When it comes to value investing, the price of admission is looking like you’re wrong for an extended period of time, until your patience is rewarded when the broader market catches wind of your thesis and piles into the stock. Shares of mineral explorer and developer Star Diamond (TSX:DIAM) fit this bill to a tee, down by almost 95 per cent since 2020, despite providing exposure to the largest undeveloped diamond deposit in the world.

A pocket of opportunity amidst a broad-market downturn

According to a recent study from McKinsey & Company, the price of natural diamonds has dropped by almost 50 per cent since 2022 because of competition from lab-grown diamonds, consumers’ increasing preference for ESG-certified diamonds, and sanctions on doing business with Russia, which supplies 30 per cent of the world’s rough diamonds, forcing downstream companies to scramble in search of replacement supply. This dynamic is creating an opportunity for natural diamond players to stand out through an emphasis on low costs, traceability and ownership value.

Star Diamond’s differentiated flagship asset

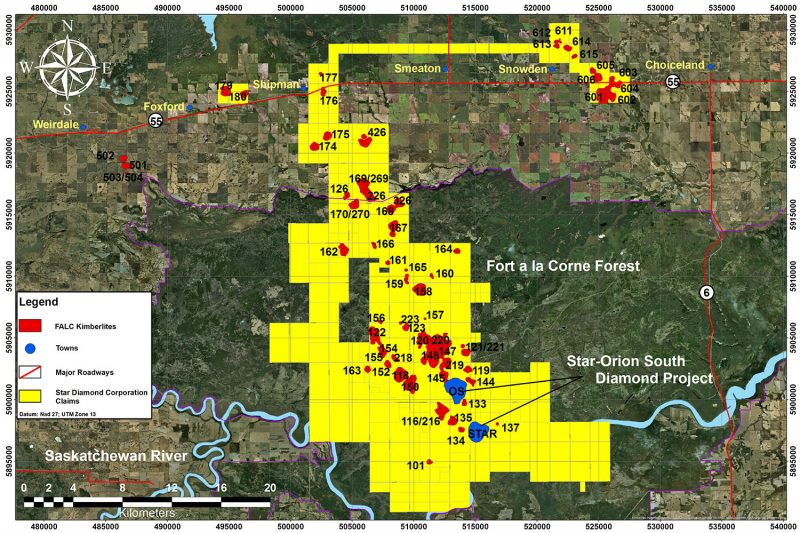

Star Diamond, market capitalization C$12.35 million, holds a 100-per-cent interest in Saskatchewan’s Fort à la Corne property, which houses dozens of diamond-bearing kimberlite bodies across its extensive land package.

Within Fort à la Corne we find the Star-Orion South project, under which lies the largest undeveloped diamond deposit in the world. Star-Orion South is a differentiated asset, boasting:

- A 2018 preliminary economic assessment detailing a C$2 billion after-tax net present value (NPV) (7 per cent), 66 million carats worth of production over a 38-year life of mine, and an after-tax payback period of only 3.4 years after the beginning of production, paving an extensive runway to generate shareholder value.

- An updated July 2024 mineral resource estimate detailing indicated resources on Star of 34.8 million carats and indicated resources on Orion South of 36.9 million carats, for a total of 71.7 million. This includes an anomalously high percentage of ultra-rare, high-purity Type IIa diamonds, which account for just over 1 per cent of global production.

- Readily accessible labor and infrastructure, as well as large continuous diamond-bearing kimberlites, facilitating low-cost production.

Star-Orion South has been explored since 1995, including bulk sampling between 2003-2009, cutting and polishing in 2007 successfully producing high-quality diamonds, and over $300 million spent by Rio Tinto (NYSE:RIO) – a 19.3 per cent Star Diamond shareholder – to develop the project to its advanced stage. All evidence considered, it is reasonable to hold high conviction in the results of a pre-feasibility study planned for 2025.

ESG-conscious diamonds

Besides being financially prospective, Star-Orion South is also aligned with ESG values (slides 21-22), with a power grid only 20 kilometres away enabling all-electric mining and processing activities, 2024 laboratory results indicating that Lizardite from the project may be able to capture significant carbon dioxide, and Saskatchewan ranking as a top mining jurisdiction according to the Fraser Institute.

Star Diamond has also been active in its flagship project’s surrounding community, establishing the Diamond Development Advisory Committee to encourage productive dialogue during regular meetings, as well as providing employment and training for 200 local community members, demonstrating management’s commitment to being a responsible steward of Star-Orion South’s world-leading deposit.

