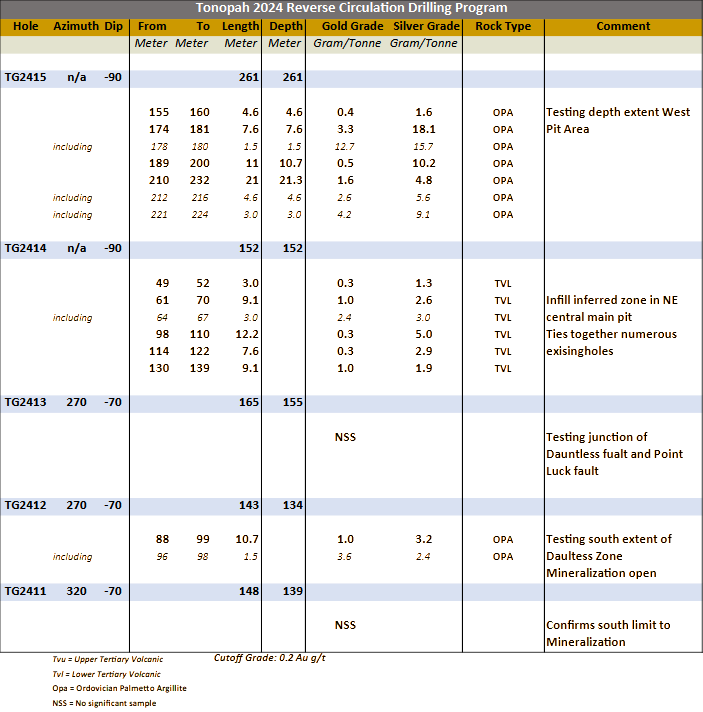

- Viva Gold (TSXV:VAU), an undervalued gold stock, is unveiling strong initial results from its 2024 drilling program at its Tonopah project in Nevada

- Highlights include 1.5 metres grading 12.7 grams per ton of gold and 10.7 metres grading 1 gram per ton of gold

- Viva Gold is a junior gold stock developing its Tonopah project in Nevada only a 30 minute drive from Kinross Gold’s Round Mountain mine

- Viva Gold stock is flat year-over-year and down by 52 per cent since 2019

Viva Gold (TSXV:VAU), an undervalued gold stock, is unveiling strong initial results from its 2024 drilling program at its Tonopah project in Nevada.

Of 13 total drill holes, five are covered in Wednesday’s news release, with an additional five being assayed and expected to be shared in January 2025.

The preliminary economic assessment-stage project, located in the prospective Walker Lane mineral trend, offers exposure to a measured, indicated and inferred resource of 600,000 ounces of gold.

Viva Gold stock has given back 52 per cent of its value since 2019, despite adding 224,000 ounces to Tonopah’s estimated resource and the price of gold rising by approximately US$1,000 per ounce over the period. Value investors should take note.

Leadership insights

“This drill program was designed to fill gaps in drilling within the existing resource pit area, with the goal of upgrading inferred gold resources to at least an indicated level for future conversion to mineral reserve in feasibility study,” James Hesketh, Viva Gold’s president and chief executive officer, said in a statement. “Additionally, we prioritized some holes in this program to target major step-outs and test the mineral model as defined by recently completed 3D modelling of historic geophysical data in combination with lithologic and structural interpretations. We are very pleased with these initial drill results as they exceed expectations and further increase our confidence in the project as we move towards feasibility and permitting.”

About Viva Gold

Viva Gold is a junior gold stock developing its Tonopah project in Nevada only a 30 minute drive from Kinross Gold’s Round Mountain mine. Management has consistently grown gold resources at Tonopah since 2018 and plans to begin work on a pre-feasibility study in 2025. The team is led by CEO James Hesketh, who has led the development and construction of eight other mines around the world.

Viva Gold stock (TSXV:VAU) is down by 7.69 per cent trading at C$0.12 per share as of 11:03 am ET. The stock is flat year-over-year but remains down by 52 per cent since 2019.

Join the discussion: Find out what everybody’s saying about this undervalued gold stock on the Viva Gold Corp. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of past drilling at Viva Gold’s Tonopah project in Nevada: Viva Gold)