- Quebec Nickel is upsizing its private placement to $1 million of units and up to an $6 million of flow-through shares and premium flow-through units for gross proceeds of up to $7,000,000

- The net proceeds from the offering will be used for general working capital purposes

- The offering is expected to close on or about November 1, 2021

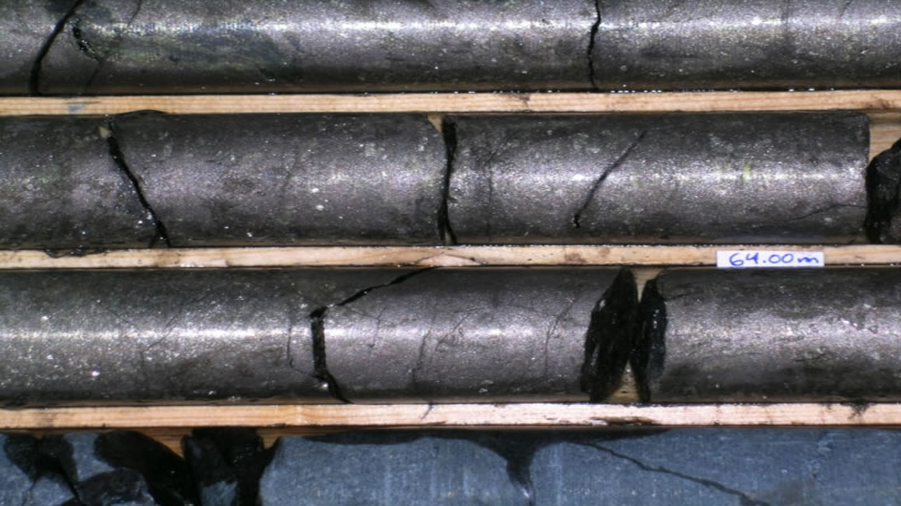

- Quebec Nickel Corp. is a mineral exploration company focused on acquiring, exploring, and developing nickel projects

- Quebec Nickel Corp. (QNI) is unchanged, trading at C$0.30 per share at 3:30 pm ET

Quebec Nickel (QNI) is upsizing its private placement for gross proceeds of up to $7,000,000.

The company will issue up to $1 million of units and up to $6 million of flow-through shares and premium flow-through units.

Each unit and the flow-through unit will consist of one common share and one-half of a transferable purchase warrant. Each warrant will entitle the holder to acquire one additional common share at a price of $0.32 for a period of two years from the closing date.

The net proceeds from the offering will be used for general working capital purposes.

Quebec Nickel may pay finder’s fees and issue finder warrants to eligible registrants of up to 7 per cent of the gross proceeds of the offering.

The offering is expected to close on or about November 1, 2021, and is subject to the approval of the CSE. All securities issued will be subject to a statutory hold period of four months from the date of issuance.

Quebec Nickel Corp. is a mineral exploration company focused on acquiring, exploring, and developing nickel projects.

Quebec Nickel Corp. (QNI) is unchanged, trading at C$0.30 per share at 3:30 pm ET.