- Romios Gold Resources (RG) has announced a non-brokered private placement for up to $200,000

- The company will issue up to 5,000,000 flow-through units at $0.04 per unit

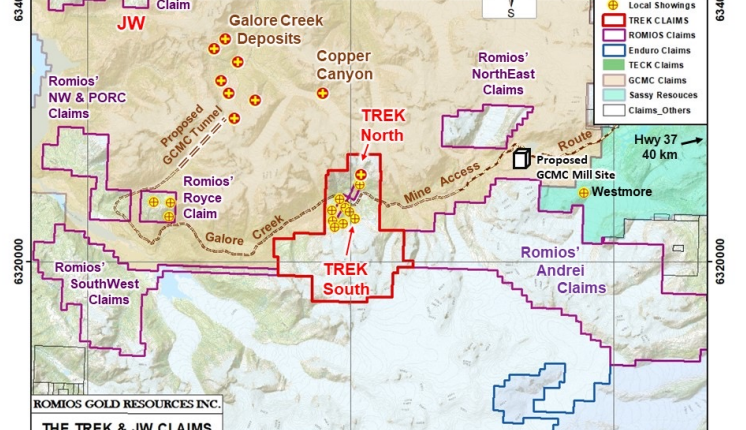

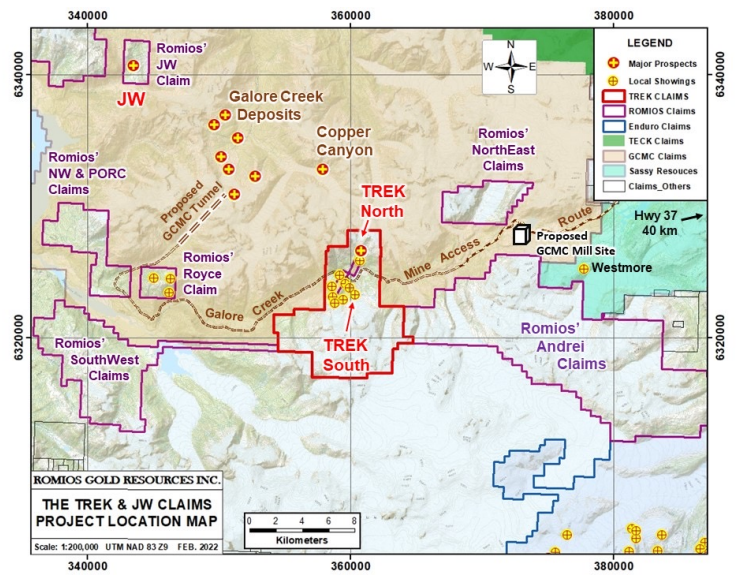

- Net proceeds will be used for the exploration of the company’s properties in BC

- Romios Gold Resources is a Canadian mineral exploration company

- Romios Gold Resources Inc. (RG) opened trading at C$0.025

Romios Gold Resources (RG) has announced a non-brokered private placement for up to $200,000.

The company will issue up to 5,000,000 flow-through units at $0.04 per unit. Each unit will consist of one common share and one share purchase warrant. Each warrant entitles the holder to purchase one additional common share for $0.08 at any time within two years.

Net proceeds will be used for the exploration of the company’s properties in BC.

All securities issued are subject to a statutory four-month hold period.

The Offering is scheduled to close before the end of December, subject to TSX Venture Exchange approval.

Romios Gold Resources is a Canadian mineral exploration company engaged in precious- and base-metal exploration, focused primarily on gold, copper and silver. It has a 100 per cent interest in the Lundmark-Akow Lake Au-Cu property, plus four additional claim blocks in northwestern Ontario and British Columbia.

Romios Gold Resources Inc. (RG) opened trading at C$0.025.