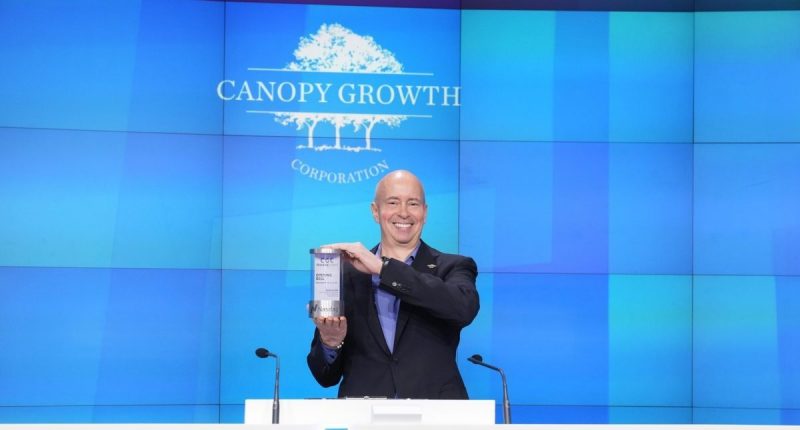

- Canopy Growth’s (TSX:WEED) chief executive officer, David Klein will be retiring at the end of its current fiscal year, March 31, 2025

- He took on the role of CEO in January 2020, and during his tenure, Canopy Growth laid the groundwork for leading the cannabis market across multiple regions by transitioning to an asset-light model in Canada and several international markets

- He also led the creation and development of Canopy USA, a pioneering structure designed to give shareholders early access to opportunities in the U.S. cannabis market before federal legalization

- Canopy Growth stock opened trading at C$9.48 per share

Canopy Growth’s (TSX:WEED) chief executive officer, David Klein will be retiring at the end of its current fiscal year, March 31, 2025.

He took on the role of CEO in January 2020, and during his tenure, Canopy Growth laid the groundwork for leading the cannabis market across multiple regions by transitioning to an asset-light model in Canada and several international markets, including Germany. He also led the creation and development of Canopy USA, a pioneering structure designed to give shareholders early access to opportunities in the U.S. cannabis market before federal legalization.

“Over the past four years, we have transformed Canopy Growth into a focused, asset-light, and financially disciplined organization that is well-positioned for sustainable growth. It has been an honour to lead Canopy Growth through this critical chapter in our evolution, and I am deeply thankful to all our team members for their dedication, and to our shareholders for their support,” CEO Klein said in a statement. “As we look to the next six months and beyond, I remain focused on driving Canopy Growth to profitability while supporting the smooth onboarding of a new CEO to lead the company forward in its next phase of growth.”

This announcement comes on the heels of the company’s fiscal Q1 2025 results, which underline the strides Canopy Growth made in strengthening its financial foundation. Highlights include a 67 per cent year-over-year increase in gross profit, achieving a consolidated gross margin of 35 per cent, and broad-based improvements across key financial metrics.

Canopy Growth is the North American cannabis company behind the brands Doja, 7ACRES, Tweed, Deep Space and Storz & Bickel.

Canopy Growth stock (TSX:WEED) opened trading at C$9.48 per share. The stock has added more than 42 per cent since the year began but has given back more than 97 per cent since 2019.

Join the discussion: Learn what other investors are saying about this cannabis stock’s Q1 2025 performance on the Canopy Growth Corp. Bullboard, and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image: Canopy Growth Corp.)