Hill Incorporated (TSXV:HILL/OTCQB:HSEED), a bioscience tech innovator, is on the fast-track to cannabis infusion technology market domination thanks to its leading-edge drug delivery solution.

The solution, known as DehydraTECH, is a patented, clinically tested system that produces more efficient and better-performing THC products, enabling manufacturers of cannabis edibles, chocolates, mints, flavored powders and more to set themselves apart from the competition.

A significant advancement in premium cannabis products

DehydraTECH dramatically optimizes the delivery of cannabinoids and other bioactive substances into the bloodstream compared with current technology. It achieves this with THC by coating it with a fatty acid or dietary lipid, then bonding it to a standard product ingredient like starch or sugar. Improvements thanks to this process include:

- Onset reduction to 12-20 minutes from 60-120 minutes

- Avoidance of first-pass liver metabolism, which degrades THC by 75-85 per cent and results in inconsistent dosing and absorption

- Increased bioavailability by 5x-10x, comparable to the speed of delivery by inhalation

- Multiple years of stable shelf life

- The masking of unwanted tastes, reducing the need for sugar or other additives

- Increased brain permeation up to 19x as shown in animal studies

Hill purchased global DehydraTECH licensing rights for products containing more than 0.3 per cent THC in December 2020. The acquisition, from developer Lexaria Bioscience, is undoubtedly a strategic one because the process ensures that virtually all THC consumed can circulate in the bloodstream in an unmetabolized form.

You heard that right. Almost no THC is lost during digestion.

This simple fact is the reason why a rising number of cannabis companies, such as Neo Alternatives and 1906 Drops, are looking to DehydraTECH to streamline manufacturing, increase dosing predictability, and improve the customer experience compared to traditional biodelivery and newer nano-emulsification technologies. These competing methods tend to use an MCT oil as a transport medium, making first-pass liver metabolism unavoidable.

DehydraTECH also enables reliable taste and dosing across product categories, including cannabis edibles, beverages, topicals, tinctures and sublingual products, and requires no changes to product formulas, sweetening the case for cannabis CPG providers keen on minimizing waste and fortifying their bottom lines.

A strong growth trend based on clear value creation

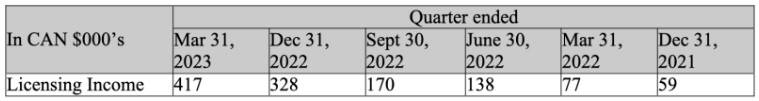

Word of the operational enhancements enabled by DehydraTECH are quickly spreading across the cannabis industry landscape, as evidenced by Hill’s FY Q3 2023 results.

DehydraTECH’s record Q3 licensing revenue increased 442 per cent YoY and 28 per cent from Q2 to C$417,000. This spike in sales stems from a rapidly expanding list of 10 active products and a U.S. presence that now spans 13 states, representing an addressable market of US$25.6 billion in estimated 2023 cannabis sales, or more than two-thirds of the entire U.S. market.

DehydraTECH licensing revenues over the past six quarters

Hill also specializes in non-alcoholic beverages, a division that has benefitted from recent enhancements across production, logistics and distribution, including larger orders to optimize supply chain timing and efficiency, resulting in:

- Lower storage costs

- Lower inventory as working capital

- A shortened order-to-cash cycle

- Increased more sustainable growth potential in a surging market after record Q2 revenue

These optimizations, coupled with DehydraTECH’s success, allowed the company to achieve a 44 per cent increase in consolidated gross profit year-to-May 30, 2023, vs. a year ago, which follows full-year FY 2022 growth of 37 per cent YoY.

Far from resting on these laurels, management has been preparing the business to continue broadening its footprint across a wider variety of cannabis brands and consumers. Let’s break down how.

A fortress balance sheet to catalyze further expansion

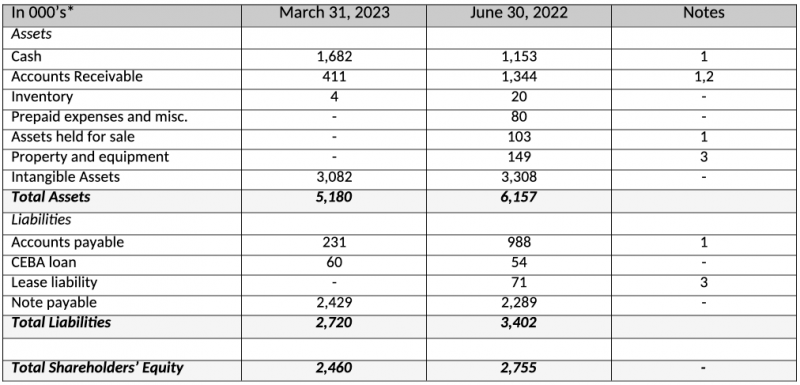

To maximize DehydraTECH revenue-generation potential across new licensees, states and product forms, Hill’s management has improved the company’s balance sheet with an eye on financial operating health.

Value-added moves include:

- Collecting all significant aged receivables, including over 95 per cent of receivables outstanding

- Settling all significant aged payables

- A legacy asset sale for net proceeds of $143,601 and a gain of $40,512

Summary of balance sheet clean-up

The end result is that Hill now holds sufficient cash to fund operations for at least the next 12 months, over which the company expects DehydraTECH to make further inroads into the U.S. cannabis edibles market.

This thesis is supported by U.S. edibles sales adding 31 per cent from US$2.2 billion in 2020 to US$2.9 billion in 2021, with another 18 per cent to US$3.4 billion in 2022, according to New Frontier Data. This trajectory sets the stage for a substantial 2023 as more states legalize cannabis and its stigma continues to fade into a relic of the past.

Cannabis tech at an attractive entry point

At a time of mass layoffs, consolidations, and cratering margins among cannabis’ overgrown global players, Hill Incorporated stands out as a leading example of how marketable pick-and-shovel innovations can lead the industry forward for manufacturers, customers and shareholders alike.

This is why Hill stock’s (TSXV:HILL) losses of approximately 20 per cent YoY represent a potential value play, contingent on your due diligence process, with investors underestimating the outsized potential of the company’s recent results backed by long-term tailwinds.

As cannabis edibles companies vie for market share by building brand value, it’s only a matter of time before wider recognition catalyzes Hill’s growth and cements its reputation as a differentiator among tech providers in the space.

This is sponsored content issued on behalf of Hill Incorporated, please see full disclaimer here.