- Foraco International SA (FAR) has received approval for a normal course issuer bid

- Foraco may purchase up to 1,000,000 of its common shares over the next 12 months

- Under the previous NCIB that ended June 18, 2021, Foraco purchased 683,888 common shares for an average price of $0.60

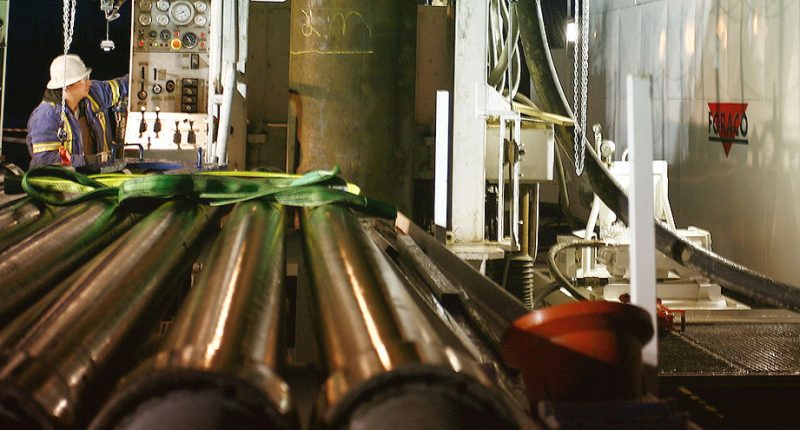

- Foraco is a global leading drilling services company that provides turnkey solutions for mining, energy, water and infrastructure projects

- Foraco International SA (FAR) is unchanged, trading at C$2.08 per share at 11:45 am ET

Foraco International SA (FAR) has received approval for a normal course issuer bid.

Foraco may purchase up to 1,000,000 of its common shares commencing between September 20, 2021, and September 19, 2022. Daily purchases will not exceed 4,543 common shares, other than block purchase exceptions.

In the previous NCIB that ended June 18, 2021, Foraco purchased 683,888 common shares for an average price of $0.60. The securities were repurchased through the TSX and through alternative trading systems.

The average daily trading volume for the six months period prior to September 1, 2021, was 18,175 common shares.

Foraco has engaged M Partners Inc. as its broker under an automatic share purchase plan to undertake purchases under the NCIB.

The company intends to hold the shares until the shares are transferred to employees under Foraco’s free share plans.

Foraco International SA (FAR) is a global leading drilling services company that provides turnkey solutions for mining, energy, water and infrastructure projects.

Foraco International SA (FAR) is unchanged, trading at C$2.08 per share at 11:45 am ET.