Egypt is quickly emerging on the radar of many gold investors as a surprisingly prosperous jurisdiction, living up to his reputation in history established by the Pharaohs and powerful kingdoms of old.

More recently, gold mining has been recorded in the first half of the 20th Century when British mines were producing gold. However, despite the obvious prosperity that lies underfoot, modern Egypt has seen little in the way of active gold mining for many years, and none since 1958 until the Sukari mine poured its first gold in 2009.

From its beginnings with alluvial workings, followed by shallow underground vein mining around 1300 BCE, gold mining in Egypt has a history as rich as the commodity itself.

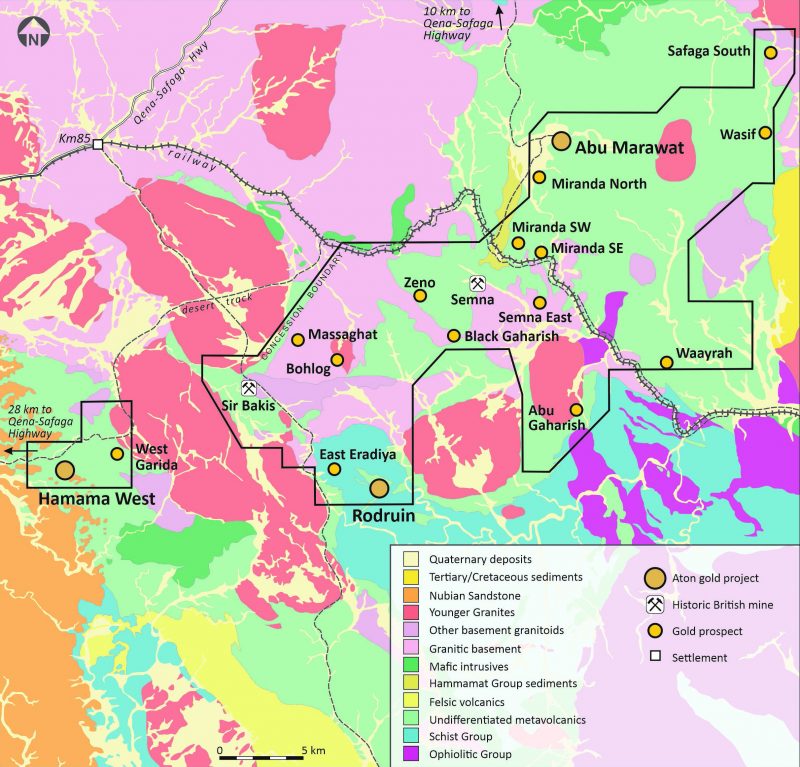

Fast forward to modern times, Aton Resources Inc. (TSXV:AAN) is focused on its 100 per cent owned Abu Marawat Concession, located in Egypt’s Arabian-Nubian Shield, approximately 200 km north of Centamin’s world-class Sukari gold mine.

All the company’s equipment and mineral exploration concessions are in Egypt. Its projects include the Hamama Deposit, Rodruin Deposit and Abu Marawat Deposit, all of which are located within the Company’s 100% owned Abu Marawat Concession,

Background – The first new gold discovery in Egypt for 100+ years:

The Abu Marawat Concession is 447.7 km2 in size and is located in an area close to excellent infrastructure; a four-lane highway, a 220kV power line, and a water pipeline are in close proximity, as are the international airports at Hurghada and Luxor.

The company has identified numerous gold and base metal exploration targets at Abu Marawat, including the advanced Rodruin exploration prospect in the south, the Hamama deposit in the west, and the Abu Marawat deposit in the northeast. Aton has unearthed several distinct geological trends within Abu Marawat, which display potential for the development of a variety of styles of precious and base metal mineralization.

