If one thing is for certain, 2022 has been the year that battery metals are dominating the resource market thanks to skyrocketing demand for electric batteries — the fuel behind electric vehicles.

What we’ve seen so far this year are unprecedented prices in metals such as nickel — which reached an all-time high of US$48,000 per metric ton in early March, sending trading on the London Metal Exchange to a six-day halt. Similarly, the price of lithium — another integral component of battery metals — also nearly doubled in price earlier this year.

That being said, the overarching electric vehicle battery market is projected to reach $559.87 billion by 2030 as electric vehicle sales continue driving market growth.

Companies like Surge Battery Metals Inc. (TSXV:NILI, OTC Pink: NILIF, Forum) is well-positioned to be a major factor in the industry thanks to its high-value deposits of clean energy battery metals in top notch mining jurisdictions such as British Columbia and Nevada.

Founded in 1987 and headquartered out of Vancouver, BC, Surge Mattery Metals is a Canadian-based mineral exploration company active in the exploration for nickel-iron alloy in British Columbia and lithium in Nevada. During a previous interview with The Market Herald, Greg Reimer, CEO of Surge Battery Metals, said that British Columbia and Nevada are both world-class mining jurisdictions for exploring nickel and lithium.

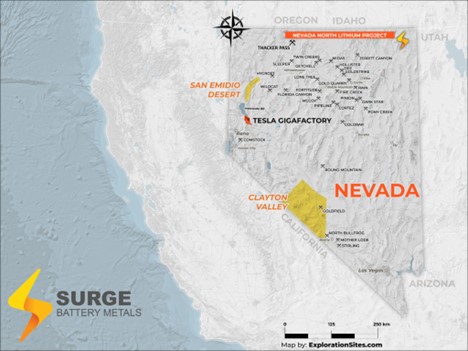

“[BC] is an extremely attractive jurisdiction for metal mining. We’ve got skilled labor and equipment throughout British Columbia and in 2020 Nevada was ranked the number one mining jurisdiction in the world for investment attractiveness by the Fraser Institute,” he told The Market Herald. “The Fraser Institute’s a think tank here in British Columbia. In the same survey, BC Canada was ranked number 17 out of 77 jurisdictions, and in addition, Nevada is currently America’s only lithium-producing state.”

In line with this, Surge Battery Metals is currently working towards advancing its lithium exploration targets in Nevada where it has three main targets.

“[Surge Battery Metals is] going to focus on our Northern Nevada properties as we find that we’ve got some good results coming out of those exploration targets, and we want to focus more of our investment on that particular project,” he told The Market Herald

Because the company is fully funded with C$3.6 million in treasury and $1.1 million expected from warrants — and is backed by a proven team and advisors — Surge Battery Metals will have an influx of news flow over the remaining course of 2022 that will have investors glued to their email inboxes for future updates.

In an interview with The Market Herald, Surge Battery Metals’ technical advisor Malcolm Bell first said the company’s interest in the EV battery market sector is to provide a significant discovery specifically for lithium in Nevada and nickel in British Columbia.

The focus in Northern Nevada on Nevada North

In Nevada in particular, Bell said that Surge Battery Metals is targeting battery metals that have rapid demand growth forecasts and that are positioned to outperform in the market. He explained this means “making a discovery,” and that the company has an extraordinary discovery in Nevada. Surge Battery Metals’ projects are located in Nevada’s world-class mining jurisdictions while also being conveniently located near Tesla’s Gigafactory.

Although the company has several battery metal projects under its belt, Surge Battery Metals is primarily focused on its Nevada North Lithium Project (NNLP), located in the Granite Range about 34 line-kilometers southeast of Jackpot, Nevada.

The Nevada North Lithium Project

With its close proximity to Jackpot, Nevada and roughly 73 line-kilometers north-northeast of Wells, Nevada, the NNLP is a Thacker Pass or Clayton Valley-type lithium clay deposit in volcanic tuff and tuffaceous sediments of the Jarbidge Rhyolite package. The project’s region was also first identified in public domain stream sediment geochemical data with follow up sediment sampling and geologic reconnaissance.

However, the immediate project area has not had modern detailed geologic mapping or age dating. Additionally, there has been limited stream sediment and rock chip sampling done, to date, which shows strong initial lithium readings. Samples have included 1,980 ppm and 1,540 ppm lithium. Rock chip samples have included up to 367 ppm lithium.

In April, Surge Battery Metals announced additional soil sampling was being done at the project which was to essentially complete the soil survey previously cut short by poor weather conditions.

In addition to preliminary results Surge previously reported, Rangefront Mining Services was contracted to complete a survey of over 500 additional samples on sampling lines spaced 100 meters apart. This sampling program will expand the area of previous sampling where assay results for lithium ranged from 29.1 ppm to 5,120 ppm Li. Results included 89 samples outlining a highly anomalous zone containing sample points greater than 1,000 ppm Li. Prior work on the property returned values of up to 1,500 ppm Li in stream sediment samples.

Bell told The Market Herald that at the Nevada North Lithium Project, the company will be proceeding with a US$450,000 exploration project, which he said is about to kick off.

“The results of [the Nevada North Lithium Project] will substantially upgrade the exploration potential of the property,” he said, adding that the second stage of exploration is at the top of the company’s goals.

Bell said the second phase of exploration would allow the company to target and build a resource in the third phase. “We will strategically expand our land position through an additional staking program targeting known sedimentary horizons with potential for lithium bearing clay deposits,” the company said.

