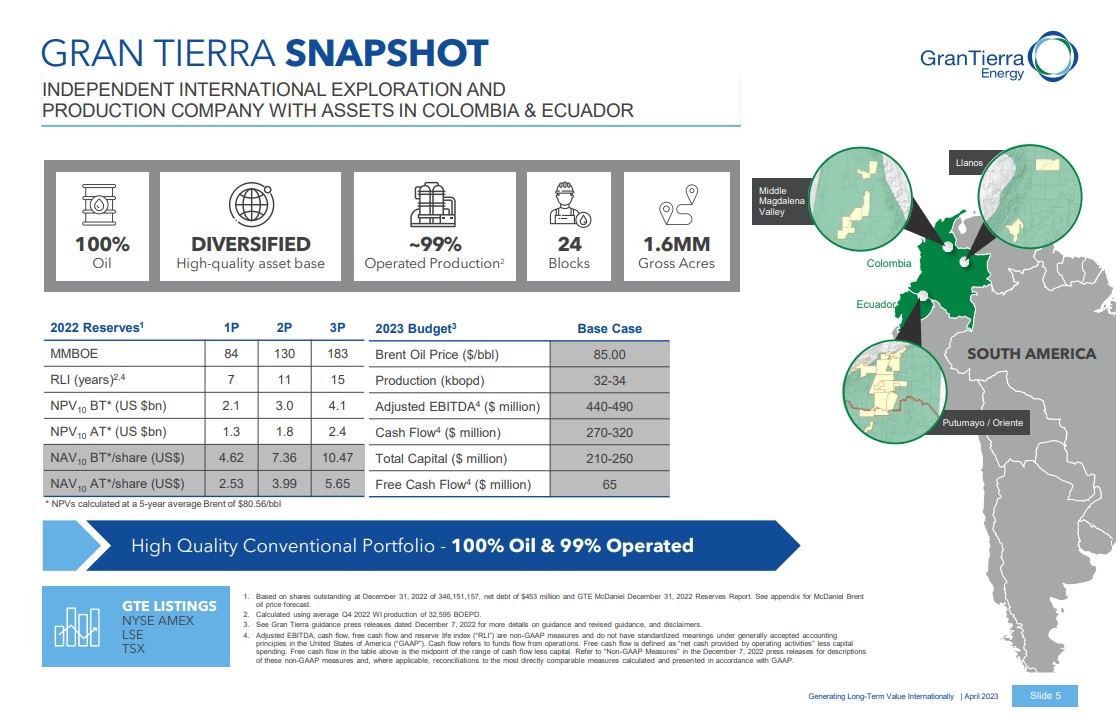

- Gran Tierra Energy (GTE) is focused on oil and gas exploration and production in Colombia and Ecuador

- It has collected net income between US$38.69 million and US$139.03 million in four of the last five years

