- Stellar AfricaGold (SPX) has closed the first tranche of a private placement for gross proceeds of $530,400

- The company issued 8,840,000 units at a price of $0.06 per unit

- The net proceeds of the financing will be used to finance the upcoming Phase 1 drilling program at the Tichka Est Gold Project in Morocco

- Stellar AfricaGold Inc. is a Canadian precious metal exploration company whose primary project is the Tichka Est Gold Project

- Stellar AfricaGold Inc. (SPX) opened trading at C$0.055

Stellar AfricaGold (SPX) has closed the first tranche of a private placement for gross proceeds of $530,400.

Under the first tranche, the company issued 8,840,000 units for $0.06 per unit. Each unit consists of one common share and one share purchase warrant. Each warrant entitles the holder to acquire one additional common share for a period of two years.

The company issued 437,667 finder warrants and $32,260 in cash in connection with the financing.

All securities in this Private Placement will be subject to a four-month hold period.

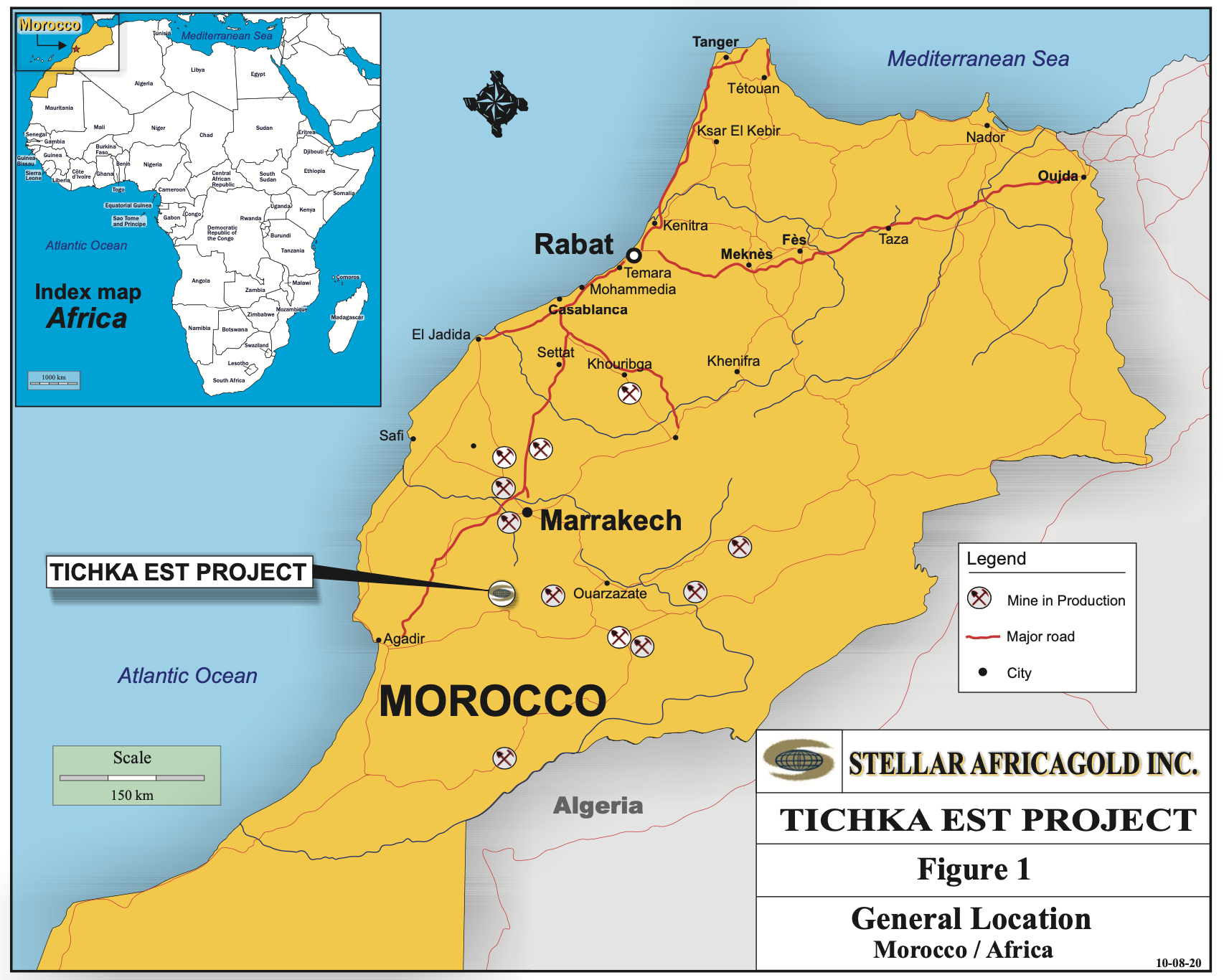

The net proceeds of the financing will be used to finance the upcoming Phase 1 drilling program at the Tichka Est Gold Project in Morocco and continue exploring other areas of the Tichka Est and Namarana Gold Project in Mali.

Stellar AfricaGold Inc. is a Canadian precious metal exploration company. Stellar’s principal exploration project is the Tichka Est Gold Project, a grouping of seven permits covering an area of 82 km2. The Tichka Est Property lies within the High Atlas Western Domain, near the city of Marrakech.

Stellar AfricaGold Inc. (SPX) opened trading at C$0.055.