- Durango Resources (DGO) has closed its non-brokered private placement for aggregate gross proceeds of C$515,500

- The company issued a total of 6,064,705 shares priced at $0.085 per share

- Durango is a Canada-based mining company

- Durango Resources (DGO) opened trading at 0.07

Durango Resources (DGO) has closed its private placement for gross proceeds of C$515,500.

The company issued a total of 6,064,705 shares priced at $0.085 per share.

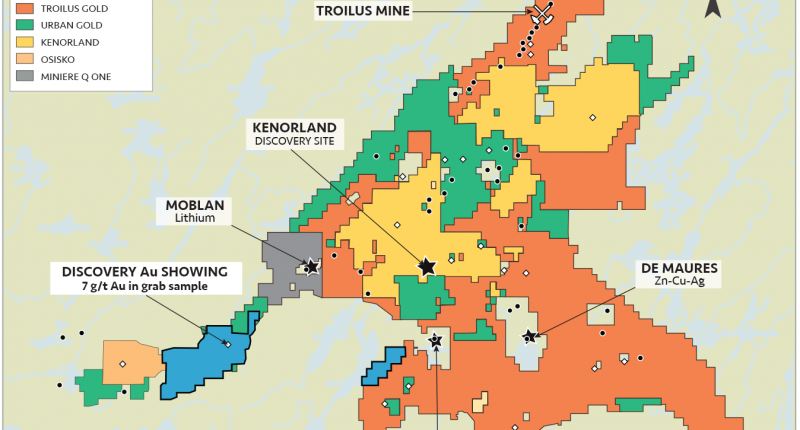

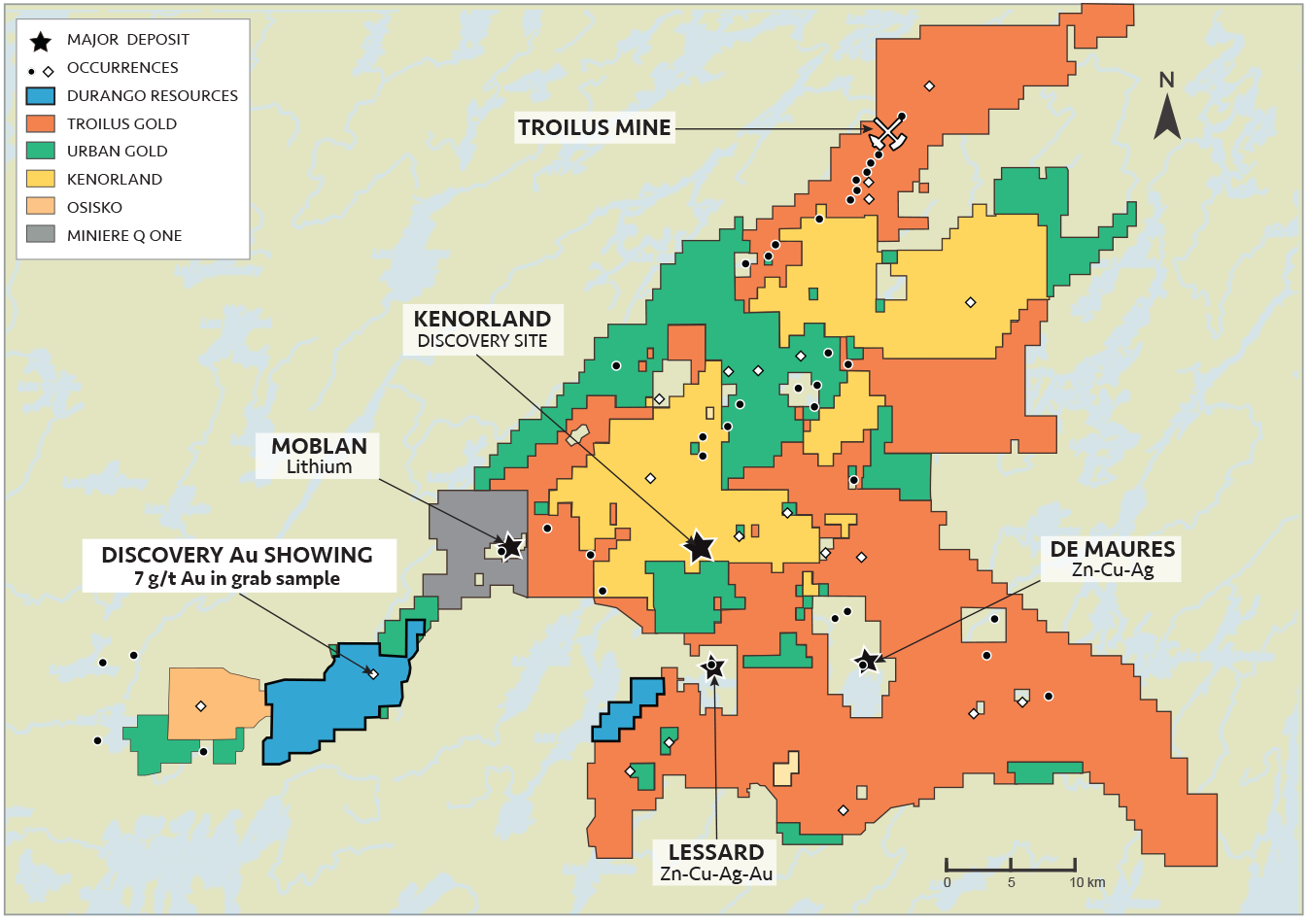

Net proceeds from the offering will be used for exploration activity on Durango’s Discovery Property, located in the Abitibi greenstone belt near Chibougamau, Québec. The Discovery Property is located on strike to the southwest of the past-producing Troilus gold mine and neighbours Troilus Gold Corp. (TSX-TLG). The Discovery Property is over 6,500ha in size and covers an essential geological northeast to southwest regional structure. The Discovery Property has excellent road access and is accessible year-round via the Route du Nord.

The company paid finder’s fees totalling C$36,085.

Securities issued are subject to a four-month hold period.

The flow-through financing was initially announced on May 20, 2022.

Durango is an exploration company engaged in the acquisition and exploration of mineral properties in Canada.

Durango Resources Inc. (DGO) is down 20 per cent, trading at, trading at C$ $0.06 per share at 10:45 am ET.