- Vendetta Mining Corp. (VTT) has closed a non-brokered private placement for gross proceeds of $934,998.70

- The company issued 18,699,974 units at a price of $0.05 per unit

- Vendetta Mining is a Canadian junior exploration company focused on acquiring, exploring, and developing mineral properties

- Vendetta Mining Corp. (VTT) opened trading at C$0.05

Vendetta Mining Corp. (VTT) has closed its previously announced non-brokered private placement for gross proceeds of $934,998.70.

The company issued 18,699,974 units at a price of $0.05 per unit. Each unit consists of one common share and one-half of one non-transferable common share purchase warrant. Each warrant is exercisable by the holder to acquire one additional common share for a period of 24 months from the closing date of the private placement at a price of C$0.06 per share.

The company paid finders’ commissions of $9,100.

All securities issued are subject to a hold period expiring on June 15, 2023.

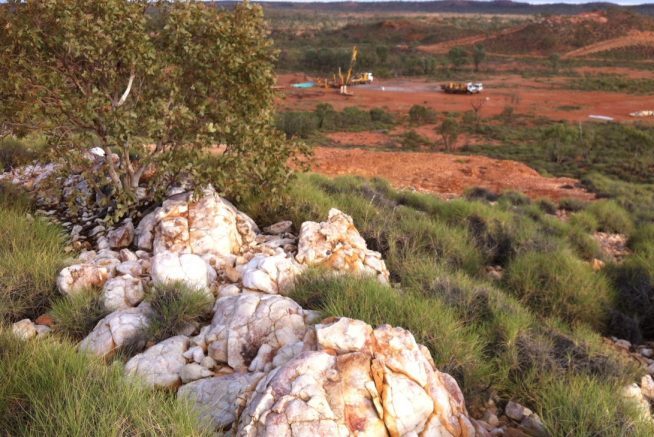

The proceeds will be used to fund the exploration of its Pegmont Lead Zinc project.

A company insider acquired 3,182,400 units under the offering.

Vendetta Mining Corp. is a Canadian junior exploration company focused on acquiring, exploring, and developing mineral properties with an emphasis on lead and zinc. It is currently focused on advancing the Pegmont Lead Zinc project in Australia.

Vendetta Mining Corp. (VTT) opened trading at C$0.05.