clinical development.

These antiviral data dovetail with broader mechanistic work indicating Ruvidar may inhibit deubiquitinating enzymes (DUBs) in addition to generating ROS—an emerging, resistance‑relevant pathway in oncology and virology—reinforcing its multi‑modal profile.

Market Context: Given the sheer prevalence of HSV and a US$4 billion+ addressable market later this decade, a therapy that works post‑infection and against acyclovir‑resistant strains could command meaningful clinical and commercial interest if safety and efficacy translate to humans.

Radiation‑activated Rutherrin: ASTRO‑selected poster signals a broader oncology play

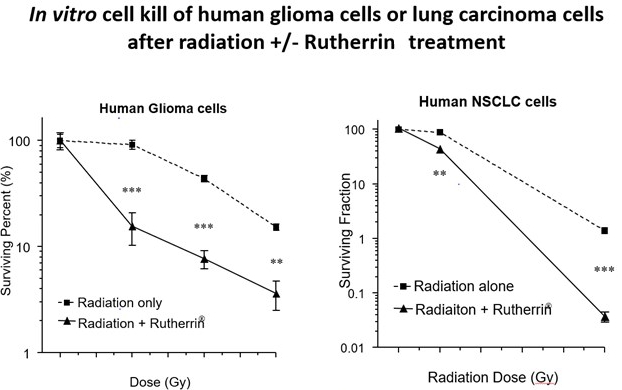

In November 2025, Theralase’s scientific poster, “Rutherrin Activated by Radiation Therapy Induces Synergistic Tumor Regression through Direct Destruction and Immune Activation in Multiple Preclinical Cancer Models,” (abstract published in the International Journal of Radiation Oncology • Biology • Physics) evaluated Rutherrin + radiation across GBM, lung, colorectal, and lymphoma models. Key findings include:

- 100× higher cancer‑cell kill vs. radiation alone (enhanced tumor destruction)

- Dual mechanism: increased ROS plus cytokine/chemokine signatures indicative of ICD (oxidative + immune activation)

- Resistance mitigation: modulation of drug efflux pathways, addressing multidrug and radiation resistance

- Durable immunity: in vivo complete regressions in colorectal models and protection upon tumor rechallenge

- Tumor selectivity and survival: >10× preferential GBM uptake vs. healthy brain and significant survival gains in GBM and lung models

The selection for ASTRO 2025 (the world’s largest radiation oncology meeting) and the journal abstract publication add scientific visibility and credibility as Theralase targets GLP tox completion and first‑in‑human studies thereafter.

Where the rubber meets the road: Clinical progress and timelines

- Bladder cancer (Ruvidar PDT): The Phase II NMIBC (CIS) study has reported interim CR ~62–64 per cent, with multi‑year durability in subsets; enrollment is nearing completion, with regulatory submissions targeted ~2026/2027 per company updates.

- Rutherrin RDT: Multiple solid‑tumor preclinical packages (including GBM and NSCLC) and conference selections (ASTRO) lay the foundation for the plan to advance into clinical testing after tox and CMC milestones.

Financial scorecard (9M 2025 vs. 9M 2024)

Theralase’s Q3 2025 results reflect a company in transition—lean commercial operations supporting a capital‑intensive R&D agenda:

- Revenue: $590,573, –5 per cent YoY (vs. $622,984)

- Cost of sales: $299,743 (51 per cent of revenue), –10 per cent YoY

- Gross margin: $290,830 (49 per cent), essentially flat YoY

- Selling expense: $212,421, –18 per cent YoY

- Admin expense: $1,444,687, +12 per cent YoY (G&A, professional fees, SBC)

- R&D: $2,116,540, +1 per cent YoY (Study II support)

- Net loss: $3,435,145, +3 per cent YoY (incl. $708,521 non‑cash)

These numbers highlight prudent cost controls in selling expenses, steady gross margin, and an expected ramp in administrative/R&D aligned with clinical execution.

Why did U.S. revenue fall by $37,000 in Q3 2025?