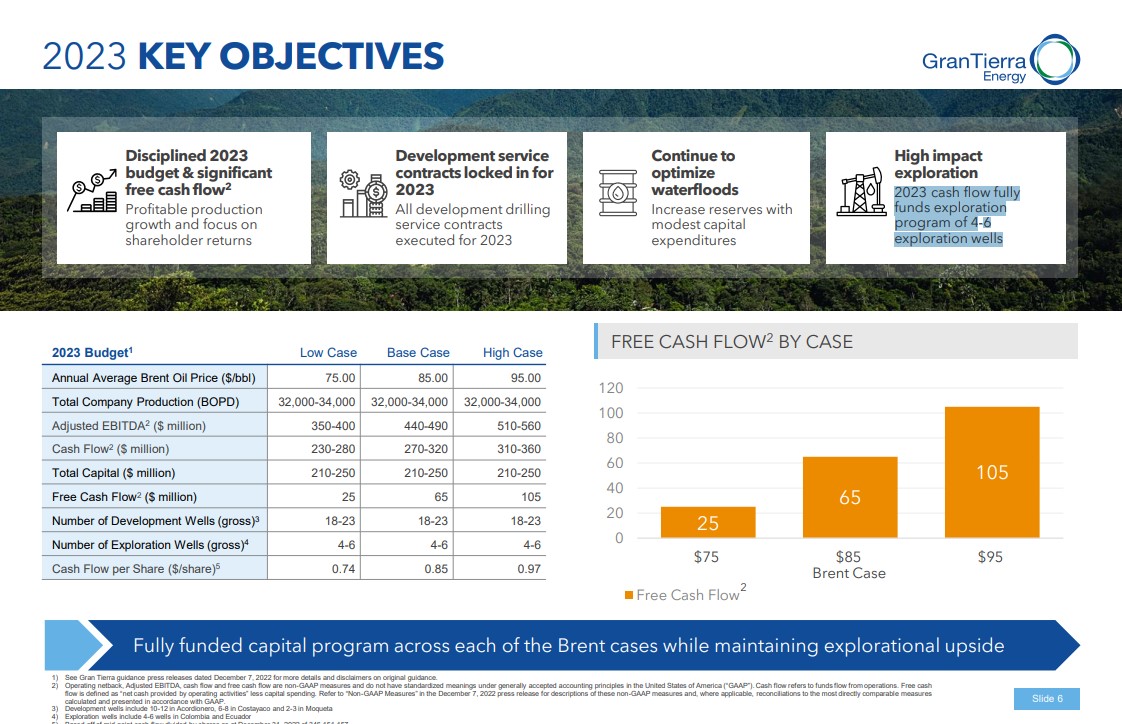

- The company plans to drill 4-6 exploration wells in Colombia and Ecuador in 2023 fully funded by internal cash flows

- It stood on 84 MMboe of 1P reserves at the end of 2022

With inflation remaining at 5.2 per cent in February, public companies are still feeling the crunch of higher prices.

With the Bank of Canada (BoC) raising its benchmark interest rate to 4.5 per cent in tow, and with it the cost to borrow money, and unemployment near a record low of 5 per cent, the current macro environment is especially difficult to operate at an optimal level without adequate capital on hand.

While the BoC sees inflation nearing 2 per cent by the end of 2024, recent BoC surveys show businesses are expecting lower sales and consumers are planning to cut back on expenses due to high household debt and higher mortgage refinancing. This means price normalization alone will not be enough to ensure a company’s sustainable production.

This is why, during uncertain times such as the present moment, many investors tend to limit their pool of prospective allocations to the cash-flowing and the cash-rich. With this thesis in mind, The Market Herald’s Cash-Rich Report introduces you to profitable companies with coffers fortified to weather a multitude of headwinds.

A recipe for long-term value creation

Gran Tierra Energy (GTE) is focused on oil and gas exploration and production in Colombia and Ecuador, both of which offer economic environments marked by contract sanctity, rule of law and the encouragement of foreign direct investment and resource development.

The company’s consolidated reserves and 2023 projections are detailed below:

