Blue Star Gold Corp (TSXV: BAU/OTCQB: BAUFF/FSE: 5WP0) has just announced more impressive drill results from its Ulu Project within the company’s district-scale land package in Nunavut.

On November 23, 2022, Blue Star announced the final results of its 2022 exploration campaign. A total of 25 drill holes were completed, spanning 3,700 meters. Drilling occurred in the Gnu (Nutaaq) Zone, Central-C Axis, Sediment Core and additional targets in the Flood Zone.

New drill highlights include:

- DD22-FLO-006: 4.41 g/t gold over 10.42 meters (hanging wall of Flood Zone)

- DD22-FLO-007: 3.52 g/t gold over 4.62 meters starting from a depth of 6.66 meters (near-surface Flood Zone)

These robust intercepts build upon even stronger numbers released previously by Blue Star, including:

- 15.00 g/t gold over 17.65 meters (includes 25.74 g/t gold over 6.00 meters; represents the highest value of all intercepts drilled by the Company)

- 6.52 g/t gold over 17.4 meters (includes 9.96 g/t gold over 6.3 meters)

Significant other intercepts were drilled throughout the 2022 spring/summer program that was focused on both potential new resource areas and on select areas of the Flood Zone deposit.

A Flood Zone core resampling program was also conducted, returning an expanded interval of 3.18 g/t gold over 31.10 meters compared to the originally reported interval of 6.91 g/t gold over 7.45 meters. Also, samples from “a sampling gap” between two previously reported high-grade intercepts resulted in 19.07 g/t gold over 6.56 meters.

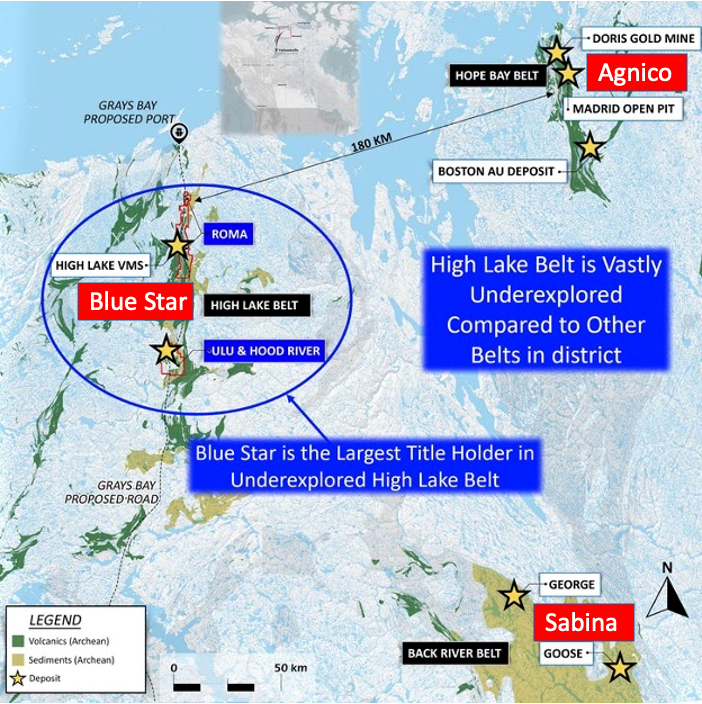

When experienced mining investors see that sort of gold grade reported over such an extended interval, they start to suspect that a mining company is onto something big, especially when Blue Star’s neighbours, Agnico Eagle and Sabina, both have multi-million-ounce resource bases and are in the development phase of constructing mines.

These are not isolated intercepts of high-grade gold mineralization. Blue Star Gold already has an established high-grade gold resource at its Ulu Project:

- A measured & indicated gold resource of 605,000 ounces, Au, at an average grade of 7.5 g/t.

- An inferred gold resource of 226,000 ounces Au at an average grade of 5.57 g/t.

Exciting results add to what is already a robust resource of high-grade gold. Yet Blue Star Gold hasn’t been rewarded for this exploration success.

No, this 3-year chart is not backward. A successful gold exploration company that has traded above CAD$1.25 is currently trading at CAD$0.26 on the back of yet more exploration success.

What’s up? Call it “poor sentiment.”

The price of gold is roughly 18% off of its 2020 high, and some mainstream pundits think that the price of gold should be even lower. These are the same esteemed(?) mainstream analysts who never think it’s the right time to invest in gold.

Who are the biggest losers from listening to these big losers? Investors.

Price of gold in 1970: $35/oz.

Price of gold in 2000: $275/oz.

Price of gold today: $1,750/oz.

In the real world, for serious investors with a long-term investment horizon, it’s always “the right time” to invest in gold.

However, there are a number of particular reasons why savvy investors will want to be overweight gold (and gold investments) at the present time.

- Inflation at multi-decade highs.

- Geopolitical tensions at multi-decade highs.

- The international monetary system is crumbling.

- Central banks (the managers of this monetary system) are loading up on gold at an unprecedented rate.

The gold price has dipped in recent months based on the belief that Western central banks will “soon” have inflation under control and will be able to achieve “a soft landing” as they aggressively hike interest rates in already-sagging economies.

Two problems with that thinking.

The central bankers claiming they will soon control inflation are the same central bankers that spent well over a year doing nothing while inflation raged because they insisted that inflation was just “transitory.”

And in the 109-year history of the Federal Reserve, it has never been able to manage “a soft landing” when it aggressively hiked interest rates in a weakening economic cycle.

Gold is insurance against high inflation. While some central bankers may (wishfully) be predicting lower inflation, others are aggressively preparing for even higher inflation.

For these reasons, more experienced gold analysts are expecting big things from (in particular) gold and silver mining stocks.

Gold, Silver And The Mining Stocks Are Poised To Explode Higher

Bet on gold, not the forked tongues of central bankers. And for even better returns, bet on gold miners.

The chart above shows how gold mining stocks, in general, have been irrationally punished by the bankers’ mindless trading algorithms.

Why Blue Star Gold Corp?

As the company’s exploration success continues, there is a strong possibility of this becoming a multi-million-ounce gold deposit – because there are already other multi-million-ounce gold deposits in this emerging gold district.

Gold is a “buy” for any investor who puts more faith in strong fundamentals and a 50-year track record of outperformance than the dubious opinions of “experts.”

And for gold investors, gold mining stocks like Blue Star Gold are a steal.

DISCLOSURE: This is a paid article by The Market Herald.