- Quebec Nickel (QNI) has announced a C$10 million private placement

- The company will use unit proceeds for general working capital

- It will use gross proceeds from flow-through and Quebec flow-through shares for Canadian exploration expenses that qualify as flow-through mining expenditures as defined in the Income Tax Act (Canada)

- It expects to close the offering on or about December 8, 2022

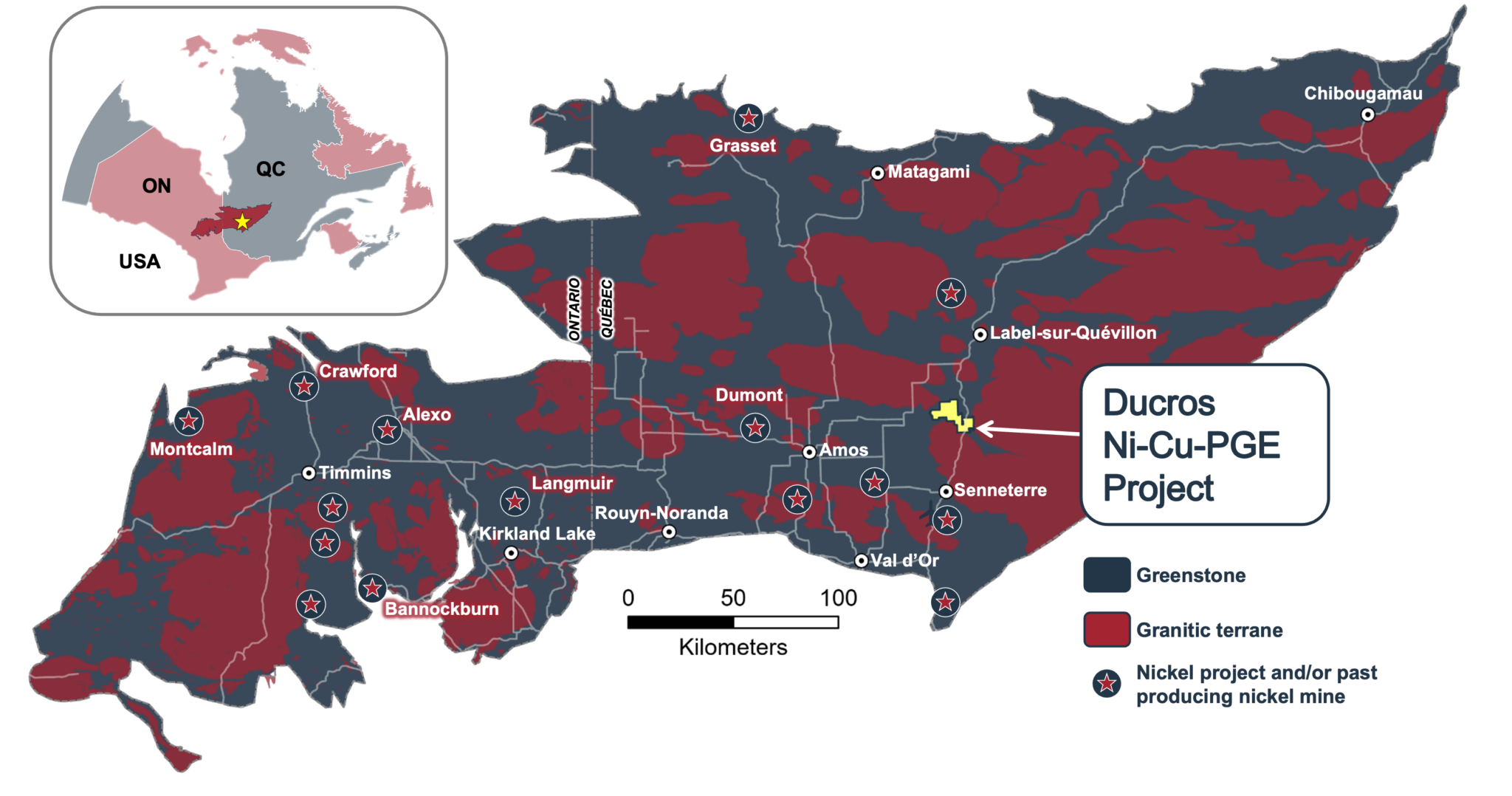

- Quebec Nickel is a mineral exploration company focused on acquiring, exploring and developing nickel projects in Quebec, Canada

- Quebec Nickel (QNI) is unchanged, trading at $0.20 per share

Quebec Nickel (QNI) has announced a C$10 million private placement.

The offering will be divided into:

- $5 million of units priced at $0.20

- Up to $2 million of flow-through shares priced at $0.24

- Up to $3 million Quebec flow-through shares priced at $0.25

Each unit is comprised of one common share and one-half of one common share purchase warrant.

Each warrant entitles the holder to acquire one common share priced at $0.30 for two years from the closing date.

The company will use unit proceeds for general working capital.

It will use gross proceeds from flow-through and Quebec flow-through shares for Canadian exploration expenses that qualify as flow-through mining expenditures as defined in the Income Tax Act (Canada).

The company will incur these expenditures on or before December 31, 2023, and renounce them to subscribers no later than December 31, 2022. The aggregate amount will not be less than gross proceeds from all flow-through shares.

Expenditures under Quebec flow-through shares will also qualify for inclusion in the “exploration base relating to certain Quebec exploration expenses” and the “exploration base relating to certain Quebec surface mining expenses or oil and gas exploration expenses”, as defined in the Taxation Act (Quebec).

The company may issue up to 22.5 million units for gross proceeds of $4.5 million under the Listed Issuer Financing Exemption, which falls outside of resale restrictions pursuant to applicable Canadian securities laws.

It expects to close the offering on or about December 8, 2022.

EMD Financial is leading the offering.

Quebec Nickel is a mineral exploration company focused on acquiring, exploring and developing nickel projects in Quebec, Canada. Its Ducros Property consists of 280 contiguous mining claims covering 15,147 hectares within the eastern portion of the Abitibi Greenstone Belt.

Quebec Nickel (QNI) is unchanged, trading at $0.20 per share as of 1:17 pm ET.