- Investing in bonds can be a valuable addition to your investment portfolio, providing stability and reliable income

- Bonds provide fixed income streams and are considered relatively low risk compared with other investment avenues

- Bonds are generally less volatile compared with other investment options

- Any major financial institution, such as a bank or a broker, can sell bonds

If you are looking for a stable and predictable investment option, investing in bonds can be a great choice.

Bonds provide fixed income streams and are considered relatively low risk compared with other investment avenues.

This article will take you through the step-by-step process on how to buy bonds in Canada, empowering you to make informed decisions and maximize your investment potential.

Investing in bonds is often considered a safe haven by many investors, even in Canada.

Bonds are generally less volatile compared with other investment options. However, like any other investment, Canadian bonds are not without their risks.

Understand bonds

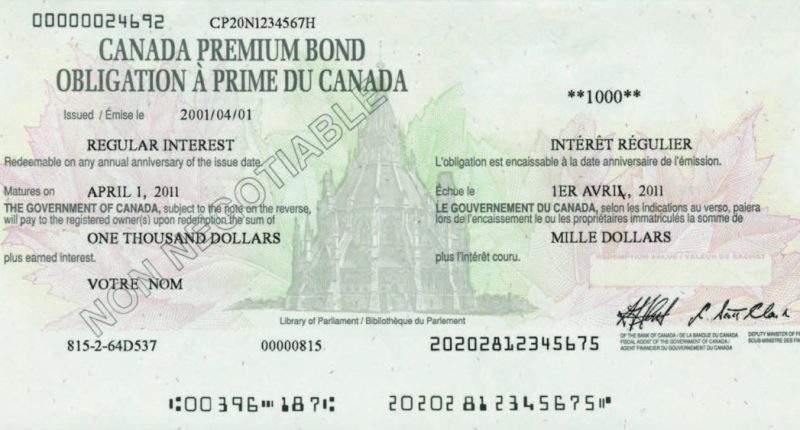

Before diving into the buying process, it’s important to understand what bonds are. Bonds are debt securities issued by governments, municipalities, provinces, corporations, or other entities to raise capital. Investors lend money to the issuer in exchange for the promise of regular fixed interest payments over a specific period.

For an up-to-date look at bond market activity, visit the Bank of Canada’s website on bond yields.

Determine your investment goals

Identifying your investment goals is crucial before venturing into the bond market. Determine the amount you are willing to invest, the time horizon you have in mind, and the level of risk where you are comfortable. This will help you select the most appropriate bond types for your investment portfolio.

Types of bonds

Various types of bonds are available to Canadians. Each type of bonds differs by those who issue them, and each type has different risk levels and interest rates.

Corporate bonds are issued by private companies and categorized into two classes, investment-grade corporate bonds (companies at a lower risk of defaulting) and high-yield bonds (proposes a higher risk of defaulting). In this case, higher risk does mean higher reward.

Government bonds are issued by the federal government and tend to be safer than corporate bonds because businesses can be more vulnerable to insolvency.

Provincial bonds are issued by provinces. While the level of quality varies, these bonds offer high quality and better rates than similar Government of Canada bonds.

Some provincial bonds are available denominated in U.S. as well as Canadian dollars; both are considered Canadian content within your RSP/RRIF.

Municipal bonds are issued by local governments and may have higher or lower yields than provincial bonds. Like provincial bonds, municipal bonds can have their interest payments (coupons) and the principal amount (residual) sold as individual securities.

Treasury bills (T-bills) are issued by the government and are one of the lowest-risk investment products available, but also offer the lowest returns, barely at inflation level.

When governments want to raise money, they issue backed T-bills to the public, which are 100 per cent guaranteed, regardless of how much is invested.

Explore their specific features to find the best fit for your investment needs.

Research bonds and issuers

Conduct comprehensive research on the bonds you are interested in purchasing. Consider factors such as the issuer’s credit rating, default risk, interest rate, maturity date and potential tax advantages. You can find this out through financial institutions, brokerages or online investment platforms.