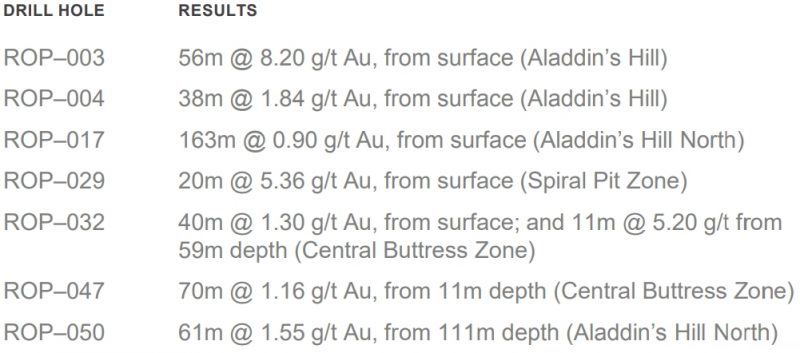

The 2018 Phase I reverse-circulation drilling program at Rodruin identified near-surface oxide and deeper primary sulphide mineralization.

50 holes were drilled for a total of 4,125 metres, to a maximum of 200 metres depth. Wide zones of oxide gold mineralization were intersected from very near to or at surface over large areas of the South Ridge.

Drill intersections included 56 metres at 8.20 g/t Au, and 163 metres at 0.90 g/t Au, both from surface.

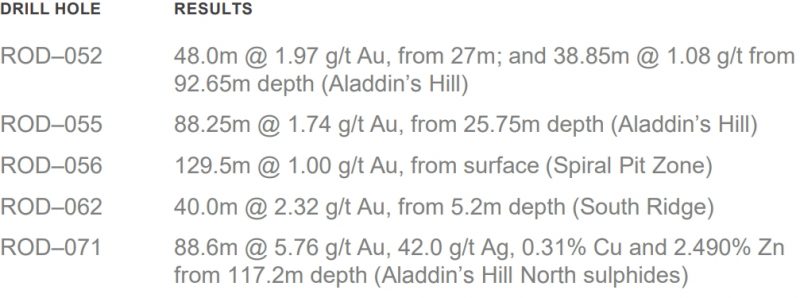

The Phase II diamond drilling program began in November 2021 and is still ongoing. As of August 2022, 60 holes for a total of more than 6,400 metres have been completed, to a maximum of 263.8 metres in depth. Recent drilling has intersected high-grade sulphide mineralization at depth.

The company’s story is clear, exploring in Egypt since 2009, and it has published two NI43-101 resource estimates with about 700,000 ounces in total gold equivalent. This is, by far, the most advanced gold exploration company in Egypt and the only internationally code-compliant gold resources that have been delineated in Egypt other than at the Sukari mine. Since amending its laws a few years ago, the country is just now opening up to foreign mining investors and trying hard to attract mining and exploration companies, with the likes of Barrick Gold and B2 Gold having recently acquired new exploration projects in the Eastern Desert.

Even though attention is growing in the country, as new exploration licenses are auctioned off, Aton was working in Egypt years ahead of anybody else there and is planning to get to mining license next year.

The company is close to finishing the current Rodruin diamond drilling program at its flagship exploration project and expects to complete this by late October 2022.

Rodruin represents an interesting opportunity for the company. Discovered roughly five years ago by Aton’s geologists, the locals referred to it as the “ancient mountain of gold,” but its location had been lost to even local Bedouin knowledge. Rodruin is the first totally new greenfields gold discovery in Egypt in more than a hundred years, although Aton were not the first people there, as it was clearly worked in ancient times. There are hundreds of ancient mining sites In Egypt, but most have been mapped and are well known, but Rodruin was hidden in the desert, deep in the mountains. The team is just now only discovering the full potential of this deposit, and there are still a lot of drill results to come.

In the news:

Most of the recent results stem from Phase II diamond drilling at Rodruin on the 100-per-cent owned Egyptian property. Drilling is testing for near-surface open-pittable resources, as well as deeper primary mineralization identified during Phase I drilling.

