- Latin Metals (LMS) has announced a non-brokered private placement for gross proceeds of up to C$1 million

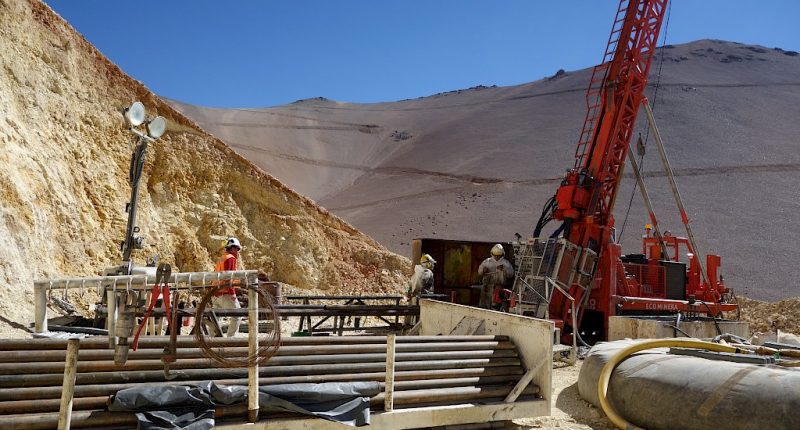

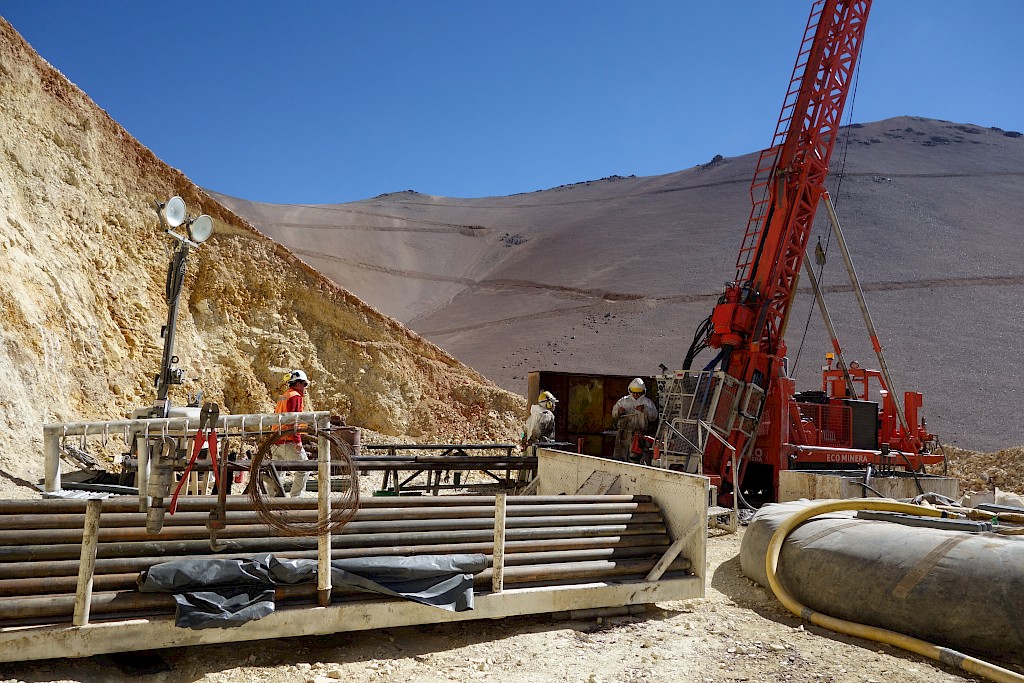

- The company will use the proceeds for ongoing exploration at its mineral projects in Argentina and Peru

- Latin Metals is a mineral exploration company acquiring a portfolio of assets in South America

- The company focuses on commodity diversification and on enlisting joint venture partners to create long-term value for shareholders

- Latin Metals (LMS) is unchanged trading at $0.175 per share

Latin Metals (LMS) has announced a non-brokered private placement for gross proceeds of up to C$1 million.

The company will offer up to 6,666,667 units priced at $0.15 per unit.

Each unit consists of one Latin Metals common share and one-half of one common share purchase warrant.

Each warrant entitles the holder to purchase one common share for $0.25 for 24 months from the closing of the financing.

Latin Metals will use the proceeds for ongoing exploration at its mineral projects in Argentina and Peru and for general working capital.

Latin Metals is a mineral exploration company acquiring a portfolio of assets in South America. The company focuses on commodity diversification and on enlisting joint venture partners to create long-term value for shareholders.

Latin Metals (LMS) is unchanged trading at $0.175 per share as of 11:25 am ET.