- CanAlaska Uranium (CVV) will acquire the Mel Nickel Deposit and surrounding mineral claims

- The acquisition provides the company with 100 per cent ownership of the mineral lease covering 26.13 sq. km. in the Thompson Nickel Belt in Manitoba

- Mel property has a historical indicated resource estimate of 4.3 million tonnes at 0.875 per cent nickel for 82.5 million pounds of contained nickel and an inferred resource estimate of 1.0 million tonnes at 0.839 percent nickel for 18.7 million pounds of contained nickel

- CanAlaska will acquire the Mel Deposit lease and surrounding claims by paying C$300,000 and issuing 2,000,000 common shares of the company, subject to TSX Venture Exchange approval.

- CanAlaska Uranium Ltd. (CVV) was trading at $0.495 per share as of 10 am ET

CanAlaska Uranium (CVV) will acquire the Mel Nickel Deposit and surrounding mineral claims.

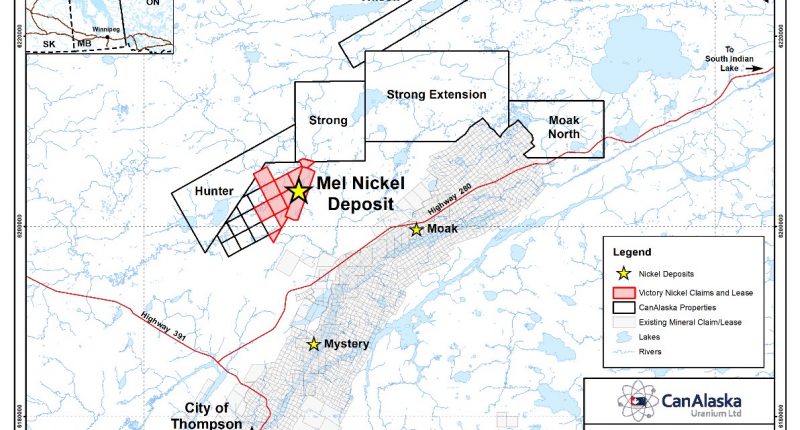

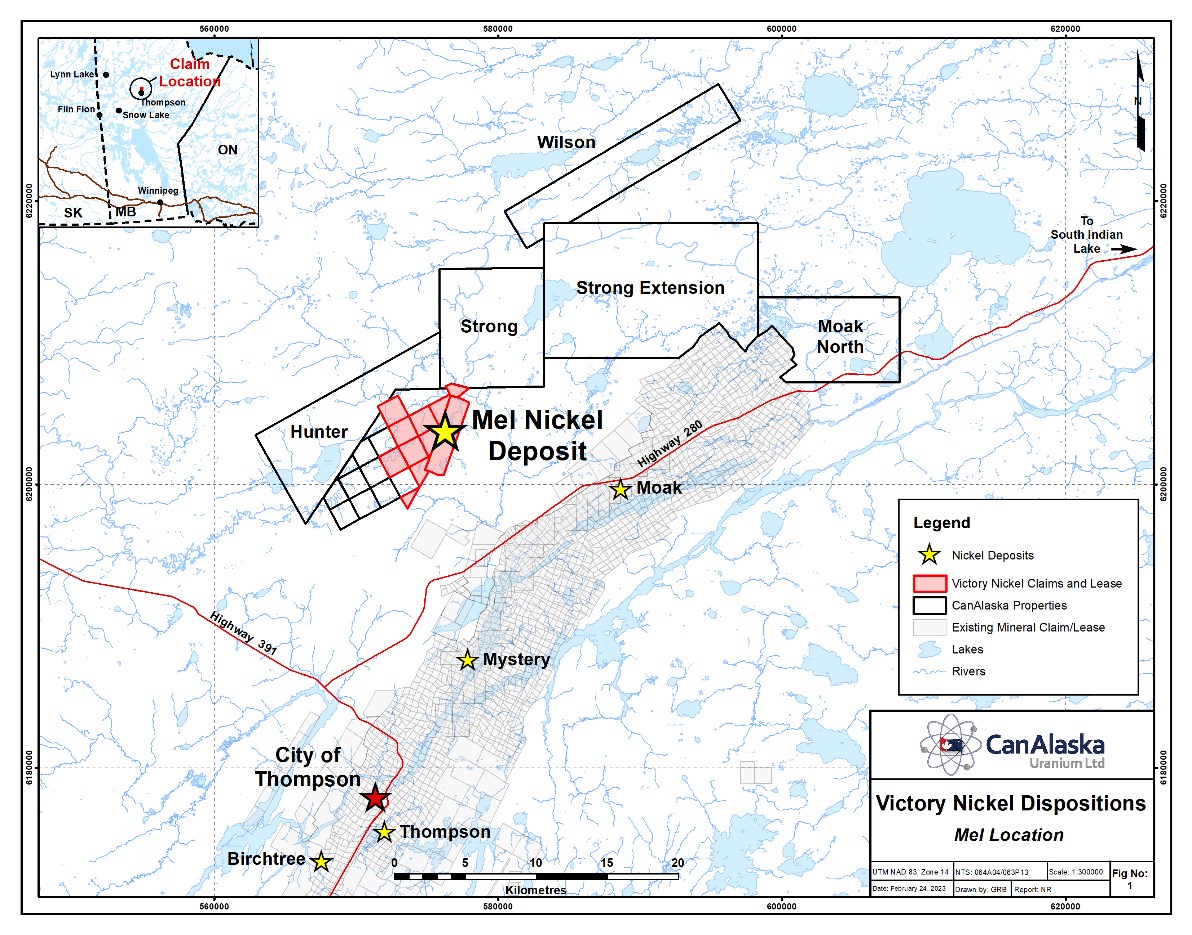

The acquisition provides the company with 100 per cent ownership of the mineral lease that hosts the Mel Deposit, as well as 10 mineral claims covering a total of 26.13 sq. km. in the Thompson Nickel Belt in Manitoba. The Mel project claims are contiguous with the company’s Hunter and Strong projects.

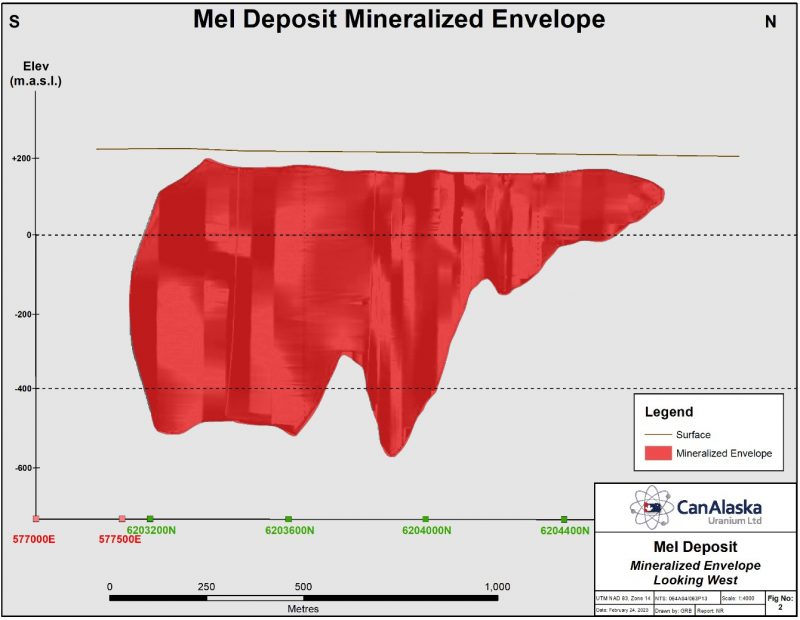