Meanwhile exploration plans include grid soil survey and geologic mapping to identify favorable horizons for drill testing and geologic and exploration work to identify source beds of anomalous sediments.

An overview of Surge Battery’s other projects

While Surge Battery Metals is currently focused on the Nevada North Lithium Project, it has several other key projects under its belt that will solidify the company as a game changer in the EV battery market space.

The company’s San Emidio Desert Lithium Project located 60 miles Northeast of Reno in the San Emidio Desert, Washoe County, Nevada covers about 5,525 acres. At the project, the company has a Property Option Agreement to earn an undivided 80% interest in 84 association placer claims covering 4,885 acres, subject to a 2% NSR, from Lithium Corporation. The Company also recently completed a Property Option Agreement to earn an undivided 80% interest in 16 minerals claims comprising 640 acres adjoining this property. Surge also owns a 100% interest in the 663-hectare property in the Teels Marsh Playa Mineral County, Nevada, which is ideally located in an active region for both lithium exploration and production.

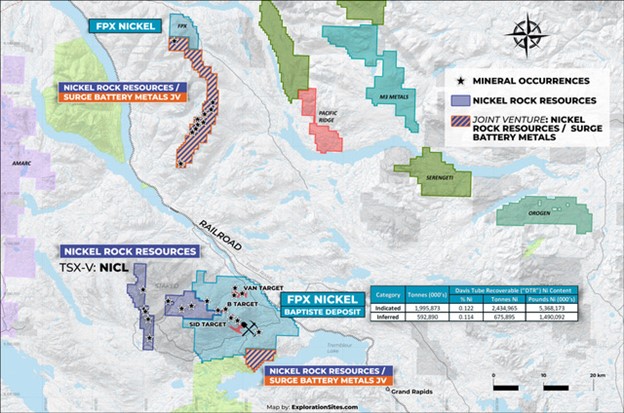

In addition to its lithium projects in Nevada, Surge Battery Metals also has nickel projects located in Northern British Columbia. Notably, the company has a Property Option Agreement to earn an undivided 80% interest in certain mineral claims from Nickel Rock Resources Inc.

The Surge Nickel Project consists of two non-contiguous mineral claims groups consisting of 6 mineral claims in the Mount Sidney Williams area (HN4) covering 1863 hectares immediately south of and adjacent to the Decar Project and the Mitchell Range area (N100) covering 8659 hectares, located in Northern British Columbia. Three of the claims are subject to 2% NSR, including the (HN4 claim and the two southernmost claims of the N100 claims).

Meanwhile, Surge Battery Metals has an exploration stage project located in the Trembleur Lake area of central British Columbia, partially adjacent to FPX Nickel Corp. ‘s Decar Nickel Project. The company’s nickel project is an advanced project targeting awaruite, a nickel-iron alloy mineral, hosted by serpentinized ultramafic intrusive rocks of the Trembleur Ultramafic Unit.

The leadership team

Greg Reimer, president and CEO

Greg Reimer is the former executive vice president of BC Hydro’s transmission and distribution business group, holding the position between June 2010 and 2017. Reimer left BC Hydro to pursue work in the green energy sector. Through his senior executive experience, Reimer brings over 26 years of experience in the public sector. During his time at BC Hydro, Reimer was responsible for over 2,300 employees who plan, design, build operate and maintain the systems and assets for safe electricity to BC Hydro customers. In total, Reimer accounted for $580 million in annual capital investments in transmission and distribution infrastructure as well as $325 million in annual operating and maintenance expenditures.

Konstantin Lichtenwald, CFO

Konstantin Mr. Lichtenwald is a co-founder of Zeus Capital Ltd. Lichtenwald specializes in providing corporate finance, valuation, taxation, financial reporting, consulting and other accounting services to both small businesses as well as public commodity resource companies. He also assists in many aspects of clients’ administration, financing and other activities. Lichtenwald also worked at Ernst & Young GmbH, Germany, in the assurance department. He earned his Bachelor of Business Administration from Pforzheim University, Germany, and holds the professional designation of chartered professional accountant is a member of Chartered Professional Accountants of British Columbia and Canada.

Bill Morton, advisor

Bill Morton has over 40 years of experience in the mining and geoscience fields and roughly 20 years of experience in senior management positions for public resources companies. Morton has been involved with several major metal exploration projects across North America. In addition to his role with Surge Battery Metals, Morton holds or has held director positions with Eastfield Resources Ltd., Lorrain Copper Corp., Cariboo Rose Resources Ltd., and Consolidated Woodjam Copper Corp. Morton received his B.Sc. from Carleton University and completed his graduate studies from UBC.

The Investment Corner

As of the time of this writing, Surge Battery Metals has a market cap of C$6.26 million and share price of $0.07. The company also has a total of 95.66 million shares and 95.66 million shares outstanding.

With ongoing news flow projected from its 2022 exploration programs, investors will want to keep their eyes on Surge Battery Metals as it continues advancing its Nevada North Lithium project and its projects in British Columbia.

In line with this, as environmental, social and governance initiatives remain at the forefront of everyone’s minds, Surge Battery Metals remains committed to creating a cleaner world and more environmentally methods of transportation.

With a proven team and advisors that have experience with business building, capital markets and resource projects, it goes without saying that Surge Battery Metals will be a company to watch out for long-term.

FULL DISCLOSURE: This is a paid article produced by The Market Herald.