The TSX, TSXV, CSE and NEO exchanges list over 4,000 companies, a daunting number for any investor to sort through.

Parsing prospective opportunities from also-rans begins with narrowing down your investable universe, leaving only companies whose operations mark a clear path forward.

In the interest of expediting that task for TMH readers, our new series, Anatomy of a Flagship Asset, introduces you to the most promising projects and products creating value in the Canadian stock market.

Next up, Western Copper and Gold (WRN), a mining company focused on ramping up its Yukon-based Casino Project – one of the largest copper-gold projects in the world – which is receiving interest from global players amid ongoing development.

One of the world’s premier greenfield copper-gold mining projects

The Casino porphyry copper-gold-molybdenum deposit consists of 1,136 full and partial quartz claims (21,126.02 ha) and 55 placer claims (490.34 ha.) some 300 km northwest of Whitehorse. To the west, Newmont is developing its Coffee Project. To the northwest, White Gold is actively exploring numerous claims in partnership with Agnico-Eagle and Kinross. Approximately 100 km to the east, Minto Explorations operates its Minto Mine, which produces copper concentrate.

According to Casino’s 2022 feasibility study for an open pit mine, the property’s metal value distribution in the mill resource stands at 7.6 billion lb of copper measured and indicated and over 3.1 billion lb inferred, with 14.8 million oz of gold measured and indicated and over 6.3 million oz inferred. Additionally, molybdenum and silver account for 17 and 4 per cent of the combined resource, respectively.

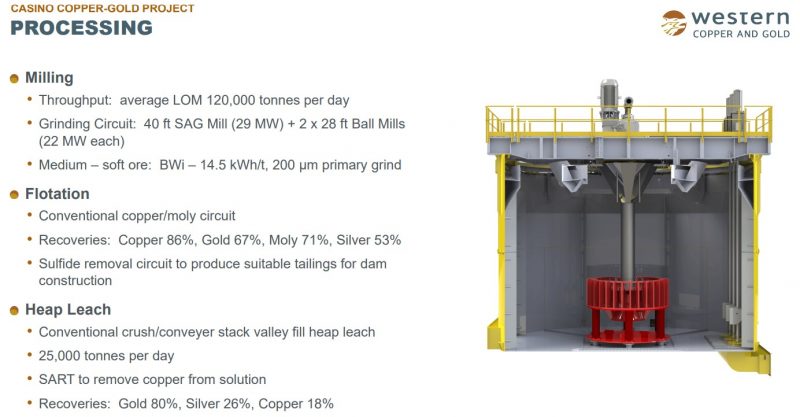

Mill feed ore will be processed through the following methods, benefitting from a heap leach reserve of 209.6 Mt at 0.28 g/t AuEq (P&P) and a mill reserve of 1.22 billion tonnes at 0.40 per cent CuEq (P&P):

Casino also offers an 800 m X 500 m core zone in the centre of the

deposit with grades that are notably higher than the overall resource grade. Confirmatory drilling is highlighted by DDH21-07 with 289.6 m of 1.01 per cent CuEq from 36.6 m, and DDH21-09 with 65.8 m of 2.53 per cent CuEq from 10.6 m.

Valuation details about the aforementioned feasibility study demonstrate why Western Copper and Gold has attracted industry leaders as investees, who we’ll cover at the end of this section:

Casino’s value is forecasted to be achieved at operating cash costs well below current copper prices (US$3.86 per lb as of April 26, 2023) and gold prices (US$1,997 per ounce as of April 27, 2023):

- Copper cash cost net of by-products: US$(0.80) per lb

- Copper cash cost co-product: US$1.54 per lb

- Gold cash cost co-product: US$799 per oz

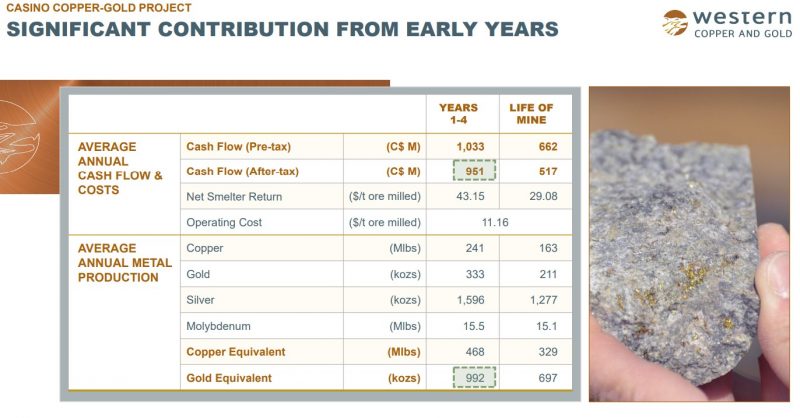

Cash flow and production metrics separated by metal are laid out below:

