- Up to 10,000,000 units will be offered for $0.05 per unit for gross proceeds of $500,000

- Purchase warrants are exercisable for three years at $0.07 per share

- Net proceeds will be used to advance the development of the Pegmont Lead-Zinc project

- Vendetta Mining is a Canadian junior exploration company

- Vendetta Mining Corp. (VTT) opened trading at C$0.045 per share

Vendetta Mining Corp. (VTT) announces a non-brokered private placement.

Up to 10,000,000 units will be offered for $0.05 per unit for gross proceeds of $500,000. Each unit will be comprised of one common share and one-half of one common share purchase warrant exercisable for three years for $0.07 per share.

The private placement is subject to the approval of the TSXV. Securities issued will be subject to a four-month hold period under securities laws.

Net proceeds will be used to advance the development of the Pegmont Lead-Zinc project and for general working capital.

Finder’s fees of up to 7% cash or 7% shares may be payable.

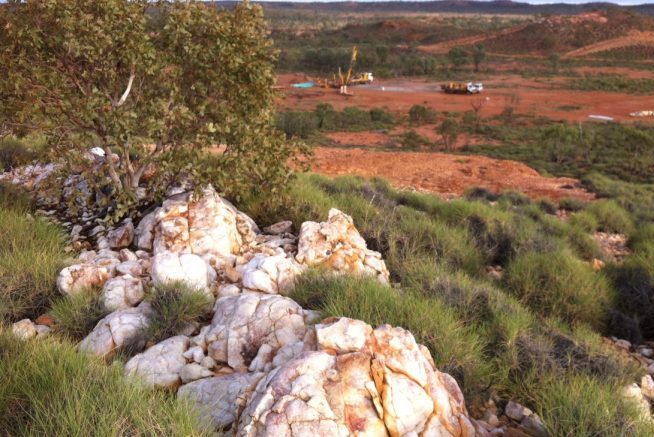

Vendetta Mining is a Canadian junior exploration company engaged in acquiring, exploring, and developing mineral properties, emphasizing lead and zinc. It is currently focused on advancing the Pegmont Lead-Zinc project in Australia.

Vendetta Mining Corp. (VTT) opened trading at C$0.045 per share.