- Radisson (RDS) has closed its previously announced private placement for aggregate gross proceeds of $6,773,110

- The company issued Class A shares priced at $0.32, Quebec flow-through Class A shares priced at $0.35 and Quebec Charity flow-through shares priced at $0.45

- The gross proceeds will be allocated to ongoing work at the historic O’Brien Gold Project in Québec

- Radisson Mining is a gold mining company

- Radisson Mining Resources Inc. (RDS) opened trading at C$0.205 per share

Radisson (RDS) has closed its previously announced private placement for aggregate gross proceeds of $6,773,110.

The offering was conducted pursuant to an agency agreement entered into between Radisson and a syndicate of agents led by Eight Capital as lead agent and BMO Capital Markets, INFOR Financial Inc., Echelon Wealth Partners Inc., Laurentian Bank Securities Inc. and Raymond James Ltd.

The company issued10,819,629 Quebec flow-through Class A shares at a price of $0.35 per share, 860,000 Quebec charity flow-through Class A shares at a price of $0.45 per share and 2,497,625 flow-through Class A shares at a price of $0.32 per share.

The gross proceeds from the sale of the FT shares will be used for exploration expenses on the O’Brien project, located in Québec.

The agents received a cash commission of $305,478 and 794,532 non-transferable compensation warrants.

All securities issued are subject to a restricted hold period ending on April 14, 2022.

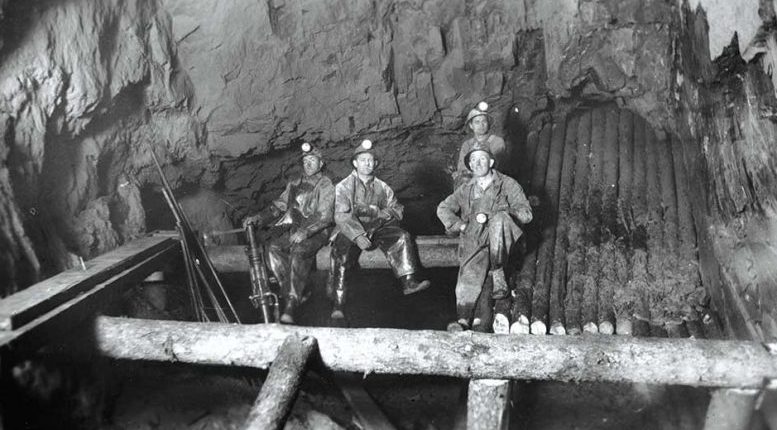

Radisson is a gold exploration company focused on its 100 per cent owned O’Brien project, located in Larder-Lake-Cadillac Break in Abitibi, Québec.

Radisson Mining Resources Inc. (RDS) opened trading at C$0.205 per share.