Additionally, the project’s ESG focus elevates its resource over lab grown-diamonds, which require approximately 250 kilowatt-hours per rough carat to produce according to McKinsey’s study – significantly higher than the figures achieved by leading miners like Alrosa and DeBeers – and rely heavily on coal in leading markets China and India.

Nothing like the real thing

Commanding an over US$40 billion value in 2024, the global diamond market is estimated to post a compound annual growth rate of 3.3 per cent through 2030, marked by:

- Declining natural diamond production and rising demand for jewelry (slide 4), fostering price appreciation.

- A clear price separation from lab-grown diamonds, whose prices trade at an 80 per cent discount to the real thing because of excess supply, up from only 20 per cent in 2018.

Star-Orion South sits at the leading edge of this diamond market tailwind, positioned to deliver low-cost, high-value product to the market contingent on successful fundraising for development studies and eventual construction. As should now be evident, the project is a globally relevant asset with demonstrated potential to create generational shareholder value.

To this end, Star Diamond’s management team, stacked with diamond-centric experience, has made a number of strategic moves to fortify Star-Orion South’s value during the market’s present stretch of temporary weakness, setting investors up to benefit from an expected recovery as falling interest rates attract consumers and investors from the sidelines.

Management’s first major value-enhancing move has been to establish a lay of the land when it comes to raising the $3-$5 million required to undertake the aforementioned pre-feasibility study. This includes discussions with over 20 royalty or streaming companies, over 70 institutions specializing in pre-build resource financing and numerous diamond wholesalers and retailers across the world.

Common responses of diamonds not falling within these investors’ mandates, and not possessing the resources to evaluate Star-Orion South properly, led management to its second value-enhancing move of putting the project on care and maintenance. The decision will help to lower operational costs until the diamond market recovers and investors with a value-bent key into the outsized opportunity. Star Diamond’s balance sheet and long-term viability will be further supported by:

- Partnering with Ritchie Bros. Auctioneers to sell its Bauer Trench Cutter, estimated to bring in $4-6 million in gross proceeds, 50 per cent of which is payable to Rio Tinto under the terms of their exit agreement.

- Ongoing discussions with numerous critical minerals companies to sell its bulk sample plant and TOMRA x-ray sorter.

- Moving the company’s head office to a smaller space in the same building, dropping lease payments by 70 per cent.

- Pausing all marketing and consulting contracts.

- The Star Diamond board and president and chief executive officer Ewan Mason forgoing compensation until the company’s finances improve.

- Strategically reducing or eliminating management functions.

Star Diamond will be fundraising in 2025 to cover care and maintenance costs until its planned asset sales enable a pivot into pre-feasibility work, with Mason seeing “the beginning of a turn-around in the larger stone end of the market” that should bode well for Star Diamond into the future.

A bargain of exponential proportions

With diamond demand expected to rise through this decade, and Star-Orion South representing an unmatched asset to supply this demand, potential investors are being gifted the chance to invest in a tier-1 project at peak pessimism, with DIAM shares down by almost 95 per cent since 2020 despite consistent development over the period. This thesis is de-risked by:

- Significant shareholders Rio Tinto at 19.3 per cent and Newmont (TSX:NGT) at 11.5 per cent, both mining giants with tier-1 due diligence teams, plus an international investor with interests in diamonds in discussions with the company to further develop Fort à la Corne that recently purchased 70.7 million shares.

- Additional vectors for value creation in unexplored Fort à la Corne kimberlites, as well as the 4,800-hectare Buffalo Hills property in Alberta, where a field of diamond-bearing kimberlites offers robust exploration upside within the prolific and underexplored Buffalo Hills Kimberlite District.

It should be glaringly obvious how uncommon it is for the top exploration property for a given commodity to trade at a near total loss, in the public stock market, available for one and all to capitalize on. The price-value dislocation is so out of the ordinary that, should the diamond market improve, as it’s expected to over time, Star Diamond may offer up exponential returns beyond reasonable expectations.

In the near term, the company has a solid plan in place to fund pre-feasibility work on Star-Orion South, which should serve as a catalyst for a share price re-rating, increasing investor awareness about the multi-billion-dollar project and the pennies on the dollar it is currently trading for.

Join the discussion: Find out what everybody’s saying about this junior diamond stock on the Star Diamond Corp. Bullboard and check out Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Star Diamond Corp., please see full disclaimer here.

(Top photo of notable stones from the Star and Orion South kimberlites: Star Diamond)