Over the past few weeks, volatility has seemingly returned to the markets, and the most-viewed stocks have been in constant upheaval because of it. For investors focused on the markets and small-cap opportunities within them, it can be hard to keep up with which cannabis company is recovering the fastest, which energy producer is on top, and which tech play is making the most impressive advancements.

As the largest investor hub in Canada, Stockhouse has plenty of small-cap focused users invested in the dramatic gains and losses made each week. They help us break down the seeming fall of a healthcare king and rise of two down-and-out sectors.

Now is as good a time as any to check in with the most-viewed stocks of each sector on the Stockhouse Bullboards and see the current state of the markets.

This week, Canadian cannabis and cannabinoid-based consumer product company, Canopy Growth Corp. (TSX: WEED, Forum) released its financial results for Q4 2021 and fiscal year ended March 31, 2022.

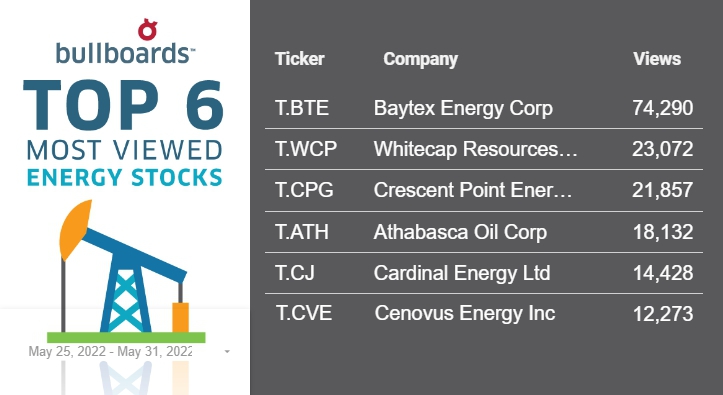

A standout energy company with oil and natural gas operations in Canada and the Asia Pacific region, Cenovus Energy Inc. (TSX:CVE, Forum) and its partners have agreed to restart the offshore West White Rose Project in Newfoundland.

Initial production is anticipated in the first half of 2026, with peak production anticipated to reach approximately 80,000 barrels per day (bbls/d), 45,000 bbls/d net to Cenovus, by year-end 2029.

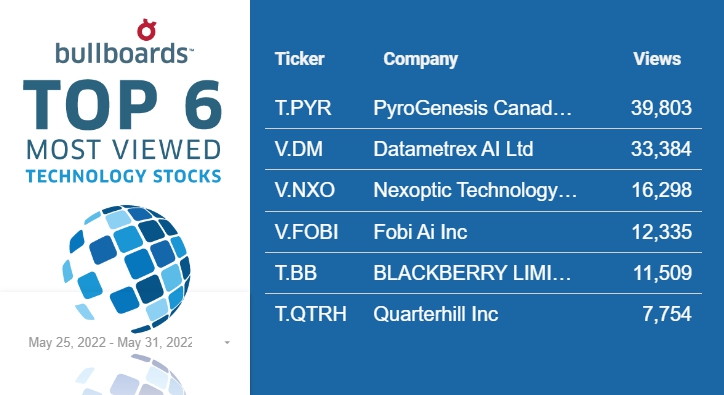

A provider of intelligent security software and services to enterprises and governments, BlackBerry Limited (TSX: BB, Forum) provided an update this week on the pending sale of its non-core patent assets to Catapult IP Innovations for $600 million.

As this week has shown, you never know what to expect when it comes to each sector’s performance, or the general market. Investors should stay as up to date as possible, and for the latest on small-cap stock movements, there’s no better place than the Stockhouse Bullboards. For previous editions of Buzz on the Bullboards: click here.