It may be early in 2023, but things are already heating up in Canada’s oil & gas industry.

In a classic David-and-Goliath story, $143-million market cap Saturn Oil & Gas (TSXV:SOIL/OTC:OILSF) is swallowing up $516-million Ridgeback Resources Inc.

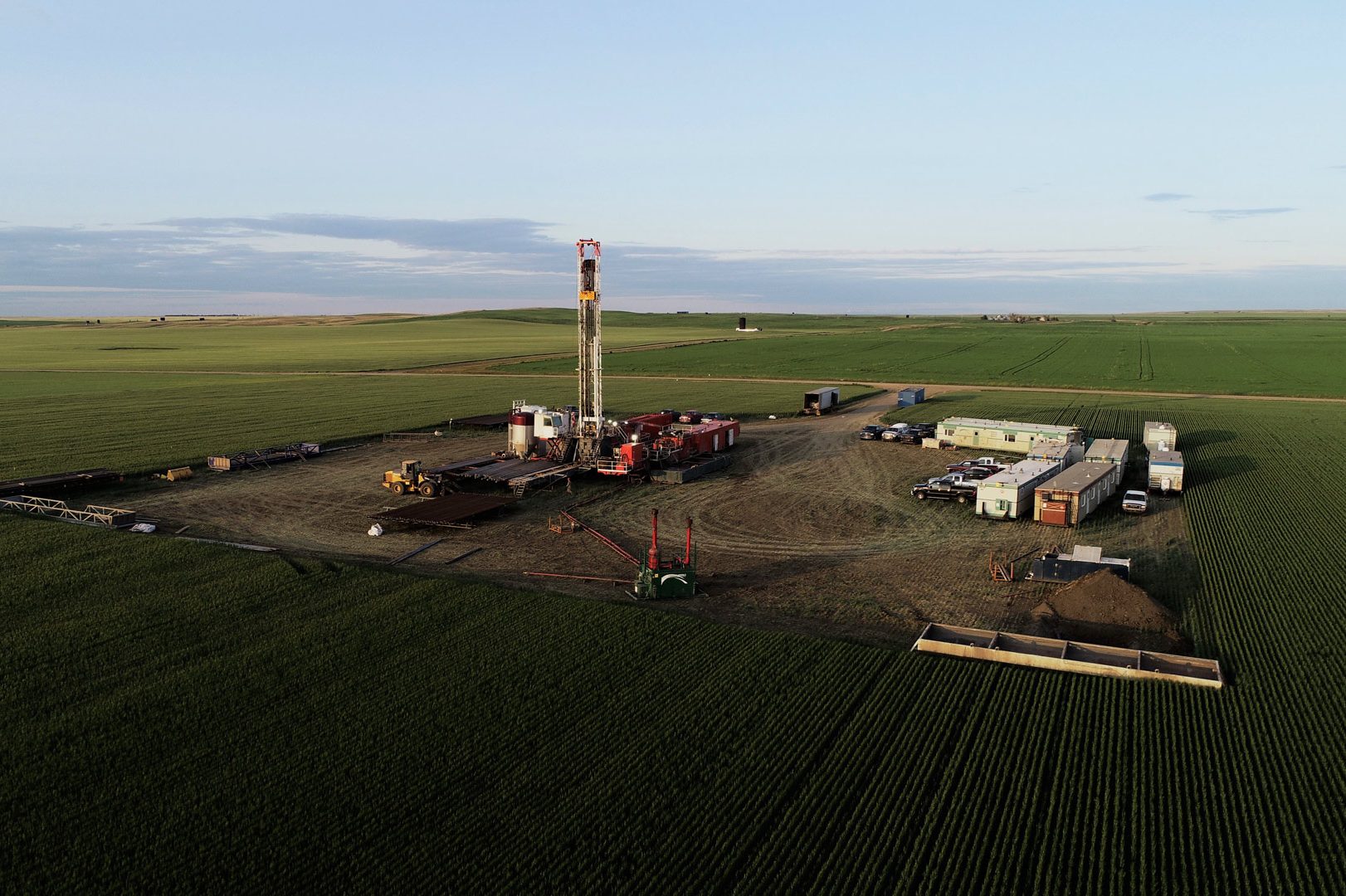

The prize? Roughly 17,000 boe per day from Ridgeback, spread across Saskatchewan and Alberta, comprised 71% of high netback, light oil and natural gas liquids. The production comes with a large development fairway of over 430,000 net acres of land, and over 700 identified drilling locations for future development.