Open an investment account

To buy bonds, you need an investment account. You can open an account with a brokerage, a bank or a financial institution. Ensure the chosen institution is reputable, offers a wide range of bond options, and has reasonable fees and commissions.

Consult with a financial advisor

If you are new to bond investing or require professional guidance, consider seeking advice from a financial advisor. They can help you determine your risk tolerance, select suitable bonds, and create a diversified portfolio that aligns with your financial goals.

Where can I buy bonds in Canada?

Any major financial institution, such as your bank or a broker, can sell you bonds. You may need to put in a minimum investment, and it is considered cheaper in the long run to buy bonds in bulk, as brokers often charge trading fees. Bonds are not traded on the major stock exchanges.

You can buy T-bills directly from the Bank of Canada, or through a brokerage, or an exchange-traded fund (ETF) or a mutual fund, which offers the most diversity.

Place your order

Once you have identified the bonds you wish to purchase, contact your chosen investment institution to place your order. Provide them with the necessary information, including the bond type, issuer name, desired quantity and price.

Monitor your investment

After purchasing bonds, it’s essential to track their performance and periodically review your investment strategy. Keep an eye on interest rate fluctuations, market conditions, and any news that might impact the issuer’s creditworthiness. Regularly evaluate your portfolio’s performance and consider rebalancing if needed.

Interest rate risk

One of the primary risks associated with bonds is the interest rate risk. As interest rates fluctuate, the value of bonds may vary inversely. When interest rates rise, bond prices tend to fall, and vice versa. This can lead to potential capital losses if an investor needs to sell bonds before maturity. Because the Bank of Canada adjusts interest rates periodically to control inflation, it is crucial for bondholders to monitor interest rate trends.

Credit risk

Credit risk refers to the possibility of a bond issuer defaulting on interest payments or principal repayments. While government bonds in Canada are generally considered low credit risk because of the country’s stable economy, corporate bonds and bonds from municipalities or other organizations carry a higher level of credit risk. Investors should assess the creditworthiness of the issuer before investing in bonds to mitigate this risk.

Liquidity risk

Liquidity risk arises when investors cannot readily sell their bonds at a fair market price. Some bonds in Canada may have limited trading activity, which can make it challenging to sell them if necessary. While government bonds usually have good liquidity, investors must carefully consider the liquidity risk associated with individual bond issues, particularly corporate bonds, or those from smaller organizations.

Inflation risk

Inflation erodes the purchasing power of money over time, and this risk also affects bond investments.

Fixed-rate bonds may become less valuable as inflation rises, as the interest earned may not keep up with the rising cost of living. Investors need to assess whether the yield on their bonds will adequately compensate for inflation to maintain the real value of their investment.

Currency risk

For international investors, buying Canadian bonds exposes them to currency risk. Fluctuations in the Canadian dollar’s value relative to their home currency can impact the investment’s returns. If the investor’s home currency weakens against the Canadian dollar, it may erode the value of their bond investment.

Investment corner

Investing in bonds can be a valuable addition to your investment portfolio, providing stability and reliable income. By understanding the bond market, conducting thorough research, and seeking professional advice when needed, you can make informed decisions and maximize your returns.

It is always important for Canadian investors to understand the associated risks. Interest rate risk, credit risk, liquidity risk, inflation risk and currency risk are all potential factors that can impact the returns on bond investments.

By carefully evaluating these risks and conducting thorough research, investors can make informed decisions about the types of bonds to invest in and mitigate potential downsides. Ultimately, diversification across various asset classes can help investors manage and minimize the risks associated with investing in bonds in Canada.

Remember, patience and a long-term perspective are vital in achieving success in bond investing.

For more information, consult the Bank of Canada’s real time bond market activity.

Join the discussion: To keep on top of the latest news updates, visit Stockhouse’s trending news page. Find out what everybody’s saying about public companies and hot topics about stocks at Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, click here.