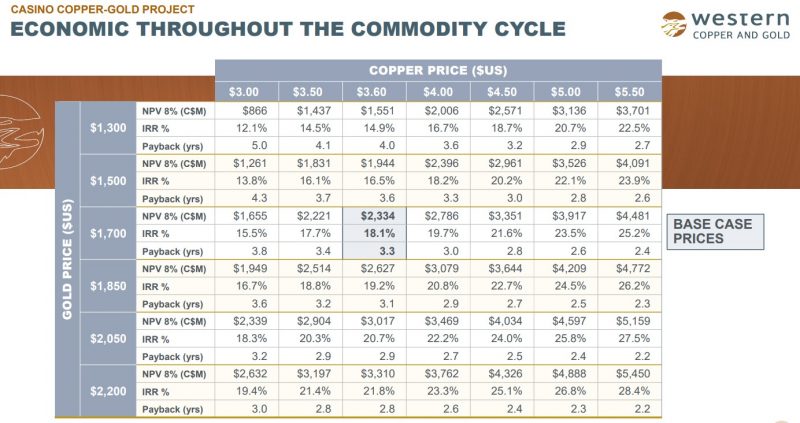

Potential investors should also take note of the project’s flexibility with regard to satisfactory returns through fluctuations in commodity prices:

The Casino asset, according to the parameters we’ve detailed thus far, represents the fifth-largest undeveloped copper-gold project controlled by a junior miner, and the eighth-largest gold project controlled by a junior miner, making it a key portfolio consideration given the current state of demand for its metals of choice.

Copper and gold demand

According to management’s analysis, to keep global warming under 1.5 degrees, annual copper supply needs to grow by more than 12 Mt in the next decade, with growth only reaching 7 Mt in the past 20 years, while available copper inventories are at their lowest levels in a decade. The 12 Mt figure is equivalent to over 150 Casino mines.

Gold prices, in turn, remain at generational highs due to historically high levels of inflation and central bank-induced currency devaluation, as well as investors’ demand for a hedge that can both minimize volatility and offer capital appreciation.

Gold is Canada’s most valuable mined commodity at 223 tonnes in 2021 for a total of C$13.7 billion (Natural Resources Canada). Approximately 55 per cent of that total went to jewelry, 25 per cent to investment, 11 per cent to central bank purchases and 8 per cent to technological applications, mostly as a component of micro-circuitry in a range of electronic products.

Once we add the fact that Casino resides in an emerging district containing 30 million ounces of gold with significant exploration upside and government, community and First Nations support, it’s no surprise that 1) management is confident that the project can contribute to the demand for critical minerals as the world transitions to a green economy, and 2) major, well-established companies have flocked to Western Copper and Gold for metals exposure.

High-profile shareholders

Over the past two years, Western Copper and Gold has benefitted from investments from legendary companies whose influence and expertise has had positive effects on its share price:

- Rio Tinto purchased ~8.0 per cent of outstanding WRN shares in May 2021 for C$25.6 million

- Mitsubishi Materials acquired ~5 per cent of outstanding WRN common shares in March 2023 for C$21.3 million

Far from passive investments, these giants are actively involved in Casino’s development process, solidifying its value proposition on the road to ore extraction.

Tying everything together from a 10,000-foot view, Western’s flagship project not only holds the promise of outsized returns, it also promises to contribute C$1.3 billion to Yukon’s economy and C$1.5 billion to Canada’s GDP every year while creating 132,280 full-time equivalent positions through the life of the operation.

The question then becomes, what needs to happen for Casino’s prospectivity to turn into reality?

Future catalysts

Potential investors interested in diving deeper into Western’s plans should closely follow the federal, territorial and First Nations permitting processes required to begin construction.

As the company works toward complying with environmental and socio-economic assessment regulation, it will require a quartz mining license, a Type A water use license, and a Fisheries Act authorization, as well as permits for camps and roads, to name just a few.

Evaluating how the company manages ongoing partnerships with strategic investors – in conjunction with testing to increase geological understanding of the deposit – will also shed light on market sentiment moving forward.

If the recent performance of WRN shares is any indication, their 390-per-cent gain from the COVID low signals how the company is well on its way to rewarding shareholders, especially those who’ve been present since Casino development began all the way back in 2008.

Western Copper and Gold (WRN) last traded at $2.36 per share.

The materials provided in this article are for information only and should not be treated as investment advice. For full disclaimer information, please click here.