- Northland Power (TSX:NPI) remains a meaningful player in utility‑scale solar, supported by long‑term contracts, diversified renewable assets, and a multi-gigawatt pipeline—despite a difficult 2025 marked by a dividend cut, project delays, and a major non‑cash impairment

- Operational performance remains solid with strong revenue, EBITDA, and free cash flow, while major offshore wind and solar‑aligned projects (like Hai Long and Baltic Power) continue advancing toward long‑term completion

- For broader solar exposure, investors can also examine Canadian Solar (NDAQ:CSIQ) and Enphase Energy (NDAQ:ENPH), which offer manufacturing and residential‑solar technology angles—reinforcing the need for deeper due diligence across the solar value chain

- Northland Power stock (TSX:NPI) opened trading at C$19.32

After a bruising November 2025—marked by a dividend reset and project timing challenges—Northland Power (TSX:NPI) is slowly regaining its footing.

Beneath the headlines, there’s a durable, long‑duration renewables platform with meaningful solar exposure alongside wind and storage, supported by long‑term contracts and a multi‑gigawatt development pipeline.

For investors, the key is separating short‑term sentiment from long‑term cash‑flow growth—especially as global electricity demand swells on the back of AI, electrification, and data‑center build‑outs.

The solar angle: Where Northland fits in a power‑hungry world

Northland isn’t a pure‑play solar module maker; it’s an owner‑operator and developer of utility‑scale renewable assets across regions, with solar as a core pillar alongside offshore/onshore wind, storage, and efficient gas. That diversified mix matters: power systems need firm capacity and complementary generation profiles to meet spikier demand curves—especially as digital workloads (AI, cloud, and edge computing) push grids to their limits. Solar helps Northland broaden its generation stack and time‑of‑day production, particularly when paired with batteries. Public investor guides frequently cite Northland as a leading Canadian renewables name with solar in the portfolio, not just wind—useful context if you’re building a solar‑themed basket rather than chasing single‑technology firms.

The macro tailwinds are real: sector strategists flag power generation to support the AI buildout as one of 2026’s biggest themes; that creates a supportive backdrop for developers with banked interconnections, shovel‑ready sites, and access to project finance.

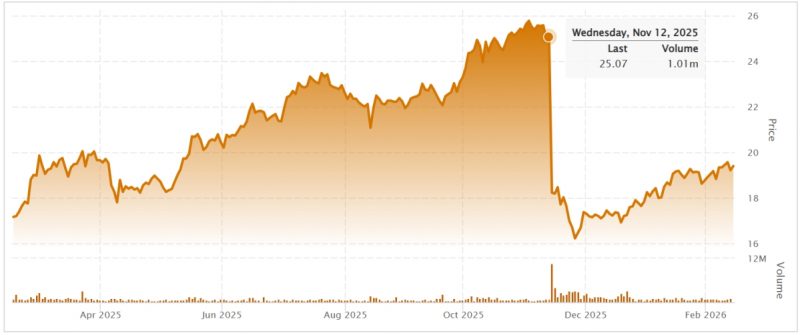

What went wrong in Q3 2025—and why it spooked the market

On November 12, 2025, Northland reported a mixed quarter: revenue and adjusted EBITDA rose ~13 per cent year over year, and free cash flow improved materially. But a C$527 million non‑cash impairment (largely tied to North Sea assets) swung results to a net loss. Management also cut the dividend by 40 per cent (to C$0.72 annually) to preserve balance‑sheet flexibility for large projects. Shares fell 20–30 per cent in the aftermath as income investors headed for the exits.

Compounding the optics, the company cautioned that slower‑than‑expected turbine commissioning at the 1.0 GW Hai Long offshore wind project could trim 2026 pre‑completion revenue by C$150–200 million (Northland share), even as the project remained on track for full commercial operations in 2027. The market hates moving targets, and the combination of a dividend cut + timing friction hit sentiment hard.

What’s still working: Contracts, pipeline, and execution

Step back from the quarterly noise and a steadier picture emerges:

- Contracted cash flows: Roughly 95 per cent of revenue is long‑term contracted, cushioning volatility and supporting non‑recourse project financing across regions. That’s a structural advantage vs. merchant‑heavy developers.

- Operational momentum: Q3 2025 delivered 96 per cent availability, with EBITDA and FCF up double‑digits year over year—evidence that underlying assets are performing even as accounting items obscured the optics.

- Visibility on near‑term builds: Baltic Power (1.1 GW) remains on schedule for 2H 2026 commercial operations, while Hai Long’s long‑dated cash flows are intact despite commissioning delays. These are large, multi‑year derisking catalysts.

