- Adyton Resources’ (ADY) CEO and a group of independent directors have resigned effective the end of the year

- The resignations come as a result of irreconcilable differences with Adyton Resources’ largest shareholder, Mayur Resources

- Mayur Resources objected to the terms of a C$4 million brokered private placement initiated by Adyton Resources

- Adyton Resouces (ADY) is unchanged at C$0.04 per share at 1:52 PM EST

Adyton Resources’ (ADY) CEO and a group of five independent directors have resigned from the company.

CEO, Frank Terranova, and directors Jason Kosec, Nick Tintor, Fred Leigh, Peter Duplessis and Rod Watt, who was a director and Chief Geologist have resigned.

The resignations come as a result of irreconcilable differences with Adyton Resources’ largest shareholder Mayur Resources which owns more than 40 per cent of Adyton Resources.

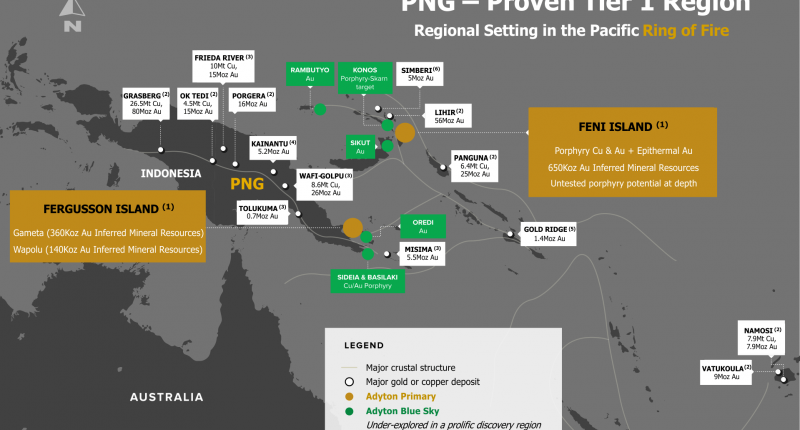

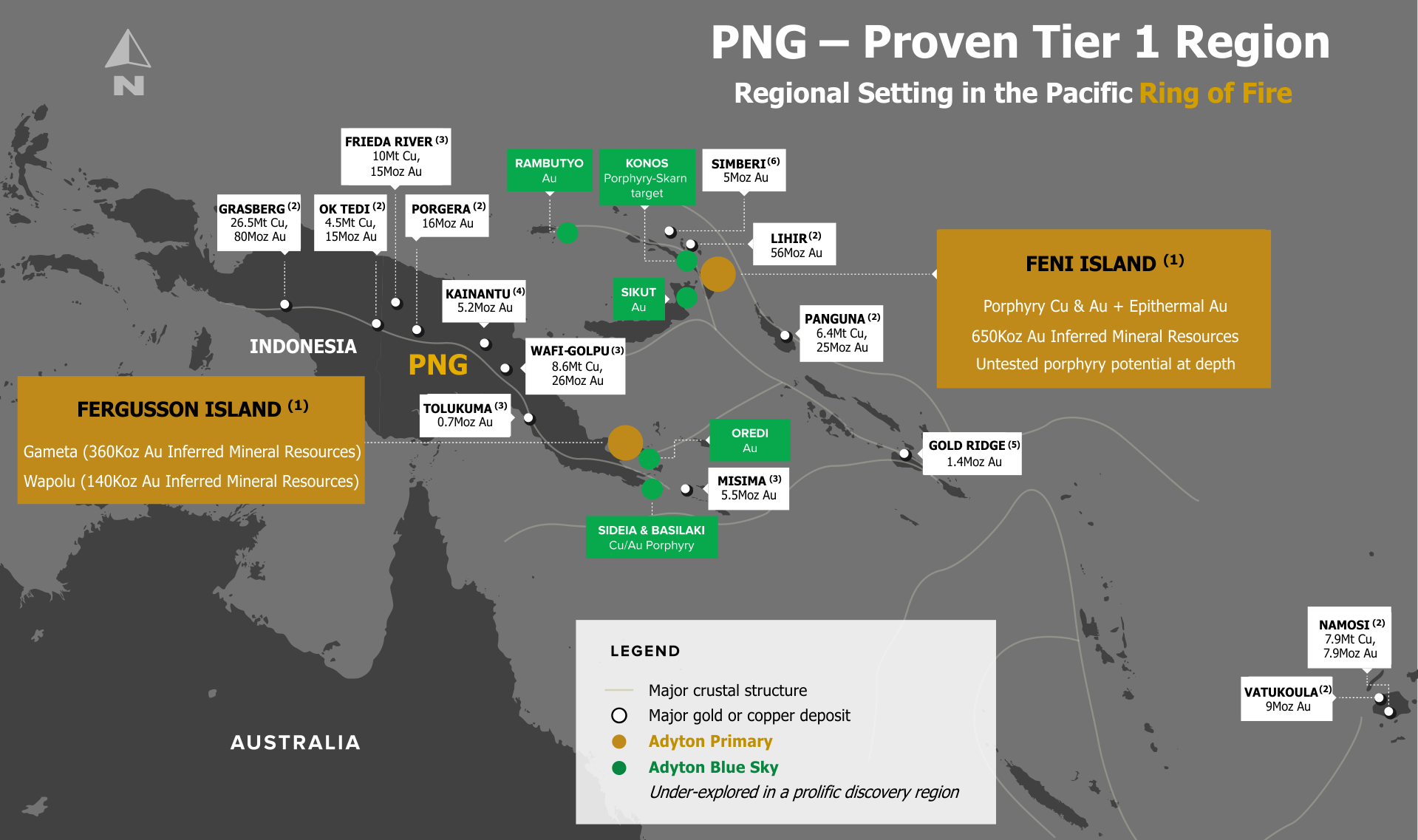

The irreconcilable differences stem from a C$4 million brokered private placement led by Eight Capital announced earlier this month, and a new business strategy for Adyton Resources, that included the exploration and development of projects in Papua New Guinea.

Following the announcement on December 3 by Adyton Resources, Mayur Resources objected to the terms. Mayur Resources alleges the amount exceeds Adyton Resources’ requirements and is being conducted in a rushed manner. Mayur Resources proposed financing alternatives, conditional on the termination of Terranova.

However, no agreement was reached with the board, so Terranova and the directors resigned.

Mayur Resources is a renewable energy and minerals business in Papua New Guinea.

Adyton Resources is a developer of gold and copper. Its mineral exploration projects are located on the Pacific Ring of Fire which hosts several world-class copper and gold deposits.

Adyton Resources (ADY) is unchanged at C$0.04 per share at 1:52 PM EST.