Management disclosed a decline in U.S. sales of therapeutic laser systems and accessories, which reduced U.S. revenue by ~$37,000 in the quarter. The press release cites lower demand for these legacy products—likely a function of competitive dynamics in medical devices, timing of purchases by clinics/distributors, and organizational focus shifting toward the oncology and antiviral pipelines.

The company’s broader 2025 cadence also included a Q1 revenue miss and stock pressure as investors repriced near‑term commercial traction versus long‑term clinical optionality—context that helps explain the softer U.S. device revenues and share weakness during the year.

The investment case: What could drive a turnaround?

Theralase is a classic biotech inflection‑point story—near‑term financials are challenged, but multiple scientific and strategic levers could catalyze re‑rating:

- Compelling clinical efficacy and durability (bladder cancer)

Interim Phase II data for Ruvidar PDT in BCG‑unresponsive NMIBC (CIS) show CR ~62–64 per cent and durable responses, surpassing clinically meaningful thresholds cited by urology groups—if replicated at data lock, this could support regulatory dossiers and commercial partnering. - Differentiated antiviral profile (HSV‑1)

Peer‑reviewed preclinical results demonstrate Ruvidar’s post‑infection efficacy and activity against acyclovir‑resistant HSV‑1, without light activation—an unusually strong profile that could justify fast‑follow clinical development in a multi‑billion‑dollar market dominated for decades by nucleoside analogues. - Rutherrin as a radiation multiplier + immune primer

The 100× cell‑kill uplift vs. radiation alone, tumor‑selective uptake, and ICD‑linked immunity collectively position Rutherrin as a platform radiosensitizer; early clinical proof could broaden addressable indications and enable partnerships with radiation oncology networks. - Capital strategy buys time

Warrant extensions and modest private placements provide runway while avoiding near‑term forced dilution, allowing the clinical story to mature. Still, investors should assume ongoing capital needs typical of clinical‑stage biotechs. - Valuation vs. optionality

With shares depressed in 2025 following misses and reduced device sales, positive trial, regulatory, or partnering news could offer asymmetric upside—the classic biotech setup where binary catalysts (e.g., Phase II completion, regulatory alignment) can reset expectations quickly.

Risks: execution (trial timelines, manufacturing, regulatory), financing (dilution risk), translation (preclinical Rutherrin and antiviral data must reproduce in humans), and commercialization (urologist and radiation oncology adoption curves).

Bottom line for investors

Theralase marries validated photodynamic oncology with a next‑gen radio‑dynamic platform and intriguing antiviral science. The 2025 setbacks—lower U.S. device sales and quarterly misses—reflect a company in the R&D heavy phase, not necessarily a broken thesis. For long‑term, risk‑tolerant investors, the proposition is straightforward:

- If Ruvidar’s Phase II bladder cancer data remain strong into completion and regulatory interactions are constructive, value inflection is plausible.

- If Rutherrin’s ASTRO‑profiled preclinical advantages translate clinically, it could become a foundational radiation adjunct across tumor types.

- If Ruvidar’s post‑infection, resistance‑beating antiviral activity carries into humans, it could disrupt a large, steady HSV market long anchored by acyclovir‑class drugs.

Next steps: Do deeper due diligence

- Read the Q3 2025 financials and MD&A for detailed cash runway, milestones, and risk disclosures

- Review urology and radiation oncology conference materials (AUA, ASTRO) and journal abstracts to gauge peer reception

- Track trial enrollment/completion and any regulatory guidance on submission timing

- Model scenarios for NMIBC adoption, radiosensitizer pricing, and HSV commercialization timelines versus financing needs

About Theralase Technologies

Theralase is not for the faint of heart, but for investors comfortable underwriting clinical and regulatory risk, it offers multiple shots on goal across oncology and virology—with catalysts that could change the narrative quickly.

Theralase Technologies stock (TSXV:TLT) last traded at $0.20.

Join the discussion: Find out what everybody’s saying about this healthcare stock on the Theralase Technologies Inc. Bullboard and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.