- Spearmint Resources (SPMT) has acquired the Green Clay Lithium Project in Clayton Valley, Nevada

- The company will earn a 100-per-cent interest in the property by issuing four million common shares plus C$60,000 in cash within the next year

- The option agreement with an arm’s-length party includes 97 contiguous claims totaling 2,000 acres

- Spearmint is focused on mineral exploration projects in Canada and the United States

- Spearmint Resources (SPMT) is up by 18.18 per cent and is currently trading at $0.13 per share

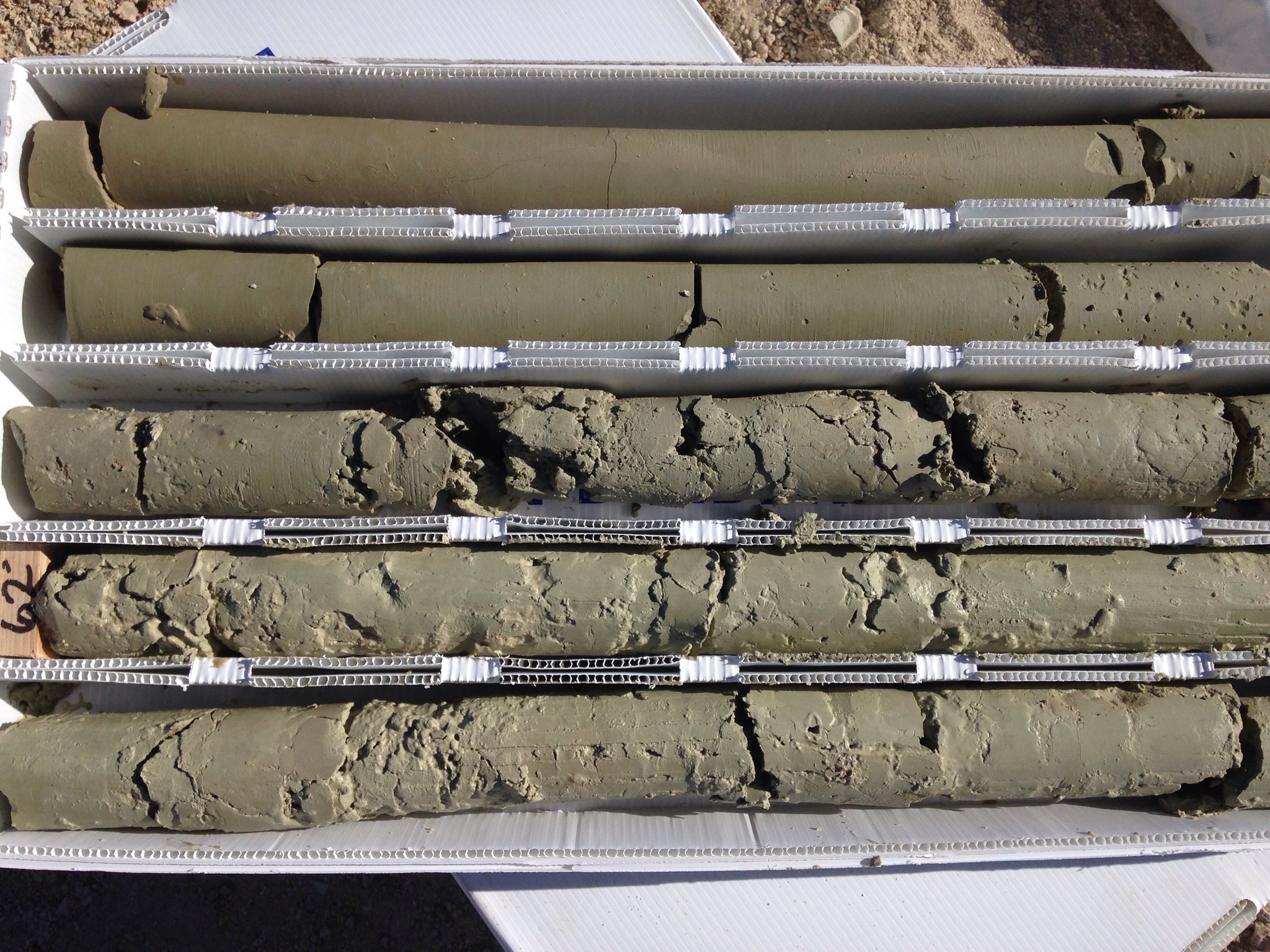

Spearmint Resources (SPMT) has acquired the Green Clay Lithium Project in Clayton Valley, Nevada.

The option agreement with an arms-length party includes 97 contiguous claims totalling 2,000 acres.

The company will earn a 100-per-cent interest in the property by issuing four million common shares priced at C$0.08 per share plus $60,000 in cash within the next year.

The deal includes a 1.5 per cent NSR royalty, which Spearmint may purchase 0.75 per cent for $500,000 at any time up to the commencement of production.

James Nelson, President of Spearmint Resources, stated,

“We are very pleased to have acquired another lithium project to add to our portfolio in Clayton Valley, Nevada, the most premier address for lithium in North America. We will begin to formulate work programs shortly for this new lithium clay project; in addition, a phase III drill program on our flagship Clayton Valley Lithium Project is being planned for Fall 2021 with the goal to build upon our recently released maiden resource estimate, which included a total of 1,006,000 tonnes of Lithium Carbonate Equivalent (LCE).

As for Spearmint’s other active projects, work is continuing on our Perron-East gold project in Quebec in the direct vicinity of Amex Exploration Inc. and Starr Peak Mining Ltd. with a drill program expected to occur in Fall 2021. We also expect to start a phase II work program shortly on our gold project directly bordering New Found Gold’s Keats discovery in Newfoundland.

Spearmint is well-funded for all planned work programs with approximately $3 million in the treasury, including flow-through funds which include an initial investment by certain funds managed by Sprott Asset Management LP. The remainder of 2021 and beyond will be an extremely active period for Spearmint with catalysts coming ahead on multiple projects.”

Spearmint is focused on mineral exploration projects in Canada and the United States.

Spearmint Resources (SPMT) is up by 18.18 per cent and is currently trading at $0.13 per share as of 1:21 pm ET.