- Canadian Metals (CME) has closed the first tranche of a non-brokered private placement for gross proceeds of $2,325,297.41

- Under the first tranche, the company issued 51,305,665 FT units and 22,279,696 NFT units

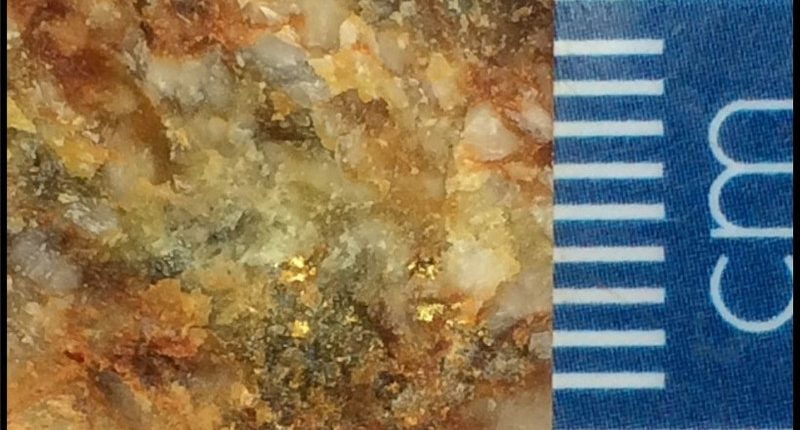

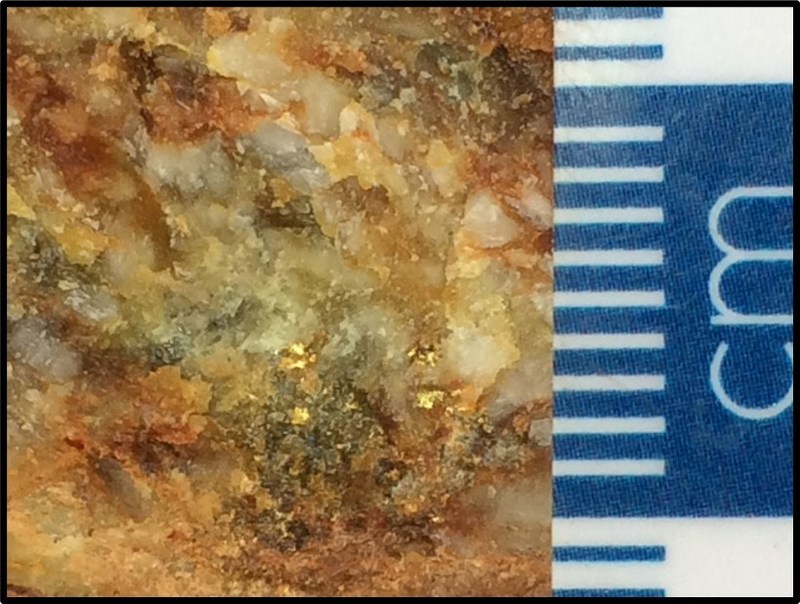

- Canadian Metals Inc. (CME) is engaged in acquiring, exploring, and evaluating mineral properties in Quebec and New Brunswick

- Canadian Metals Inc. (CME) is up 16.67 per cent on the day, trading at C$0.035 per share at 10 am ET

Canadian Metals (CME) has closed the first tranche of a non-brokered private placement.

Under the first tranche, the company issued 51,305,665 FT units and 22,279,696 NFT units for gross proceeds of $2,325,297.41.

Each FT unit includes one flow-through common share and one common share purchase warrant. Each NFT unit includes one non-flow-through common share and one warrant. Each warrant entitles the holder to purchase one common non-flow-through common share at a price of $0.048 for two years.

Canadian Metals paid cash finder’s fees of $107,363.84 and issued 2,143,200 finder’s warrants.

All securities issued are subject to a statutory four-month hold period.

Net proceeds will be used for general exploration and working capital.

Canadian Metals Inc. (CME) is engaged in acquiring, exploring, and evaluating mineral properties in Quebec and New Brunswick. Its properties include Lac La Chesnaye Property, Chisholm Brook Property, Frenette Property, Silicate Brutus, Seignelay, Lac Robot, Baie-Trinite, and Mouchalagane Properties.

Canadian Metals Inc. (CME) is up 16.67 per cent on the day, trading at C$0.035 per share at 10 am ET.