- Pacific Bay Minerals Ltd. (PBM) signs a letter of intent with Brixton Metals Corp. (BBB) to purchase up to a 100 per cent interest in the Atlin Goldfields Project

- PBM can earn a 51 per cent interest by paying $3.5 million in exploration expenditures, and issuing 5 million shares and the rest under similar conditions

- If the 100 per cent ownership is not reached, the two companies will enter a joint venture

- PBM also announces a non-brokered private placement of 5 million units for $0.10 each

- Pacific Bay Minerals Ltd. (PBM) is unchanged trading at $0.08 per share as of 2:34 p.m. ET

- Brixton Metals Corp. (BBB) is unchanged trading at $0.18 per share as of 2:34 p.m. ET

Pacific Bay Minerals (PBM) has signed an LOI with Brixton Metals (BBB).

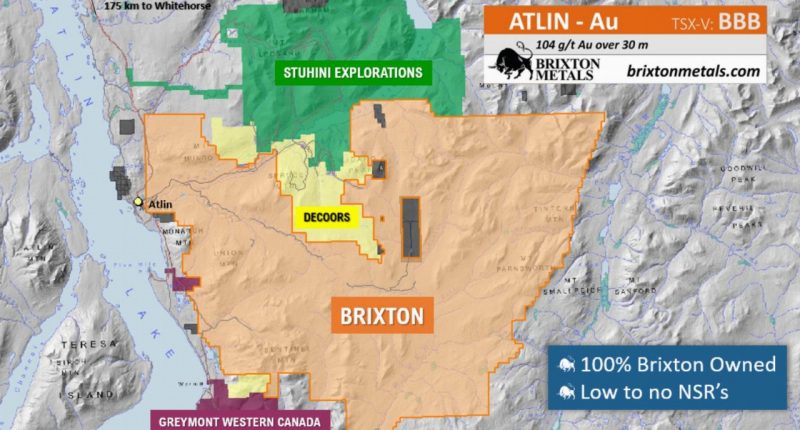

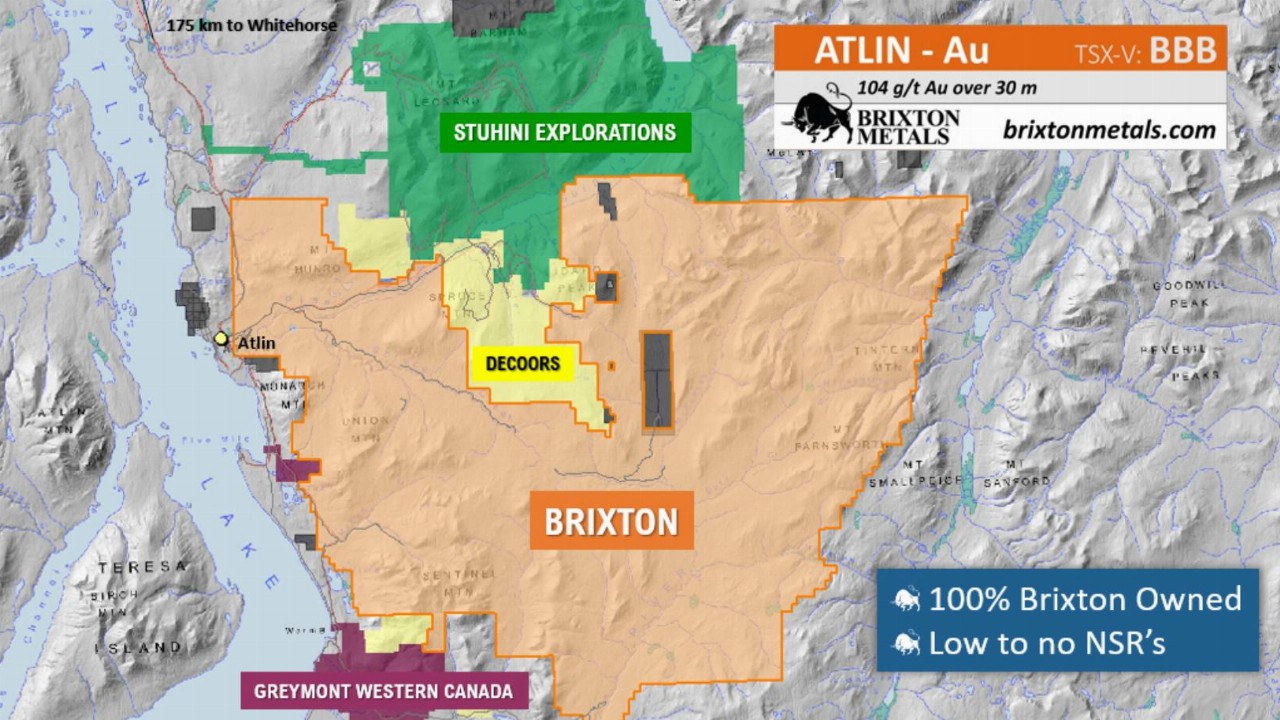

The agreement is in reference to PBM’s interest in acquiring up to a 100 per cent interest in the Atlin Goldfields Project in B.C.

The agreement is subject to the completion of a definitive option agreement, PBM completing a $500,000 financing, and the approval of the TSX Venture Exchange.

PBM may acquire up to a 100 per cent interest in the project from Brixton by completing the following:

- Earning a 51 per cent interest by paying $3.5 million in exploration expenditures, $1.7 million of which in cash, and issuing 5 million of its shares by the fourth anniversary of the closing

- If the 51 per cent interest earn-in has been completed then PBM can earn an additional 49 per cent interest with an additional $3.5 million in exploration expenditures, $1.5 million of which in cash, and issuing 5 million more shares before the seventh anniversary of the closing

If PBM exercises the 51 per cent earn-in but does not exercise the additional 49% earn-in, then the companies will enter a joint venture. Following this, the interest in the property will revert to 49 per cent in favour of PBM and 51 per cent for Brixton. Each party will then participate in programs and budgets according to their pro-rata interests.

If PBM acquires 100 per cent of the property, then Brixton will retain at 2.00 per cent net smelter return royalty (NSR). 1.00 per cent of the NSR will be purchasable at any time by PBM for $2.5 million.

In connection with the agreement, PBM also announces a non-brokered private placement of up to 5 million units for $0.10 each, coming to a total of $500,000.

Each unit will consist of one common share and one common share purchase warrant of the PBM.

Each warrant will entitle the holder to purchase one common share for $0.15 per common share for a year after closing.

Existing shareholders who might not otherwise qualify may participate in this private placement through the “Existing Security Holder Exemption”.

The Company intends to use the net proceeds of the private placement towards expenditures required under the agreement and to exercise the option on the property.

Pacific Bay Minerals Ltd. (PBM) is unchanged trading at $0.08 per share as of 2:34 p.m. ET.

Brixton Metals Corp. (BBB) is unchanged trading at $0.18 per share as of 2:34 p.m. ET.