Drill hole ROD-071 returned 5.76 g/t gold, 42 g/t silver, 0.31 per cent copper and 2.40 per cent zinc over 88.6 metres, in sulphide mineralization, including 39.4 g/t gold, 261.7 g/t silver, 0.84 per cent copper and 3.55 per cent zinc over 9.9 metres, with drill hole ROD-075, also returning an intersection of 7.04 g/t gold, 47 g/t silver, 0.63 per cent copper and 7.18 per cent zinc over 36.9 metres, including 26.8 g/t gold, 142.4 g/t silver, 1.25 per cent copper and 16.85 per cent zinc over a 9.9-metre interval.

.The results hold the potential for significant high-grade polymetallic sulphide gold resources at Rodruin.

Other significant oxide zone results include 88.25 metres grading 1.74 g/t gold and 9.7 g/t silver (ROD-055), 129.5 metres grading 1.00 g/t gold and 8.8 g/t silver (ROD-056), 75.2 metres grading 1.72 g/t gold and 11.5 g/t silver (ROD-079), and 53.4 metres grading 2.99 g/t gold and 5.33 g/t silver (ROD-082).

The drilling is ongoing, and Tonno Vahk, Aton’s interim CEO, stated, “the sulphide intersection from hole ROD-071 is by some distance the best intersection Aton has ever drilled in Egypt and is hugely encouraging for the deeper sulphide potential at Rodruin. The mineralization is hosted in very strongly altered sediments, associated with significant copper and zinc sulphides, and appears to be the freshly unearthed precursor to the high-grade mineralization that we intersected in the discovery hole ROP-003 at Aladdin’s Hill in 2018.”

“Everything that we are seeing is backing up our long-held belief that the Rodruin deposit comprises zones of bulk mineralization, containing discrete very high-grade zones. The mineralization at Rodruin is rather unusual, but its association with silver, zinc and copper indicates a polymetallic association that is similar to what we see at the Abu Marawat and Hamama deposits, and it is our belief that these three deposits are all genetically related,” he added. The Company is working towards the publication of a maiden NI43-101 mineral resource estimate at Rodruin early next year.

The Rodruin gold project is their key exploration target within the company’s 100 per cent owned Abu Marawat Concession in the Eastern Desert of Egypt, but the Company also has a further ten high-profile targets in the area.

Indeed the Company has very recently released the results from a short first-pass 5-hole RC program at the West Garida prospect, only 3 km from Hamama, where it has announced the discovery of high-grade quartz vein hosted mineralization, including a 1m interval grading 41.7 g/t gold and 263 g/t silver. This new drill discovery at West Garida only serves to further highlight the fantastic exploration potential of the Abu Marawat Concession.

Meanwhile, at its Hamama West gold-silver development project, a recent drill program was completed on August 24, 2022, with a total of 6,620 metres drilled, including the five holes at the West Garida prospect. Assay results have been received for the first 35 holes, HAP-101 to HAP-135, to date.

Significant intersections:

- 2.90 g/t Au, 68.9 g/t Ag and 3.71 g/t AuEq over a 37-metre interval from surface (drill hole HAP-115),

- 2.87 g/t Au, 54.3 g/t Ag and 3.51 AuEq over a 22-metre interval from 1 metre depth (hole HAP-110),

- 1.43 g/t Au, 24.1 g/t Ag and 1.72 g/t AuEq over a 32-metre interval from 3 metres depth (hole HAP-115)

The Hamama West project has an indicated resource of 137,000 ounces of gold equivalent and an inferred resource of 341,000 ounces AuEq.

The program was designed by Aton, in conjunction with its mineral resource consultants, Cube Consulting, based out of Perth, Western Australia, to test the oxide and transitional portion of the Hamama West mineral resource estimate.

CEO Vahk explained that the program was completed on schedule, and the team is pleased with the results so far.

