Acting as both the precious metal and commodity, silver has been a top performer in 2022.

New applications for silver have been emerging, from electric vehicles and solar panels, leading to a scenario where a metal that was essentially a by-product is growing on its own. Even in the face of an incoming economic slowdown, many experts in this space believe that silver is a part of the green transition and is not going anywhere.

The outlook for green technological and critical metals is very bright and mining projects are going to become more and more valuable because they are getting to be more and more difficult to explore. From the supply side, the discovery to output period has slowed down significantly. Investors who want to make a move in this space should act soon, as the upward pressure on prices for metals like silver and copper is going to be quite significant.

For those looking for an emerging opportunity, Alianza Minerals Ltd. (TSXV: ANZ) is an exciting story to talk about.

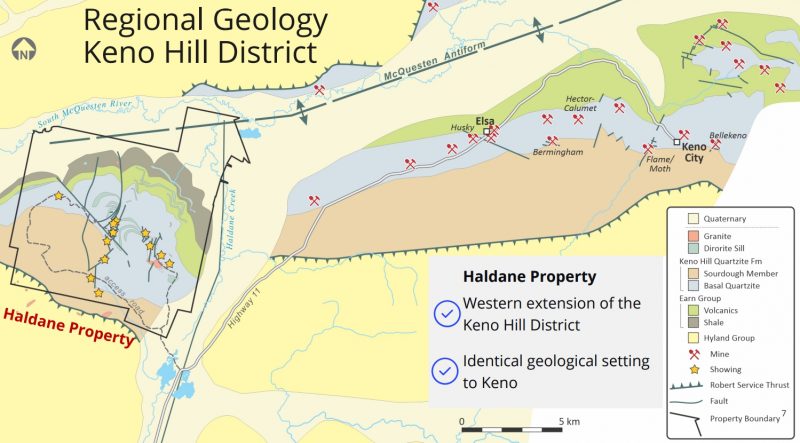

With ongoing exploration programs at its 100% owned flagship, Alianza operates the Haldane Silver Project in the prolific Keno Hill District, Yukon Territory.

A well documented “elephant district” for silver, the Keno Hill District is home to numerous high-grade deposits, from 1913 to 1989, it produced roughly 220 million ounces of silver at a grade of 1,150 grams per ton. Keno Hill represents one of the world’s highest-grade silver camps and is Canada’s second-largest silver producer.

Let’s dig a little deeper into this project and see what it has to offer ….

Haldane Silver Project:

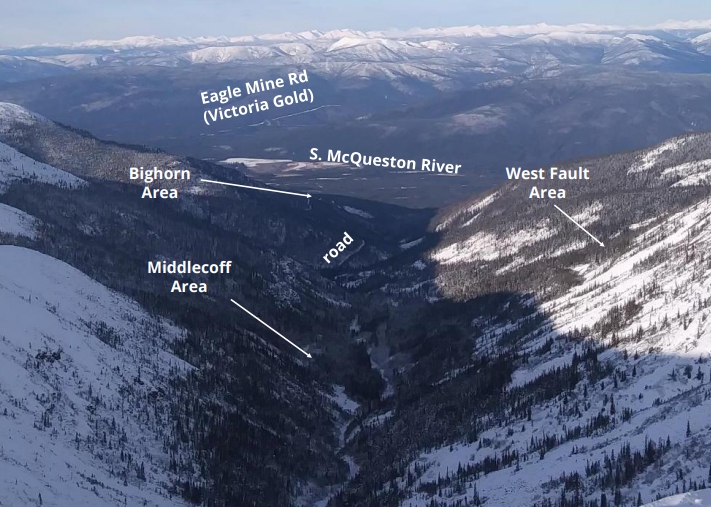

Located in the traditional territory of the Na -Cho Nyak Dun First Nation, the 85 sq. km. (8,579-hectare) Haldane project is in the western portion of the Keno Hill silver district, 25 kilometres west of Keno City, Yukon. A relatively under-explored area, work at Haldane is targeting extensions of historical high-grade silver production on the property as well as recently defined targets, such as the West Fault, in new areas of the property.

