As governments continue to devalue fiat currency and inflation runs rampant across the globe, the importance of real assets to investor portfolios is at a generational high.

Miners, in particular, represent fertile ground for prospective allocations due to higher metals prices spurred on by post-pandemic demand, which has set the stage for the sector as a safe-haven from inflation and ongoing geopolitical tensions.

One exemplary issuer to consider is RooGold (CSE:ROO, C$4M market cap), a precious metals explorer establishing a dominant presence in New South Wales, Australia, one of the world’s friendliest mining jurisdictions with a gold endowment in excess of 100 Moz.

The company has consolidated 14 high-potential gold and silver concessions spanning 2,696 km2, including 139 historic mines and prospects, with an expert team continually reviewing synergistic ventures as they arise. Each concession is marked by deposits controlled by regional structures and contacts with limited exploration history, which affords RooGold outsized discovery opportunities.

The junior explorer recently announced high-grade gold and silver assays from preliminary rock chip sampling at its 100-per-cent owned Arthurs Seat Project in the highly prospective New England Orogen.

Rock chip sampling program

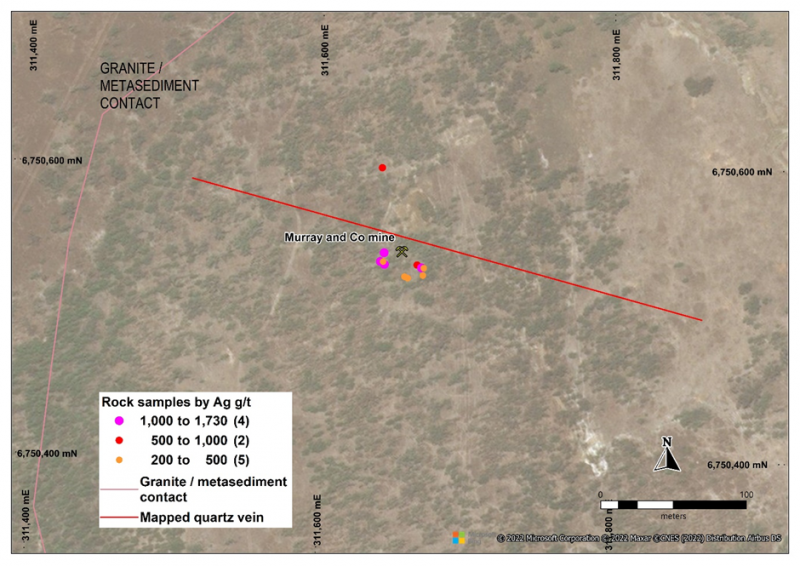

The company collected 274 rock chip samples from Arthurs Seat focused on mullock dumps and shafts at the Murray and Co Mine and McDonalds Prospect, as well as along the N-S fault and greisen-altered granite contact at the Arthurs Seat Prospect.

The assays confirm historic assays at both McDonalds and Murray and Co.

Murray and Co Mine

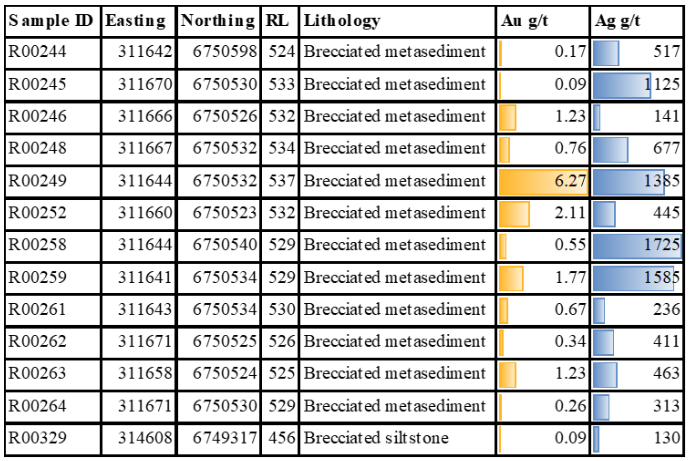

A total of 27 rock samples returned highly anomalous gold and silver assays over a 40 m strike length.

A standout result graded 6.27 g/t gold and 1,385 g/t silver (R00249) from the westernmost shaft from a brecciated and silicified metasediment containing multiple quartz veins.

Murray and Co resides within a zone of quartz-veined metasediment approximately 350 m in E-W strike length. The property has been subject to very little historical work. Roo’s gold assays are the first ever reported from the area.

Significant assays from rock chip sampling at Murray and Co Mine

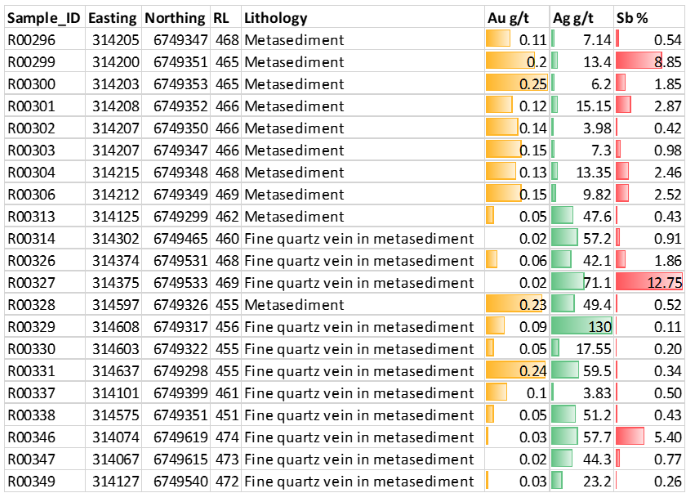

McDonalds Mine Prospect

RooGold collected 47 rock samples at the prospect, which returned anomalous gold and silver assays over a 600 m x 350 m area. Visual observations from certain samples included massive stibnite with antimony values up to 12.75 per cent.

The results hold the potential for a polymetallic precious and base-metal deposit along strike from the high-grade silver values at Murray and Co 2.75 km to the west.

Significant assays from rock sampling at the McDonalds Prospect

Castlerag Silver Project

Roo has also secured access to the high-grade workings at the Castlerag Project (EL 9141), which is 6 km from Deepwater in northern New South Wales.

Historic production at the Castlerag Mine is estimated at 4,000 tonnes averaging 1,200 g/t silver and over 20 per cent lead.

Sampling of these workings will begin imminently.

“Our first past rock chip sampling program at Arthurs Seat has returned high-grade gold-silver assays,” stated Carlos Espinosa, RooGold’s CEO. “These results confirm the historic assays of known prospects and are highly encouraging for follow-up work.”

Investment case

Given Arthurs Seat’s excellent assays, the company’s overall project portfolio’s historic small-scale production grades of up to 1,648 g/t silver and 132 g/t gold, and the technical team’s almost 150 years of experience with reducing risk and adding shareholder value across a diversity of commodities, RooGold boasts elevated growth prospects well beyond current inflationary pressures.

With a share price potentially below intrinsic value given recent performance, and large institutions’ general inability to participate in the microcap space, individual investors have ample reasons to put the company through a full due diligence process.

For more information, visit www.roogoldinc.com.

FULL DISCLOSURE: This is a paid article produced by The Market Herald.