- Shares of Anfield Energy Inc. (TSXV:AEC) jumped nearly 30 per cent by midday Wednesday on news of its acquisition by IsoEnergy Ltd. (TSX:ISO)

- IsoEnergy will acquire all issued and outstanding common shares of Anfield, including its 100 per cent ownership of the Shootaring Canyon Mill in Utah

- The mill is one of only three licensed, permitted and constructed conventional uranium mills in the United States, making it a valuable asset in the current energy landscape

- IsoEnergy Ltd. stock (TSX:ISO) opened trading at C$3.25 per share and Anfield Energy Inc. (TSXV:AEC) opened trading at C$0.09 per share

Shares of Anfield Energy Inc. (TSXV:AEC) jumped nearly 30 per cent by midday Wednesday on news of its acquisition by IsoEnergy Ltd. (TSX:ISO).

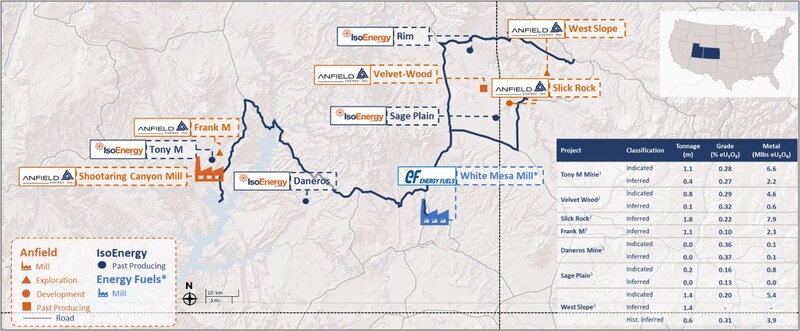

In a move to bolster its position in the uranium market, IsoEnergy will acquire all issued and outstanding common shares of Anfield, including its 100 per cent ownership of the Shootaring Canyon Mill in southeastern Utah. This mill is one of only three licensed, permitted and constructed conventional uranium mills in the United States, making it a valuable asset in the current energy landscape.

In a media release, ISO’s team explained that a restart application has been submitted to the State of Utah for the Shootaring Canyon Mill to increase throughput from 750 stpd to 1,000 stpd and expand licensed annual production capacity from 450,000 kg U3O8 to 1,360,000 kg U3O8.

Shootaring historically produced and sold 27,825 pounds of U3O8 and has not been decommissioned, it has just been under care and maintenance since operations ceased in the early 1980s.

Under the terms of the transaction, Anfield shareholders will receive 0.031 of a common share of IsoEnergy for each Anfield share held. Post-transaction, existing shareholders of IsoEnergy and Anfield will own approximately 83.8 per cent and 16.2 per cent, respectively, on a fully diluted, in-the-money basis of the outstanding IsoEnergy shares.

Anfield’s portfolio also includes conventional uranium and vanadium projects in Utah, Colorado, New Mexico and Arizona.

IsoEnergy is a well-established uranium exploration and development company with a portfolio of projects in Saskatchewan’s Athabasca Basin. The company’s focus on high-grade uranium deposits has positioned it as a key player in the nuclear energy sector.

IsoEnergy Ltd. stock (TSX:ISO) opened trading at C$3.25 per share.

Anfield Energy Inc. (TSXV:AEC) opened trading at C$0.09 per share.

Join the discussion: Find out what everybody’s saying about this stock on IsoEnergy’s Bullboard investor discussion forum and Anfield Energy’s, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

Top image: Anfield Energy Inc.