- American Potash Corp. (KCL) has received approval to drill exploratory wells on the Green River Potash and Lithium Project in Utah

- The leases lie within an area designated for future potash and brine processing

- Formal drill permits will be issued upon meeting certain requirements specified in the company’s notice of intent to conduct exploration

- The permits provide for drilling to depths of up to 9,000 feet

- The wells will be spaced far apart to help estimate potential potash and lithium resources

- American Potash Corp. (KCL) is up 16.67 per cent, trading at $0.03 per share as of 12:57 p.m. EST

American Potash Corp. (KCL) has received approval from the Utah Division of Oil Gas and Mining.

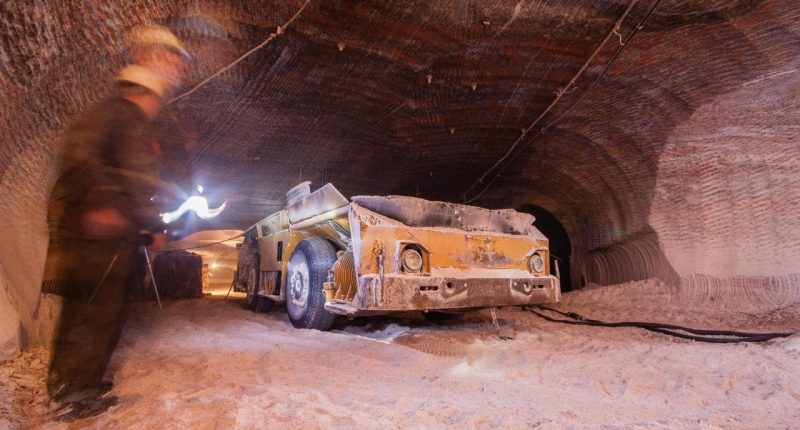

The company has been given the go-ahead to drill exploratory wells on three of its eleven mineral leases on the Green River Potash and Lithium Project in Utah.

The three state leases and a large area covered by the Federal Potash Permit applications lie within an area designated for future potash and brine processing, including energy-efficient solar evaporation ponds.

According to the company, formal drill permits will be issued upon meeting certain requirements specified in the company’s notice of intent to conduct exploration. The permits provide for drilling to 9,000 feet deep to acquire information from multiple potash and lithium horizons encountered in nearby historical oil and gas wells.

The three proposed wells, named Dumas Point, Mineral Springs, and Ten Mile, are spaced far apart to provide a large area of guidance for estimating potential potash and lithium resources within this portion of the project.

The Green River Potash and Lithium Project is within Utah’s Paradox Salt Basin, and the company believes it could potentially be one of the largest sources of potash in the U.S. The project is estimated to have 600 million to one billion tonnes of sylvinite grading between 19 per cent to 29 per cent.

American Potash Corp. (KCL) is up 16.67 per cent, trading at $0.03 per share as of 12:57 p.m. EST.