- Victory Battery Metals (VR) has shared initial exploration plans for its Stingray Property in Quebec

- The property offers over 25 km of strike length adjacent to Patriot Battery Metals’ (PMET) significant Corvette lithium discoveries

- The initial program at Stingray will consist of prospecting, reconnaissance mapping and geochemical sampling

- Victory Battery Metals is a mineral exploration company with interests in North America

- Victory Battery Metals (VR) is unchanged, trading at $0.13 per share

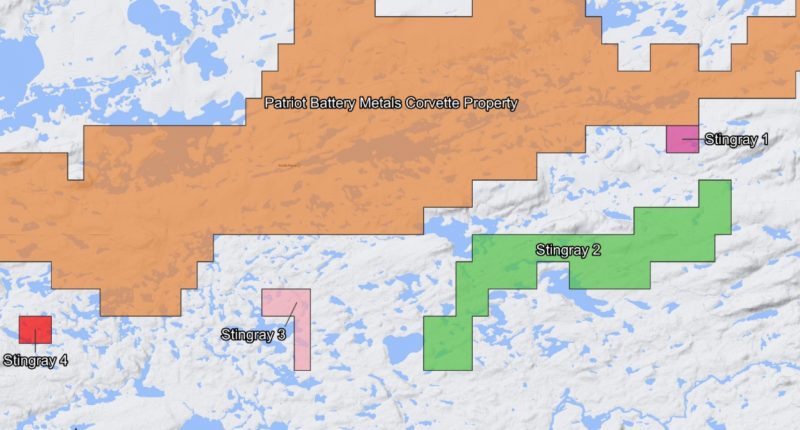

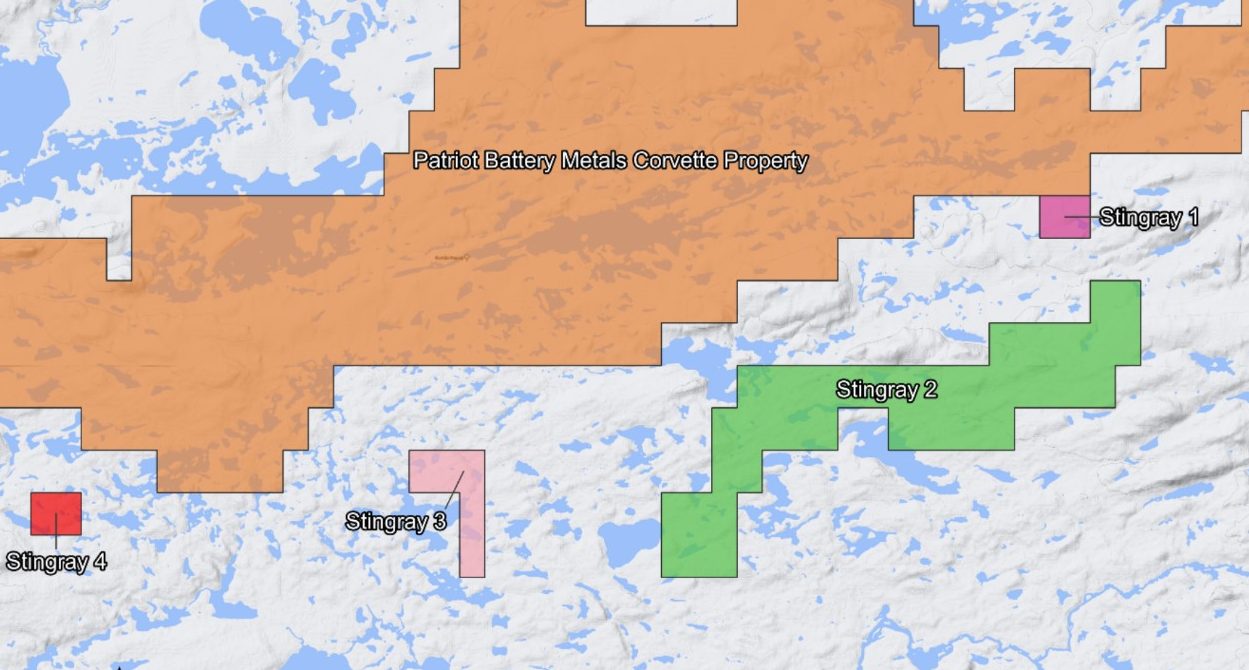

Victory Battery Metals (VR) has shared initial exploration plans for its Stingray Property in Quebec.

The property is comprised of several claim blocks (over 25 km of strike length) adjacent to and along the same rock unit as Patriot Battery Metals’ (PMET) significant Corvette lithium discoveries.

Victory’s initial program will consist of prospecting, reconnaissance mapping and geochemical sampling to uncover prospective pegmatites.

Additionally, the company has closed the first tranche of its previously announced private placement. It raised gross proceeds of $448,000. One insider participated in the closing.

“The Stingray Property array is in a prime location, and our exploration team has outlined an initial program while simultaneously looking for additional strategically aligned property in the area,” said Mark Ireton, Victory’s President and CEO.

Victory Battery Metals is a mineral exploration company with interests in North America.

Victory Battery Metals (VR) is unchanged, trading at $0.13 per share as of 12:07 pm EST.