Under the terms of the deal, the CAD$516 purchase price will be comprised of C$475 million in cash plus $41 million of Saturn common shares. The purchase price is remarkably below the Net Present Value (at 10%) of the Proved Producing Reserves, which amounts to $915 million and a fraction of the NPV10% of the Proved plus Probable Reserves, which amounted to $1.8 billion, as evaluated in a recent Ryder Scott Reserve Report. And in an industry where cash flow is king, the annualized expected net operating income of the Ridgeback assets of $311 million is being acquired at a low 1.7x multiple.

Over 80% of Ridgeway’s shareholders voted in favour of this acquisition, to be completed by way of a statutory plan of arrangement. Saturn’s CEO, John Jeffrey, framed the acquisition for investors.

“This transformational acquisition is an important step for Saturn to establish material scale in its Alberta and Saskatchewan operations, where we will leverage our high-quality light oil-focused production that has considerable prospective development drilling inventory, our teams track record of operational outperformance and capital efficiency, a strong hedge book, and supportive equity backers like GMT Capital Corp. and Libra Advisors, LLC to mitigate corporate risk, rapidly deleverage, and sustainably grow in a profitable manner for many years to come.”

For prospective investors, what might be of greatest interest was some number-crunching that Jeffrey did on the deal.

“The attractive acquisition metrics and compelling economics of the Ridgeback Acquisition paired up with our existing portfolio of free cash flow generating assets will allow Saturn to repay all corporate indebtedness within three years and ultimately provide a significant return of capital to enhance shareholder value.”

Debt-free in three years? Transformational, indeed.

Reaction within Canada’s oil patch was a combination of shock and enthusiasm. An opinion piece in the Calgary Herald expressed the shock.

After volatile prices slowed oilpatch M&A in 2022, new year starts with $525m deal

How do you strike a deal to make a major purpose – or a significant sale – when the underlying price of the asset careens around like a bumper car at a country fair?

Even Ridgeway’s CEO Paul Charron acknowledged the challenging conditions to close such a large acquisition.

“Quite frankly, it’s not actually an easy time to transact. It is challenging for a lot of companies. Financing is challenging.”

Yet Saturn’s management team is taking this acquisition to the finish line, having secured the major financing required to close a deal of this magnitude. The strongly accretive nature of the transaction likely aided Saturn Oil & Gas greatly in getting the bankers on board.

An article from Pipeline Online captured the enthusiasm over this acquisition.

Saturn Oil & Gas acquires Ridgeback Resources in a deal that will be rockin’ in the Bakken

Saturn Oil & Gas Ltd. Is continuing an exponential growth pattern through acquisitions.

At the close of the markets on Friday, Jan. 20, Saturn announced it was acquiring Ridgeback Resources Inc., one of the largest players in the Saskatchewan Bakken and Mississippian plays, which also has significant operations in three areas of Alberta.

And Pipeline Online was clearly impressed with the purchase price paid by Saturn for these assets. After reviewing the history of Ridgeback and a previous purchase of these assets in 2016, editor Brian Zinchuk offered these thoughts.

Step forward to Jan.20, and Saturn was able to make a deal for half of that value [2016 purchase price], for most, but not all of what Ridgeback was last summer, Ridgeback had successfully sold off its 2,500 boepd Grande Prairie properties to another party.

That translates into over 85% of Ridgeway’s total production for less than half of the CAD$1.35 billion 2016 purchase price. It’s a big bite for Saturn Oil & Gas, increasing oil and gas production by roughly 140%.

Investors will like the sound of that. They will also likely be salivating at the Updated Guidance that Saturn included in the January 20th release.

The acquisition is expected to be 25% accretive to Saturn’s 2023E cash flow per fully diluted share which is forecasted at $2.33. That is a decent amount of cash flow for Saturn Oil & Gas’ shares, currently trading around $2.40.

Will Saturn’s big deal be the catalyst for a flurry of new M&A activity in the Canadian oil patch? Hard to say.

What’s a lot easier to conclude is that this major acquisition by Saturn Oil & Gas will dramatically increase its operational footprint in Canada’s oil & gas industry. The Company is reaching the 30,000 boe/d milestones and has established a sustainable cash flow generating platform of light oil assets.

Saturn is an ice-cold gas giant planet, well below -100⁰ C.

As an aspiring oil & gas giant in Alberta and Saskatchewan, Saturn Oil & Gas is currently red-hot.

DISCLOSURE: This is a paid article by The Market Herald.