- CanAlaska (CVV) stakes historical uranium showings

- Near 92 energy and baselode energy uranium drillhole intersections

- The presence of biotite gneiss, graphitic gneiss and calcsilicate (mafic gneiss) lithologies provides the contrast in rock strength

- CanAlaska is currently drilling on its West McArthur Joint Venture Project in the 42 Zone discovery area, a joint venture with Cameco Corporation

- CanAlaska Uranium’s (CVV) is up 2.86 per cent and is trading at C$0.72 at 11:52 am ET

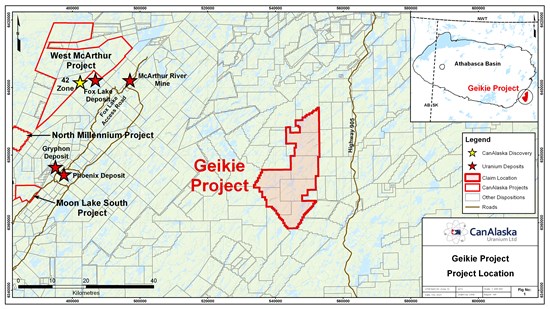

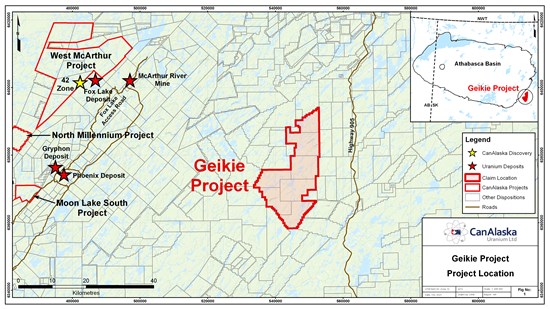

CanAlaska Uranium (CVV) has identified six new uranium targets along 35 kilometres of major structures on its newly-acquired Geikie Project.

The targets are outlined by coincident magnetic breaks and prospective geology offsets just 10 kilometres from 92 Energy’s Gemini mineralization (GM) and Baselode Energy’s ACKIO and Beckett mineralization, and only 10 kilometres from a major highway.

CanAlaska’s Geikie property straddles the extension of a fertile corridor of biotite gneisses hosting the Agip S high-grade uranium showing with up to 49 per cent U and the recent Baselode Energy radioactive intersections near Beckett Lake on the Hook Lake property.

The latter appears similar to 92 Energy’s GM uranium zone near where Baselode has also intersected elevated radioactivity.

The presence of biotite gneiss, graphitic gneiss and calcsilicate (mafic gneiss) lithologies provides the contrast in rock strength and chemistry to create the pathway for structural disturbance together with the reducing conditions necessary to precipitate uranium.

At least two large north-south trending Tabbernor faults interact with and displace these fertile uranium corridors creating ideal conditions for uranium deposits to form.

Several historical uranium showings occur on the property with grades as high as 0.225 per cent U identified (Figure 2).

The presence of Athabasca Group sandstone boulders in the project area demonstrates that the Athabasca Basin once covered this area indicating good potential for high-grade basement-hosted unconformity-related uranium deposits to form similar to NexGen’s Arrow and Cameco’s Eagle Point and Millennium uranium deposits.

CanAlaska CEO, Cory Belyk, comments, “Our team recognized the underexplored opportunity in this region of the eastern Athabasca Basin in conjunction with recent exploration success indicators, and acquired this very large contiguous land position just prior to the recent uranium staking rush.”

CanAlaska is currently drilling on its West McArthur Joint Venture Project in the 42 Zone discovery area, a joint venture with Cameco Corporation.

CanAlaska Uranium Ltd. holds interests in approximately 300,000 hectares, in Canada’s Athabasca Basin – the “Saudi Arabia of Uranium.” CanAlaska’s strategic holdings have attracted major international mining companies.

CanAlaska Uranium’s (CVV) is up 2.86 per cent and is trading at C$0.72 at 11:52 am ET.