- Consolidated Uranium subsidiary Labrador Uranium has announced a private placement of subscription receipts for gross proceeds of up to C$7,000,000

- Labrador Uranium will issue up to 10,000,000 subscription receipts at a price of $0.70 per receipt

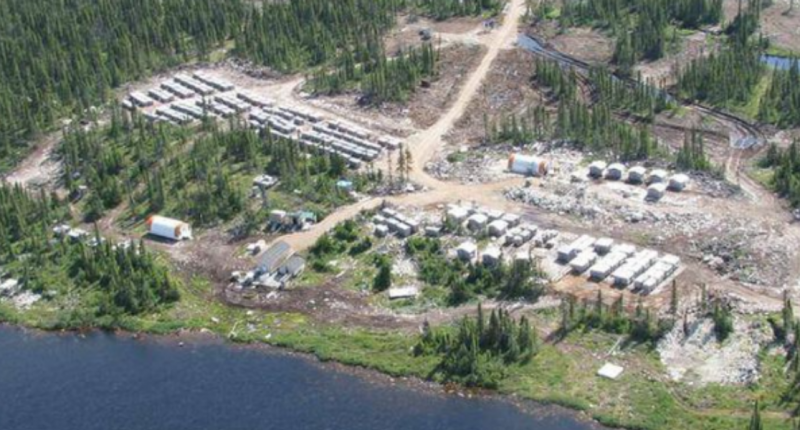

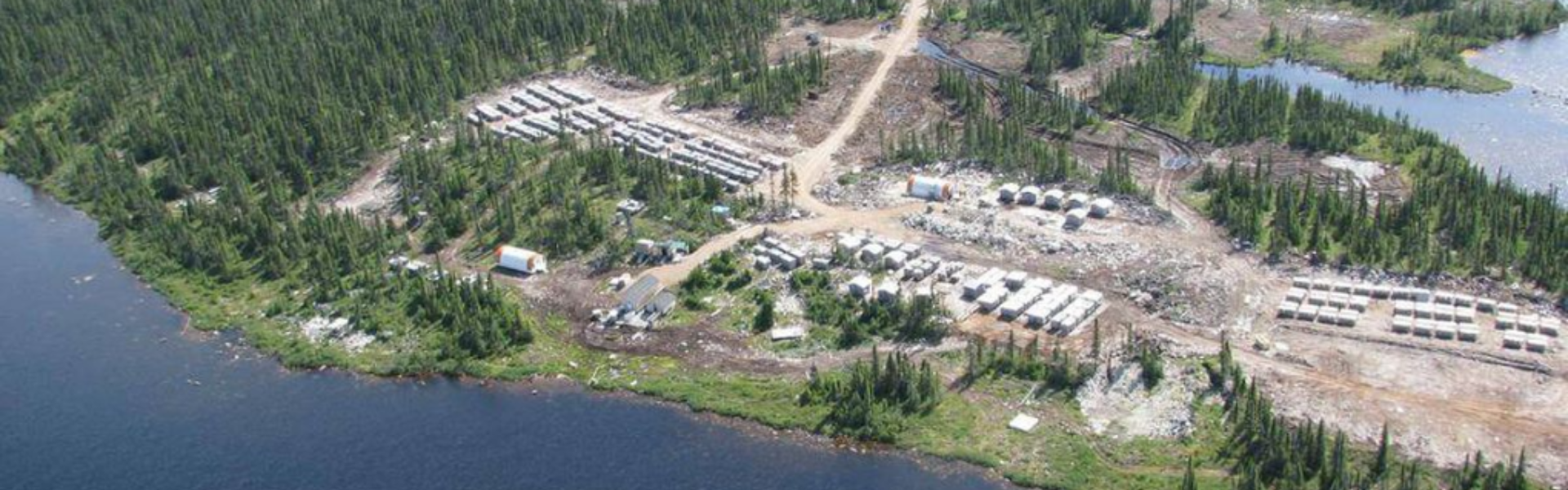

- Once released from escrow, the net proceeds of the offering will be used to fund the proposed exploration programs for the Moran Lake Project, the Central Mineral Belt Project and the Notakwanon Project

- The offering is scheduled to close on or around November 11th

- Consolidated Uranium Inc is an exploration company with uranium projects in Australia, Canada, Argentina and the US

- Consolidated Uranium Inc. (CUR) opened trading at C$2.96 per share

Consolidated Uranium (CUR) subsidiary Labrador Uranium has announced a private placement of subscription receipts for gross proceeds of up to C$7,000,000.

Labrador Uranium will issue up to 10,000,000 subscription receipts at a price of $0.70 per receipt. Red Cloud Securities Inc. will act as lead agent and sole bookrunner on behalf of a syndicate of agents.

The agent will have an option, exercisable in full or in part to sell up to an additional 1,428,571 receipts for additional gross proceeds of up to C$1,000,000.

Philip Williams, President and CEO of Consolidated Uranium, commented on the financing.

“We could not be more thrilled with the enthusiastic response that we have received so quickly for Labrador Uranium. The financing announced today has seen higher demand than anticipated and is expected to be largely subscribed for by existing Consolidated Uranium institutional shareholders. I would highlight that all existing shareholders of CUR, on the effective date of the arrangement, will receive LUR shares though the pro-rata distribution of the 16 million LUR shares that CUR will be receiving for the transfer of its Moran Lake Project.”

Each subscription receipt entitles the holder to receive one unit of LUR. Each unit will consist of one class B common share of LUR and one-half of one common share purchase warrant. Each whole purchase warrant will entitle the holder to purchase one class B common share of LUR at a price of C$1.05 for a period of 24 months following the escrow release date. The escrow release conditions include the completion of the spin-out of Labrador Uranium and the receipt of conditional approval for the listing of LUR’s class B common shares on the CSE.

The proceeds of the LUR offering, net of 50 per cent of the fee payable to the agents, will be held in escrow until the escrow release conditions are satisfied.

The net proceeds of the offering will be used to fund the proposed exploration programs for the Moran Lake Project, the Central Mineral Belt Project and the Notakwanon Project as well as for working capital and general corporate purposes.

The offering is scheduled to close on or around November 11, 2021.

Consolidated Uranium Inc is an exploration company that has acquired or has the right to acquire uranium projects in Australia, Canada, Argentina and the United States.

Consolidated Uranium Inc. (CUR) opened trading at C$2.96 per share.