By Dr. Ryan D. Long, CEO of Mining and Metals Research Corporation.

Silvercorp Metals Inc. (TSX: SVM | NYSE-A: SVM) has announced a letter of intent to acquire Celsius Resources Limited (ASX: CLA | AIM: CLA) in a cash and equity transaction.

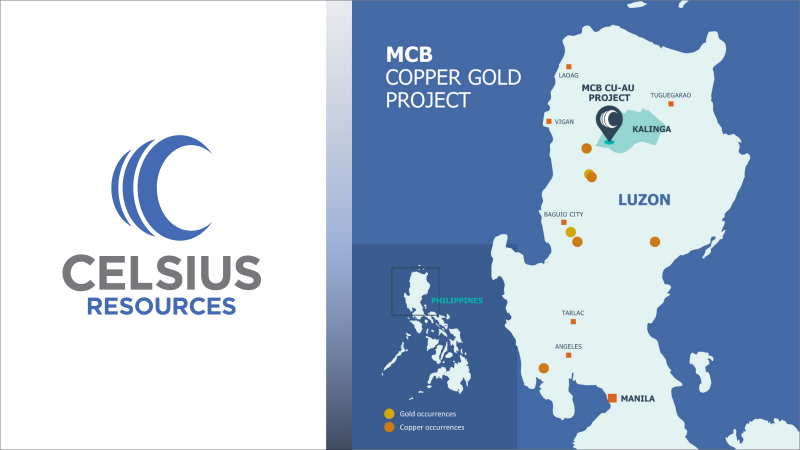

If closed, the A$56 million deal would result in Silvercorp taking ownership of the Maalinao-Caigutan-Biyog (MCB) Copper-Gold Porphyry Project, located on the Island of Luzon in the Philippines (Figure 1), as well as retaining an interest in a new exploration company that will hold Celsius’ earlier-stage projects.

Figure 1: Location of the MCB Project

The MCB Project is an advanced development project with an updated JORC 2012 compliant measured and indicated mineral resource estimate of 296 Mt at an average grade of 0.46% copper (Cu) and 0.12g/t gold (Au), and an inferred estimate of 42 Mt at an average grade of 0.52% Cu and 0.11g/t Au (Figure 2).

Figure 2: MCB Project’s Resource Base

Celsius’ December 2021 scoping study was focused on a high-grade core of 48.8 Mt at an average grade of 0.85% Cu and 0.41g/t Au. This study defined a post-tax NPV8 of US$464 million and a post-tax IRR of 31%, assuming a Cu price of US$4.00/lb and an Au price of US$1,695/oz over a 25-year mine life.

The underground sublevel open stoping operation modelled in the study would produce an average of 22,000 t of Cu and 27,000 oz of Au in concentrate per year, generating US$2.5 billion in revenue over the first ten years (Figure 3). Over the life of mine, the operation is forecast to generate over US$1 billion in cumulative cash flow (Figure 3).

Figure 3: MCB Project’s Scoping Study Economics

The low initial capex (US$253 million) and low-opex, averaging US$0.73/lb Cu (C1 Cash Cost), during the first 10 years of the mine’s life make the project’s economics very attractive (Figure 3), and would likely be transformational for Silvercorp taking the company’s business to the next tier of mining companies.

The MCB project has an appropriate, government-sanctioned deal structure in place with a domestic company, and as a result, Celsius is in the final stages of obtaining the mining permit from the Philippine Government for the development of the project.

Silvercorp is currently debt free and has a cash and short-term investments balance of US$210.3 million, alongside its existing equity portfolio that has a market value of US$121.8 million as of December 31, 2022. This is a substantial amount of capital that can used to fund the further exploration and economic studies at MCB, and when combined with the continued cash flow generated from Silvercorp’s existing operations at the Ying Mines and GC Mine, it is also likely that Silvercorp will be able to fund a large portion of the MCB Project’s construction costs internally. In addition, part of the development capital is expected to be funded by the domestic partner, further reducing the need for external financing.

Silvercorp’s management has been committed to expanding and diversifying its operating portfolio for some time and, if it closes, the acquisition of Celsius would be a transformational event for the company that diversifies both its geographic and commodity exposure.

Further Details on the Proposed Transaction Terms

Silvercorp has signed a non-binding term sheet with Celsius to acquire all the outstanding shares of Celsius at a fixed price of A$0.03 per share (76% premium to 20-day VWAP). Under the agreement 90% of the consideration will be settled through the issue of Silvercorp shares, with 10% to be paid in cash.

Additionally, the companies have signed a binding subscription agreement for A$5 million at a subscription price of A$0.015, to be primarily used as interim funding for the MCB Project.

Alongside the acquisition, the companies intend to spin out Celsius’ earlier-stage Sagay Project and Opuwo Cobalt Project into a new ASX or AIM listed SpinCo via a demerger. Silvercorp has agreed, under the non-binding term sheet, to invest A$4 million in SpinCo, valued at a post-financed market capitalisation of A$30 million.

The transaction, if completed, is targeted to close in Q4 2023.

This is third-party provided content issued on behalf of Silvercorp Metals, please see full disclaimer here.