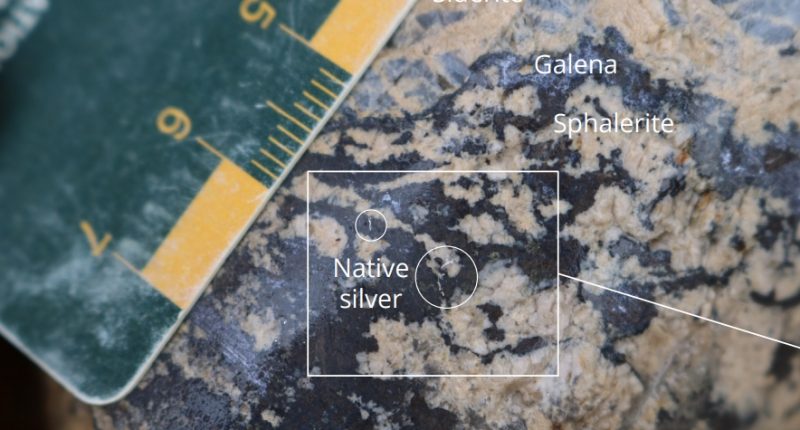

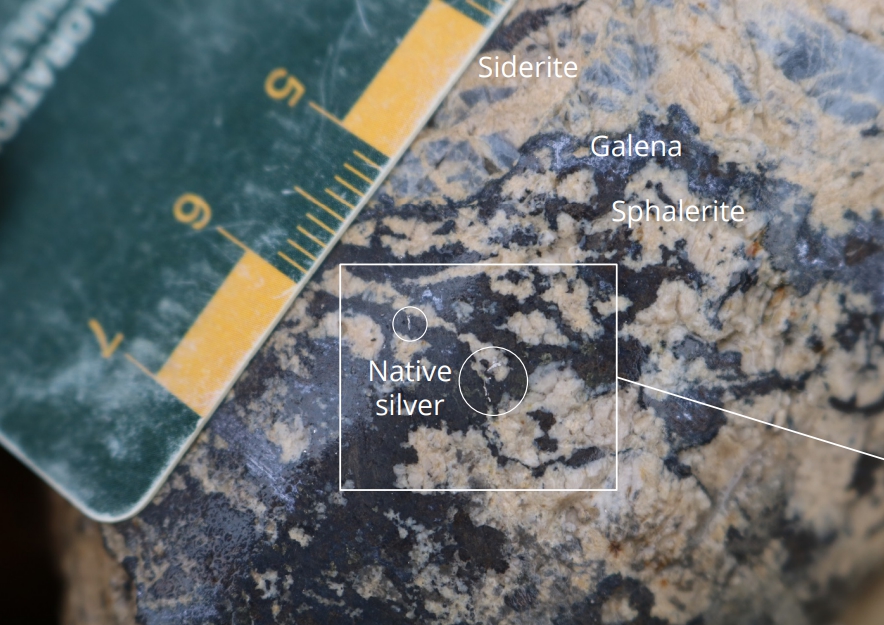

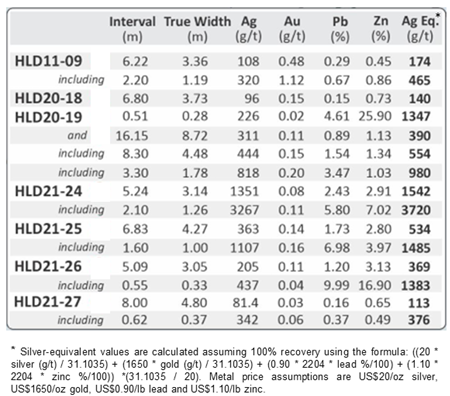

The 2021 drilling campaign at the Haldane high-grade silver property focused on the West Fault Complex target where a strong vein-fault system with high-grade silver mineralization is being defined. These results added 80 metres of trend to the high-grade silver vein mineralization at West Fault.

Following up on the initial success in hole HLD20-19, HLD21-25 has further extended the West Fault mineralization by 62 metres down dip with an intersection averaging 1,107 g/t silver, 6.98% lead and 3.97% zinc (1,485 g/t silver-equivalent) over 1.60 metre (estimated true width of 1 metre).

Exploration at Haldane is targeting extensions of historical high-grade silver production on the property as well as recently defined targets, such as the West Fault, in new areas of the property.

Jason Weber, P.Geo, President and CEO of Alianza sat down with Caroline Egan to discuss the program results.

“We continue to expand the West Fault Complex mineralization at Haldane, with our third high-grade silver intersection. We have now extended the known mineralization 62 metres down dip in this hole and in our previously released HLD21-24, we have extended mineralization 75 metres down dip and approximately 50 metres along strike of HLD20-19. The additional holes at West Fault Complex are showing that it is a large structure with excellent potential for additional high grade silver mineralization.”

Table 1 – West Fault Target Drill Intercepts

Earlier this year the company filed a National Instrument 43-101 (NI 43-101) compliant technical report the project, noting that drilling revealed two splays of strongly mineralized veins within the West Fault Complex. The next phase of drilling will test the West Fault Complex vein mineralization to the southwest and down dip to determine the extent of high-grade silver mineralization at this target. This program is planned to commence in the summer with a minimum of 2,000 metres of drilling planned. In addition to the high priority West Fault, plans for additional holes at the Middlecoff and the recently discovered Bighorn targets are being drawn up as well. Program details will be made available once finalized.

