- Sprott Asset Management (SII) has signed a definitive agreement with Uranium Participation Corporation (U) to form the Sprott Physical Uranium Trust

- Uranium Participation Corporation will become a wholly-owned subsidiary of the trust

- The trust will be managed by Sprott Asset Management with assistance from WMC Energy

- The transaction is expected to close in late Q2 or early Q3 2021

- Uranium Participation Corporation is the world’s largest publicly-traded investment vehicle providing exposure to the price of uranium

- Sprott is a global leader in precious metal and real asset investments

- Uranium Participation Corporation (U) is up by 1 per cent trading at $5.04 per share

- Sprott (SII) is trading flat at $54.13 per share

Sprott Asset Management (SII) has signed a definitive agreement with Uranium Participation Corporation (U) to form the Sprott Physical Uranium Trust.

Uranium Participation Corporation will become a wholly-owned subsidiary of the trust.

Each UPC common share will be exchanged for one unit of the newly-formed trust.

If UPC shareholders are Canadian residents for tax purposes, they may elect to receive one exchangeable share of a Canadian subsidiary of the trust, which will be exchangeable into one unit of the trust.

The trust will be managed by Sprott Asset Management with assistance from WMC Energy, a global commodities merchant with significant experience in the nuclear fuel cycle.

The transaction is expected to close in late Q2 or early Q3 2021.

John Ciampaglia, CEO of Sprott Asset Management, commented,

“We believe our global brand, fund marketing experience, and client base of more than 200,000 investors will improve trading liquidity and grow UPC’s asset base during what we believe is the start of a bull market for physical uranium.”

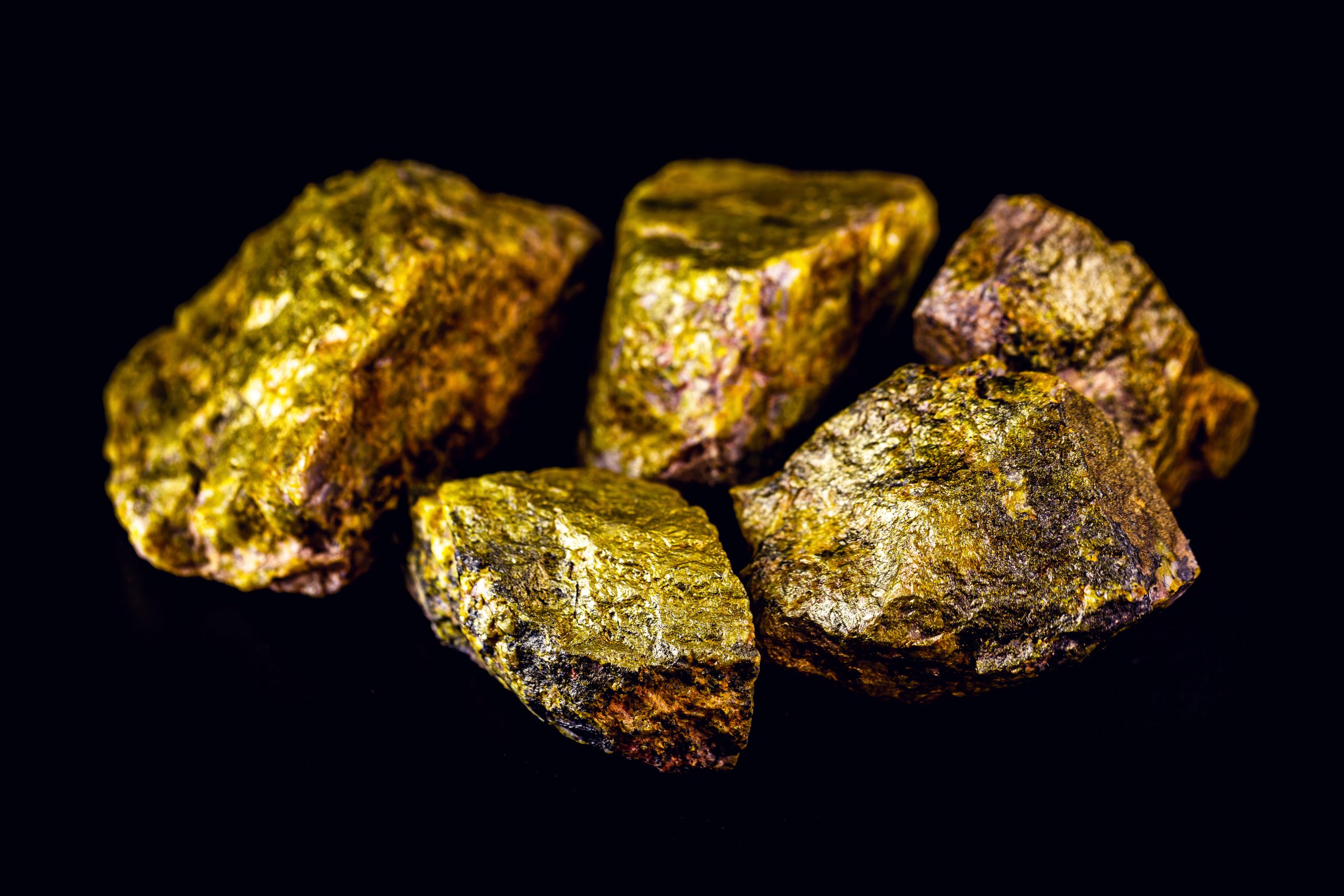

Uranium Participation Corporation is the world’s largest publicly-traded investment vehicle providing exposure to the price of uranium. The investment holds physical uranium in the form of uranium oxide in concentrates and uranium hexafluoride.

At the end of March 2021, UPC reported holding 16,269,658 pounds of U3O8 and 300,000 KgU as UF6 with a market value of approximately C$665 million.

Sprott Asset Management LP is a wholly-owned subsidiary of Sprott.

Sprott is a global leader in precious metal and real asset investments.

Uranium Participation Corporation (U) is up by 1 per cent trading at $5.04 per share at market open.

Sprott (SII) is trading flat at $54.13 per share at market open.