- NexGold (TSXV:NEXG) acquired all issued and outstanding common Signal Gold shares of through a court-approved plan of arrangement

- This merger combines NexGold’s Goliath Gold Complex Project in Northern Ontario with Signal Gold’s Goldboro Gold Project in Nova Scotia, creating a leading near-term gold developer

- NexGold and Signal Gold have completed a restructuring of their respective debt facilities, significantly reducing the debt profile of the combined entity

- NexGold Mining stock (TSXV:NEXG) last traded at $0.69 per share

NexGold Mining Corp. (TSXV:NEXG) and Signal Gold Inc. have completed their transaction.

NexGold acquired all issued and outstanding common Signal Gold shares of through a court-approved plan of arrangement under the Business Corporations Act (Ontario).

This merger combines NexGold’s Goliath Gold Complex Project in Northern Ontario with Signal Gold’s Goldboro Gold Project in Nova Scotia, creating a leading near-term gold developer.

“Today we have created a stronger and larger company with two cornerstone assets that we believe are near-term gold development projects,” Kevin Bullock, president, CEO and director of the combined company, stated in a news release. “We have also strengthened the balance sheet, and now have a great opportunity to create immense value for our combined shareholder base. We extend our thanks to shareholders, stakeholders and our Rightsholders that will help us realize our vision. With this transaction, NexGold is primed to move forward on our path to development.”

Under the arrangement, former Signal Gold shareholders received 0.1244 of a NexGold common share for each Signal share held. NexGold issued approximately 31.9 million NexGold shares to former Signal Gold shareholders, representing approximately 70 per cent and 30 per cent of the issued and outstanding NexGold shares, respectively, on a fully-diluted in-the-money basis, excluding any securities issued in connection with the arrangement.

Board of Directors and senior management

Mary-Lynn Oke, a former Signal Gold director, and Kevin Bullock have joined the NexGold Board of Directors. The combined company will be managed by Kevin Bullock as President and CEO, Jeremy Wyeth as Chief Operating Officer, and Orin Baranowsky as chief financial officer.

Jim Gowans, chairman of NexGold, stated: “I am excited for the path forward for NexGold, a company that I believe has two of the most advanced gold projects in Canada, with significant exploration potential and an excellent team in place capable of delivering on a clear path to being a multi-asset producer. With the recently announced Benefits Agreement with the Assembly of Nova Scotia Mi’kmaq, the first of its kind in the Province of Nova Scotia, NexGold has demonstrated a commitment to building meaningful relationships towards mutual benefits with the Mi’kmaq of Nova Scotia in a responsible, respectful, and sustainable manner.”

Debt restructuring

NexGold and Signal Gold have completed a restructuring of their respective debt facilities, significantly reducing the debt profile of the combined entity. Signal Gold’s outstanding credit facility of approximately US$20.8 million with Nebari and NexGold’s US$6.2 million facility with Extract Capital have been repaid in connection with the arrangement.

Under the new debt restructuring, NexGold has entered into a US$12.0 million facility with Nebari, with a 30-month term and an interest rate of 11.4 per cent. Existing Signal Gold warrants associated with the prior Nebari facility were canceled, and 3,160,602 new NexGold warrants were issued to Nebari with an exercise price of $1.00 per NexGold Share with a 30 month term.

Nebari has also paid NexGold US$6.0 million for a 0.6 per cent net smelter return royalty on the Goldboro Project, which includes a 100 per cent buy-back right for the first 30 months at NexGold’s option. If the royalty is not repurchased during the 30-month period, the royalty rate will increase to 2.0 per cent.

Steven Bowles, Managing Director of Nebari, commented: “We have been monitoring the progress of the Goliath Project for many years and have been a partner with Signal in advancing the Goldboro Project. We are very pleased to continue this relationship with NexGold as they progress the development of both of their advanced projects. The experience and dedication of the combined teams demonstrated throughout Nebari’s due diligence during the merger process between NexGold and Signal provides us with a great deal of confidence in the organization’s ability to execute on its development plans and are excited to add another asset in a Tier-One mining jurisdiction to our growing portfolio.”

Advisory shares

In connection with the arrangement, Fiore Management and Advisory Corp. was issued 638,334 NexGold shares for advisory services provided to NexGold. BMO Nesbitt Burns Inc. will also be issued NexGold shares as partial consideration for financial advisory services provided to Signal Gold. The number of NexGold shares to be issued will be determined based on NexGold’s closing share price today and disclosed in NexGold’s material change report to be filed in connection with the closing of the arrangement.

Delisting of Signal shares

The Signal shares (formerly (TSX:SGNL)) delisted from the TSX and OTCQB Venture Market this week. Signal Gold intends to submit an application to cease to be a reporting issuer and to terminate its public company reporting requirements as soon as possible thereafter.

About NexGold Mining Corp.

NexGold Mining Corp. is a gold-focused company with assets in Canada and Alaska. NexGold’s Goliath Gold Complex, which includes the Goliath, Goldlund, and Miller deposits, is located in Northwestern Ontario. The deposits benefit from excellent access to the Trans-Canada Highway, related power and rail infrastructure, and close proximity to several communities, including Dryden, Ontario. For information on the Goliath Project, refer to the technical report, prepared in accordance with NI 43-101, entitled “Goliath Gold Complex – NI 43-101 Technical Report and Prefeasibility Study” dated March 27, 2023, with an effective date of February 22, 2023, led by independent consultants Ausenco Engineering Canada Inc.

NexGold Mining stock (TSXV:NEXG) last traded at $0.69 per share and has risen 25.45 per cent since the start of the year.

Join the discussion: Find out what everybody’s saying about this stock on the NexGold Mining Corp. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

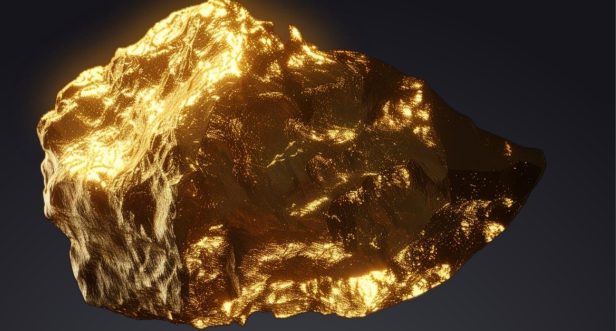

(Top image via NexGold Mining Corp.)