The Keno Hill District:

More than 217 million oz of silver was produced from 1913-1989 in the district, with an average production grade of 1,149 g/t Ag (37 oz/t), 5.62% Pb, 3.14% Zn.

Often considered a silver district, companies who operate in the area have noted that once you take a step back and observe the rocks that host these deposits, precious metals can be found at nearly any turn.

A neighbour of Alianza, Banyan Gold Corp. (TSXV: BYN) recently released an updated mineral resource estimate for its AurMac Property located in the Mayo Mining district, which comprises a total inferred mineral resource of 3,990,000 ounces of gold.

Nearby in the district, Alexco Resource Corp. (TSX: AXU) reported results from Bermingham drilling, with composite assays to 1,681 g/t Ag over 20.37 metres, true width.

It has long been one of Canada’s top mining districts, with more than a century of history and much like the famous Klondike gold rush, Keno Hill set off its own stampede of sourdoughs and eventually produced more riches than even the Klondike itself.

The famously rich Keno Hill silver deposit made the Yukon one of the world’s leading silver producers and backstopped the territorial economy for decades. For those that want to know more about this piece of Canada’s history, the book “Hills of Silver: The Yukon’s Mighty Keno Hill Mine” by Dr. Aaro E. Aho has a great story to tell. CEO Weber added that Dr. Aho even did some work at Haldane in the 1960s and he and his team still use his underground mapping and data to target drilling.

From 1918-2018, only sporadic work programs focused on specific areas of the property were undertaken in the Mt Haldane area. Alianza’s approach – step back and assess the entire property to prioritize targets for follow up.

Meet The Team:

Jason Weber, P.Geo – President & Chief Executive Officer, and Director is a geologist with more than 25 years of experience in the minerals exploration industry.

He was President and CEO of Kiska Metals Corporation, prior to Alianza, a junior exploration company focused on the exploration and development of the Whistler gold-copper porphyry project in Alaska. He was also President and CEO of Rimfire Minerals Corporation from 2007 to 2009.

Rob Duncan, M.Sc. – VP Exploration has more than 30 years of experience in mineral exploration with a wide range of companies, from major producers such as Rio Tinto and Inmet Mining to junior explorers. He has held senior management positions at several junior explorers exploring throughout the North American Cordillera, Canadian Shield and Eastern Europe on a wide variety of deposit types including orogenic gold, porphyry copper (gold), VMS, intrusion related gold, and epithermal gold-silver systems. He also has over ten years of management experience specifically with prospect generator companies, having held the position of Exploration Manager at Rimfire Minerals and VP Exploration and Project Development at Evrim Resources.

Marc G. Blythe, M.B.A, P.Eng. is also a director with the company and has a Master of Business Administration from La Trobe University in Melbourne and a Bachelor of Mining Engineering degree from the Western Australian School of Mines. Mr. Blythe was Vice President, Mining of Almaden Minerals Ltd from 2006 to 2011 and President & CEO of Tarsis Resources Ltd. He was also the Vice President of Corporate Development at Nevsun Resources Ltd. Prior to that, he was Corporate Senior Mining Engineer for Placer Dome Inc. based in Vancouver from 2004 until 2006, where he completed internal and external mine evaluation, including advising on potential acquisitions and mining technology implementation.

Mark T. Brown, CPA – CA – Executive Chairman is a Chartered Accountant with extensive experience in mining and minerals exploration. He was controller of two operating gold mines and founder of Rare Element Resources which he took from inception to listing on NYSE-Amex exchange. He is a partner in Pacific Opportunity Capital Ltd., a financial consulting and merchant banking firm active in venture capital markets in North America.

On the horizon:

In a one-on-one interview on the project, CEO Weber explained that the company is at the stage where now that the team is stepping out on the project and formulating a deposit at the West Fault, a clear path emerges for where the company is headed for the rest of the year.

“We can show that there are other targets on the property that have the same potential as West Fault, then I think now people will see that there is a critical mass there.”

Instead of talking about one significant deposit, we would like to be talking about the potential of two or three deposits. With a goal to find a 15-to-25-million-ounce deposit, the next six months is about building on the 100 by 90 metre footprint, expanding that, and then showing through some solid drill intersections at other targets, investors will see a clear progression toward a bright future for the whole project.

Investment summary:

Given the grades reported by the company, the future is bright for Alianza Minerals. The company is just beginning to tap into its resource at the Haldane property.

Analysts predict that silver will continue to perform well in 2022 and as we move into a much stronger metals market, Alianza Minerals Inc. is very well positioned.

To keep up with what’s happening around the company, visit alianzaminerals.com.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.