- VR Resources (VRR) has closed the first tranche of its previously announced non-brokered private placement for gross proceeds of $1,031,000

- In this first tranche, VR Resources issued 6,443,750 units for $0.16 per unit

- Each unit consisted of one common share of the company and one-half of a common share purchase warrant

- VR plans to use the net proceeds of the financing for its mineral exploration business

- VR Resources is an established junior exploration company focused on greenfields opportunities in critical metals, copper and gold

- VR Resources Ltd. opened trading at $0.145 per share

VR Resources (VRR) has closed the first tranche of its non-brokered private placement for gross proceeds of $1,031,000.

In this first tranche, VR Resources issued 6,443,750 units at a price of $0.16 per unit.

Each unit consisted of one common share of the company and one-half of a common share purchase warrant.

Each whole warrant will entitle the holder to acquire one additional common share at an exercise price of $0.25 per common share for a period of 18 months from the closing date of the financing.

In connection with the financing, the company paid cash fees of $11,940 to certain finders.

The securities that were issued under the financing are subject to a four-month hold period under Canadian securities law.

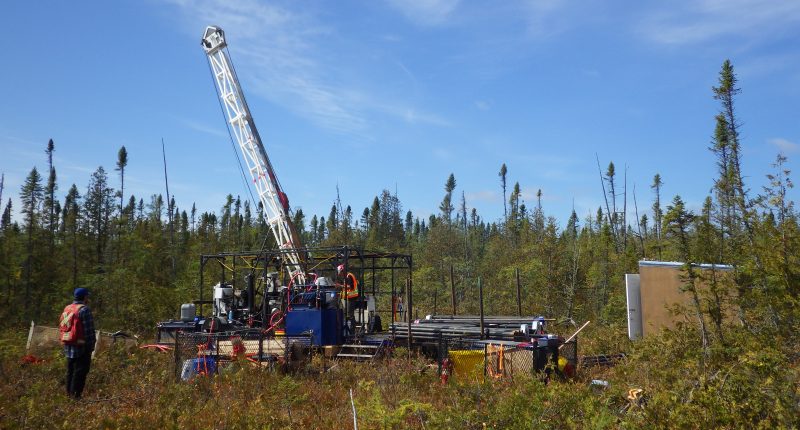

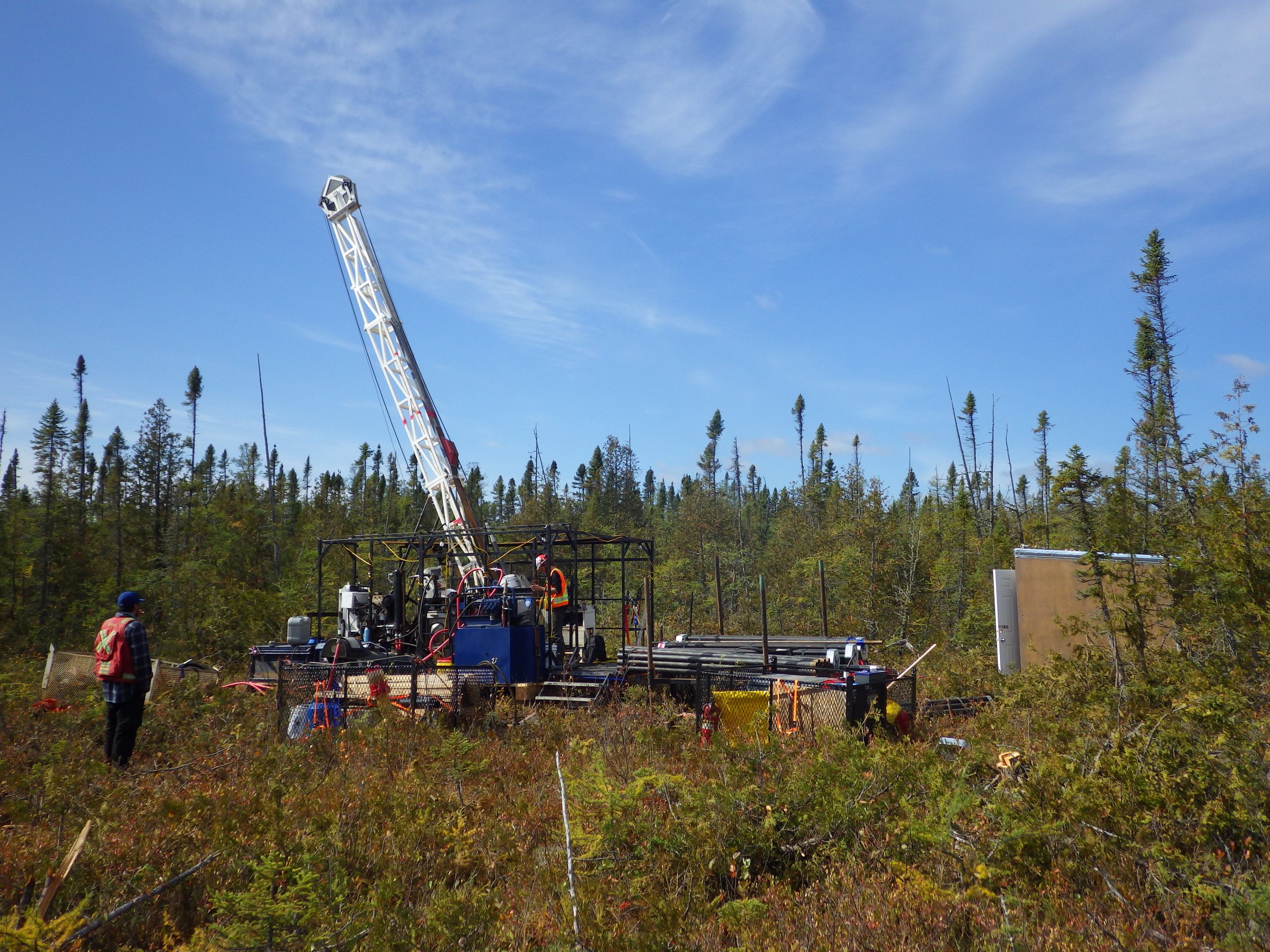

VR plans to use the net proceeds of the financing for its mineral exploration business, including active exploration on various mineral properties held in Ontario, Canada, and Nevada, USA.

VR Resources is an established junior exploration company focused on greenfields opportunities in critical metals, copper and gold.

VR Resources Ltd. opened trading at $0.145 per share.