- Canada Nickel Company (TSXV:CNC) is detailing an initial mineral resource estimate at its Reid nickel sulphide project near Timmins, Ontario

- The company estimates an additional up to 2.1 billion mineralized tons to be explored on the property

- Canada Nickel Company is advancing nickel-sulphide projects in Ontario to supply the electric vehicle and stainless steel markets

- Canada Nickel Company stock is down by 19.57 per cent year-over-year but has added 2.78 per cent since inception in 2020

Canada Nickel Company (TSXV:CNC) is detailing an initial mineral resource estimate at its Reid nickel sulphide project near Timmins, Ontario.

The project is located only 16 kilometres southwest of the company’s flagship Crawford nickel sulphide project ($2.6 billion after-tax net present value (8 per cent)) and is more than twice its size.

The Reid resource covers only 55 per cent of the property and measures 2.2 kilometres long, 900 metres wide and up to 700 metres deep, while remaining open in multiple directions. Here’s a breakdown:

- 0.59 billion tons grading 0.24 per cent nickel indicated, representing 1.4 million tons of contained nickel.

- 0.99 billion tons grading 0.23 per cent nickel, representing 2.2 million tons of contained nickel.

- Based on 26,508 metres of core drilling across 55 drill holes.

According to Monday’s news release, the company believes there are 0.9-2.1 billion tons grading between 0.20 and 0.22 per cent nickel to be exploited at Reid based on previous core drilling and geophysical survey data.

Reid is the second of seven new nickel resources Canada Nickel Company expects to confirm by mid-2025. The first, at the Deloro project, was announced in July.

Investors can expect a technical report on Reid’s mineral resource estimate within 45 days. Mineralogical studies, metallurgical testing and infill drilling will continue through 2025 to upgrade the resource.

The company has completed over 119,000 metres of drilling across fourteen properties in 2024.

Leadership insights

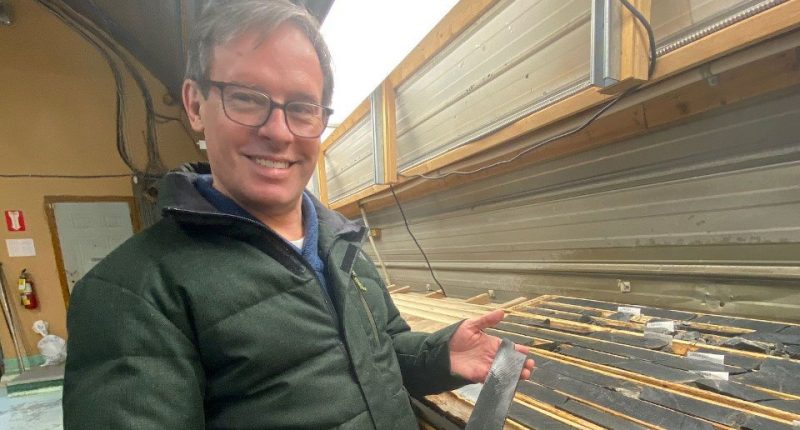

“The size and scale of the Reid resource, which is significantly larger than the initial Crawford resource, validates our belief in the potential of the Timmins Nickel District,” Mark Selby, Canada Nickel Company’s chief executive officer (CEO), said in a statement. “Reid’s target footprint is more than twice the size of our initial Crawford project and is only the second of seven new mineral resources we expect to announce by mid-2025. We look forward to continuing to demonstrate the potential of this world-class district.”

About Canada Nickel Company

Canada Nickel Company is advancing nickel-sulphide projects in Ontario to supply the electric vehicle and stainless steel markets. The company is also developing processes to produce net-zero-carbon nickel, cobalt and iron products.

Canada Nickel Company stock (TSXV:CNC) is up by 0.54 per cent trading at C$0.92 per share as of 9:55 am ET. The stock is down by 19.57 per cent year-over-year but has added 2.78 per cent since inception in 2020.

Join the discussion: Find out what everybody’s saying about this Canadian nickel stock on the Canada Nickel Company Inc. Bullboard and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of Canada Nickel Company CEO, Mark Selby: Canada Nickel Company)