- Medaro Mining (MEDA) has announced a non-brokered private placement for gross proceeds of up to $4,000,000

- The company will issue up to 16,666,667 flow-through units and up to 6,666,667 units

- Net proceeds from the offering will be used for exploration expenditures, further development of its lithium extraction technology and working capital

- Medaro Mining Corp is a lithium exploration company

- Medaro Mining Corp. (MEDA) opened trading at C$0.19

Medaro Mining (MEDA) has announced a non-brokered private placement for gross proceeds of up to $4,000,000.

The company will issue up to 16,666,667 flow-through units for aggregate gross proceeds of up to $3,000,000 and up to 6,666,667 units for aggregate gross proceeds of up to $1,000,000.

Each FT unit will include one flow-through common share and one-half of one common share purchase warrant. Each whole warrant will be exercisable for two years. Each NFT Unit will be composed of one common share and one-half of one warrant.

The company plans to allocate the net proceeds towards exploration expenditures, further development of its lithium extraction technology and working capital.

All securities issued will be subject to a statutory four-month hold period.

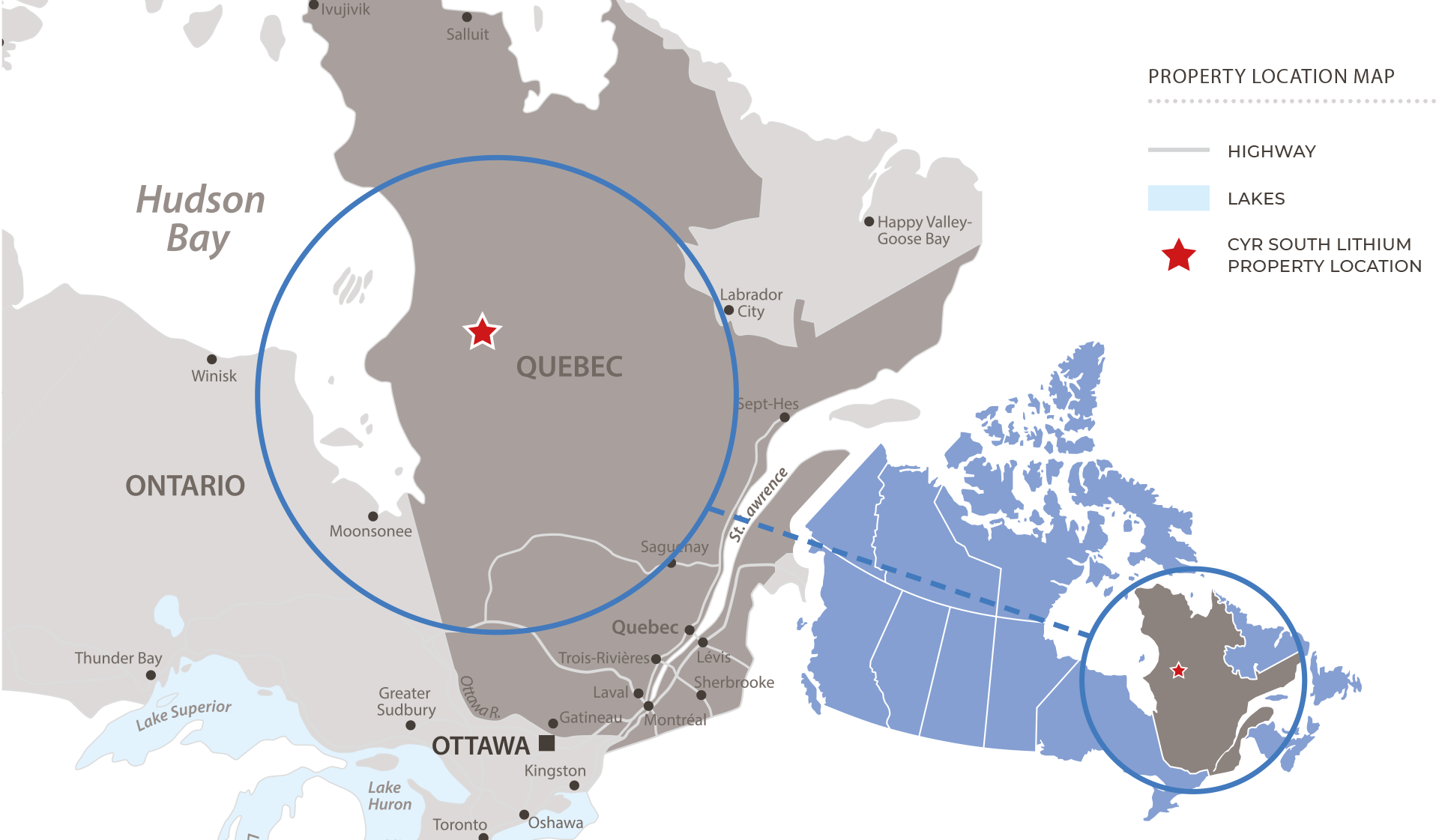

Medaro Mining Corp. is a lithium exploration company based in Vancouver, BC, which holds options on the Superb Lake lithium property in Thunder Bay, Ontario, the Cyr South lithium property in James Bay, Quebec and the Yurchison uranium property in Northern Saskatchewan.

Medaro Mining Corp. (MEDA) opened trading at C$0.19.