Mel property is located within 25 kilometres of Vale Canada Limited’s processing facilities in Thompson, Manitoba. It has a historically indicated resource estimate of 4.3 million tonnes at 0.875 per cent nickel for 82.5 million pounds of contained nickel and an inferred resource estimate of 1.0 million tonnes at 0.839 percent nickel for 18.7 million pounds of contained nickel.

CanAlaska will acquire the Mel Deposit lease and surrounding claims by paying C$300,000 and issuing 2,000,000 common shares of the company, subject to TSX Venture Exchange approval.

CanAlaska’s CEO, Cory Belyk, explained that the acquisition of the high-grade Mel nickel deposit and its surrounding exploration claims in the north Thompson Nickel Belt region compliments the company’s existing nickel assets.

“It provides the company with a 100 per cent owned and large nickel resource in the 5th largest sulphide nickel belt in the world near Vale’s Thompson operation. This acquisition further positions CanAlaska’s district-scale nickel assets, now over 40,000 hectares total, as a front-runner among global nickel exploration portfolios that will allow the company to attract outside investment in a strengthening nickel market. New sources of nickel supply are scarce, and demand is quickly growing as the world continues to electrify toward a carbon-free energy future.”

CanAlaska Uranium Ltd. is engaged in the exploration of uranium, nickel, and diamond properties. It holds interests in approximately 3000 sq. km. in Canada’s Athabasca Basin.

CanAlaska Uranium Ltd. (CVV) was trading at $0.495 per share as of 10 am ET.