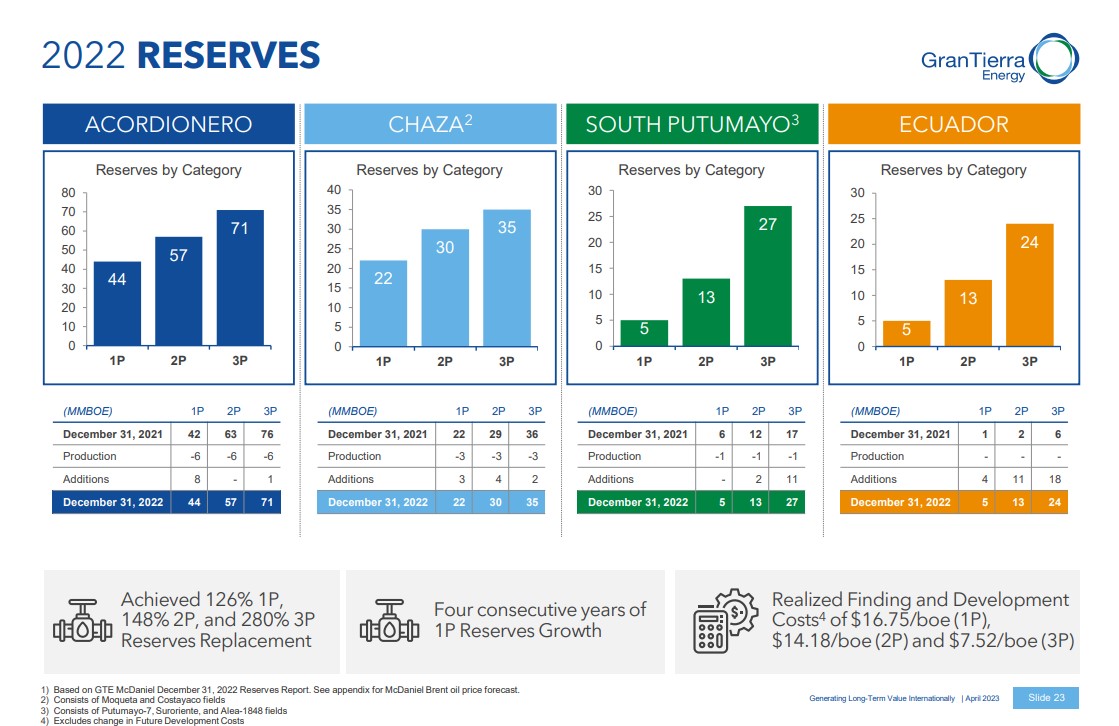

Since 2015, Gran Tierra has added 114 MMbbl in 1P reserves and

144 MMbbl in 2P reserves – based on GTE McDaniel Historical Reserves Reports from 2015 – 2022 – while producing over 76 MMboe. These reserves are broken down by individual asset below:

The company’s consistent productivity and profitability, which we’ll examine in the next section, has allowed it to enhance sustainability and vertical integration to ensure a long runway for shareholder value creation.

A recent example of this came in 2022, when Gran Tierra’s gas-to-power projects generated 69 per cent of the total energy used in company operations, which included the discovery of four exploration wells and the addition of new reserves of 5 MMboe (1P), 16 MMboe (2P) and 32 MMboe (3P).

To date, the company’s environmental efforts have resulted in the planting of 1,470,000 trees and the conservation, preservation, or reforestation of ~3,800 ha of land.

Margin of safety

With an unwavering focus on low-cost operations, Gran Tierra has managed to reduce

drilling times and costs by roughly 50 per cent since 2018, facilitating 4 years of consecutive 1P reserves growth as of April 2023, and 190-per-cent 2P reserves replacement from 2015 to 2022.

One of the key catalysts to these cost reductions is the company’s use of waterflood technology in several key pools, which improves recovery by displacing oil towards producing wells and maintaining and increasing reservoir pressure.

There are approximately 930 MMbbls 2P original oil-in-place under waterflood in Gran Tierra’s four biggest oil fields.

The company’s lean cash management approach has resulted in a stellar financial performance, with net income between US$38.69 million and US$139.03 million in four of the last five years, and operating cash flow between US$81.07 million and US$427.71 million over the last five years.

Add a 40-per-cent reduction in net debt since Q2 2021 to US$453 million, and we begin to get a sense of the responsible and reliable processes and infrastructure Gran Tierra has in place.

Management is forecasting free cash flow of approximately US$135 million before exploration and US$65 million after exploration for fiscal 2023. It also views GTE shares as undervalued to its 1P and 2P before-tax net asset values per share of US$4.62 and US$7.36, respectively.

Looking ahead

Gran Tierra plans to drill 4-6 exploration wells in Colombia and Ecuador in 2023 fully funded by internal cash flows.

The company has additional support through access to an up to US$150 million credit facility expiring August 2024 and US$127 million in cash on hand as of December 2022.

With an eye toward the future, potential investors should look out for work on a diversity of development opportunities within Gran Tierra’s portfolio, including a polymer injection project in Acordionero and 115 proved plus probable undeveloped drilling locations.

Gran Tierra is forecasting US$1.4 billion in future net revenue after taxes and capital expenditures on a 1P basis over the next five years.

Gran Tierra Energy (GTE) is up by approximately 260 per cent since its COVID low, reflecting its consistent fuel production during a period of unprecedented, inflation-inducing demand.

The materials provided in this article are for information only and should not be treated as investment advice. For full disclaimer information, please click here.