- Longer‑term capacity growth: Management and external coverage point to ambitions to reach ~7 GW by 2030, with a focus on core markets (Canada/Europe) across solar, wind, and storage—a path that, if executed, can rebuild confidence and support multiple expansion.

Why solar within northland’s mix still matters for investors

- Diversification and correlation: Adding solar to offshore/onshore wind smooths generation risk. Correlations of wind and solar generation can be low; adding storage improves dispatchability. In practice, that can stabilize project‑level cash flows and reduce portfolio volatility.

- Grid Need and AI load: 2026 sector outlooks emphasize surging electricity demand; developers with solar + storage can deliver capacity faster than many thermal or nuclear pathways, benefiting from policy support and contract auctions.

- Capital discipline post‑reset: The dividend reset hurt, but it also reallocates capital to higher‑IRR projects—many of which are renewable (including solar) or storage. If management hits milestones without further balance‑sheet strain, equity holders can be rewarded through NAV growth and eventual payout growth.

Valuation and sentiment: What has to go right from here

- Repairing trust: A cut from C$1.20 → $0.72 signals a new capital‑allocation regime. To retake pre‑November levels, Northland must meet or beat 2026 construction/commissioning timelines and hold the line on capex. Analysts already dialed back targets (e.g., a downgrade and PT reduction to C$25), so execution can be a real catalyst.

- No more negative surprises: Another impairment or a fresh schedule slip would delay multiple re‑rating. Conversely, milestone updates at Baltic Power and visible progress at Hai Long would reinforce the “earn‑back” story.

- Macro tailwinds: Easing rates and improving project finance terms would help renewables broadly. The sector’s recent volatility has been driven as much by cost of capital as by fundamentals.

Portfolio context: Sizing Northland’s solar exposure

For investors building a solar‑tilted basket, Northland can play the “utility‑scale developer/operator” role—complementing pure‑plays and component makers. Public overviews list Northland among Canada’s top renewables with meaningful solar alongside wind and gas, offering contracted cash flows and global diversification—useful attributes if you want solar exposure without manufacturing cyclicality.

Peer lens: Canadian Solar and Enphase Energy (quick look)

Canadian Solar (NASDAQ:CSIQ) – Panels and projects (Global)

- One of the world’s largest solar module manufacturers with a utility‑scale development arm. However, recent analyst sentiment turned mixed‑to‑negative, reflecting margin pressure, policy/tax‑credit transitions, and a choppy demand backdrop—reminders that manufacturing is cyclical even when volumes grow. For diversified investors, CSIQ can add upstream leverage to solar cycles but raises risk relative to a contracted‑asset owner.

Enphase Energy (NASDAQ:ENPH) – Residential solar electronics and storage

- Enphase anchors the distributed solar side with micro‑inverters, energy management, and home batteries. It offers technology and margin profile quite different from Northland’s asset‑owner model, and its fortunes track U.S. residential install trends and incentives. Pairing Northland (utility‑scale, contracted) with Enphase (distributed, tech‑driven) can diversify a solar sleeve across end markets and risk factors. (Note: while not Canadian‑listed, ENPH is a common complement in North American solar allocations.)

Bottom Line: A solar‑relevant developer that’s reset for execution

Northland Power’s 2025 reset didn’t change the world’s need for more clean electricity—or the role that solar plays in meeting it. What it did do is lower the bar for expectations and reset the payout, giving management room to fund an ambitious build program across solar, wind, and storage. If they deliver on construction milestones and avoid further impairments, the equity case can improve steadily from here.

Next step: Treat Northland (and solar peers like Canadian Solar and Enphase) as starting points—not endpoints. Dive into project‑level updates, contract durations, leverage, and interest‑rate sensitivity. For each name, model cash flows across rate scenarios and stress‑test timelines and capex. Then size your positions accordingly.

Investors should deepen their due diligence—reviewing filings, earnings calls, and project milestones—before committing capital to Northland Power, Canadian Solar, or Enphase Energy. A disciplined, research‑first approach is the best way to turn a volatile sector into a long‑term compounder.

Don’t let the sun go down on your investments

Northland Power Inc. is a global power producer dedicated to helping the clean energy transition by producing electricity from clean, renewable resources.

Northland Power stock (TSX:NPI) opened trading 0.70 per cent higher at C$19.32 and has risen more than 12 per cent since this time last year.

Join the discussion: Find out what everybody’s saying about this stock on the Northland Power Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.