- TC Transcontinental (TCL.A) reported increased revenue in the third quarter, driven by organic growth in the company’s printing sector

- Revenue for Q3 2021 was up 5.8 per cent year-over-year, while earnings from operations were $50.2 million

- TC Transcontinental expects to continue to generate significant cash flows in the upcoming quarter

- TC Transcontinental is a Canadian printer and flexible packaging provider

- Transcontinental Inc. (TCL.A) is currently down 5.04 per cent, trading at $23.17 per share

TC Transcontinental (TCL.A) reported increased revenue in the third quarter, driven by organic growth in the company’s printing sector.

Revenue for Q3 2021 was up 5.8 per cent year-over-year, increasing from $587.4 million in the third quarter of 2020 to $621.6 million in 2021.

“Our printing sector, while continuing to be impacted by the pandemic, posted strong organic growth in revenues and generated solid profitability as a result of the gradual reopening of the economy and our disciplined cost control,” remarked TC Transcontinental president and CEO François Olivier.

The company experienced a decline in operating earnings that it attributes to a decrease in the Canada Emergency Wage Subsidy compared to the same period last year. Compared to $75.3 million in 2020, earnings from operations at the end of Q3 2021 were $50.2 million.

“We continue to secure significant and promising agreements with many customers, while our sustainable packaging products, which contribute to the circular economy for plastic, are gaining momentum,” added Mr. Olivier. “All of this bodes well for our growth outlook in the coming years.”

TC Transcontinental expects to continue to generate significant cash flows in the upcoming quarter, allowing the company to reduce its net debt and focus on organic growth.

“Our performance since the beginning of the fiscal year,” continued François Olivier, “combined with the solid foundations of our customer relationships and the development of sustainable products, [. . .] allow us to pursue our growth strategy in each of our three sectors and look to the future with confidence.”

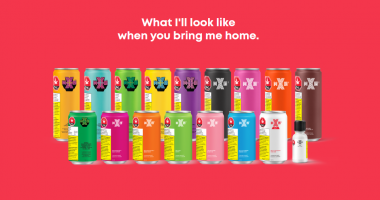

TC Transcontinental is a Canadian printer and flexible packaging provider that operates in the packaging, printing and media sectors.

Transcontinental Inc. (TCL.A) is currently down 5.04 per cent, trading at $23.17 per share as of 3:28 pm ET.