“The results are in line with our expectations and again confirm that the Hamama West oxide gold cap will be an easily mineable body of oxide mineralization outcropping at surface, and which metallurgical testing has shown to be eminently treatable using heap leach processing technology. As soon as all the results have been received, they will be forwarded on to our consultants Cube Consulting, who will commence work on revising the Hamama West mineral resource estimate. The development of the Hamama West starter open pit and heap leach project on the outcropping oxides, as only the second commercial gold mining operation in Egypt, will be a huge step forwards for the mining and mineral exploration sector in Egypt, the Egyptian Mineral Resources Authority, and of course for Aton, and for all our stakeholders.”

The nearest neighbouring mine to Aton is the world-class Sukari mine operated by Centamin. It’s the only operating gold mine in Egypt and is in the top fifteen in the world with annual production of close to 0.5M gold ounces per year. Sukari is scheduled to produce its 5 millionth ounce of gold this year and has a further 5.8M ounces of booked reserves and 9.8M of additional resources ahead of it.

Aton’s Concession lies only two hundred kilometres north of Sukari, which makes them well positioned to build something comparable. Aton has high hopes for its regional exploration targets and believes that the Abu Gaharish area, in particular, is an analogue of the Sukari deposit

Meet the team:

“We have a very, very strong exploration team. We have four ex-pat geos and a team of local geologists, most have been with us for a while now,” CEO Vahk stated, noting that with the increased interest in Egypt, knowledgeable geologists are in high demand.

Highly experienced in his own right, CEO Vahk is a former derivatives and financial engineering specialist with more than 20 years in the financial markets. In the last decade, he has been managing private equity investments in Eastern Europe, the Middle East, and Africa, with a focus on mining and real estate.

Javier Orduña, MSC, MCSM, MAIG is the company’s Exploration Manager and has more than 25 years of experience, primarily as an exploration geologist. He has worked in Australia, Central Asia, west and north-east Africa, Europe, Cuba, and the Middle East. He has worked in regional greenfield exploration through to brownfield mine-based exploration and has also spent time as an underground mine geologist at St. Ives in Western Australia. He has also worked on several feasibility studies and mine development projects and has been involved in successfully bringing several major projects through to production in Kazakhstan. He has experience in a wide variety of geological settings and has extensive experience in gold and VMS deposits in particular.

CEO Vahk pointed to him as a key person on the team, given his deep experience around the world.

Future outlook:

Once the current Rodruin drilling is completed, the next objective on Aton’s agenda is to produce a revised resource estimate at Hamama, as well as the maiden resource estimate at Rodruin. The Company is working towards completing the supporting documentation for the re-statement of the Commercial Discovery at Hamama West, as well as a new Commercial Discovery at Rodruin, in line with the terms of its concession agreement, for submission to the Egyptian Mineral Resource Authority. Based on this, the company anticipates the Ministry of Petroleum to issue the exploitation licence for the development of both Hamama and Rodruin while enabling the ongoing exploration of the retained high-priority regional targets, such as Abu Gaharish.

CEO Vahk explained that the team is on schedule with this plan and that Cube Consulting, a well-regarded consulting company from Australia, is on board to complete the NI 43-101 resource estimate.

“A year from now, I expect us to have the Rodruin and Hamama Commercial Discoveries already approved by Egypt. We will be forming a joint venture company with the EMRA, who will be our 50/50 partner in the mining operations, just as at Sukari.”

Investment summary:

There is a lot to be excited about with what Aton Resources is proposing. A relatively untapped project in the Arabian Nubian Shield, one of the world’s least explored gold exploration areas.

The company is backed by a good relationship with the Egyptian government, prioritizing the mining sector and which is targeting mining to contribute a 10% share of GDP. Egypt is a very favourable jurisdiction for the development of gold mining partly because of its desert environment with a very limited local population and is actively encouraging the exploration and mining sector through its recent amendments to the regulatory and licencing regime for gold exploration. Aton does not have a single person living in its almost 450 km2 concession area and has worked closely with the neighbouring Bedouin communities for many years since the start of its fieldwork. All in all, Aton has so far invested $35 million in Egypt and has drilled 45,000 metres to date. They’re finally close to bearing fruit and starting to generate cash flow.

FULL DISCLOSURE: This is a paid article produced by The Market Herald.