- Kenorland Minerals (KLD) has arranged a non-brokered $6.3 million private placement

- The company will issue 9,000,000 common shares at $0.70 per share

- The company reserves the right to increase the number of shares issued by up to 2,000,000 for total gross proceeds of up to $7.7 million

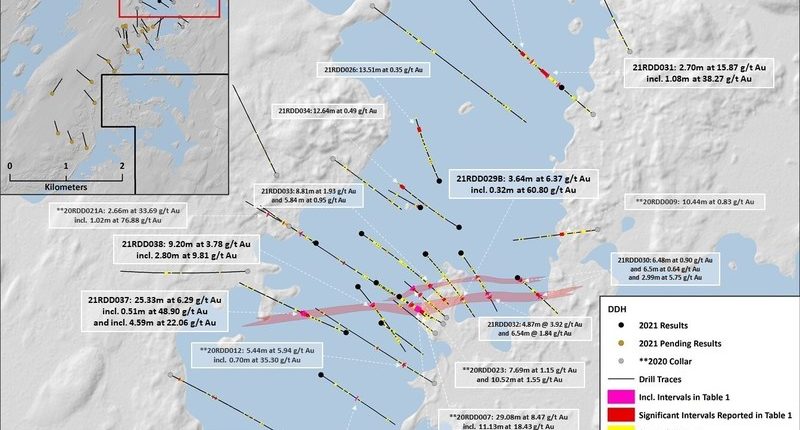

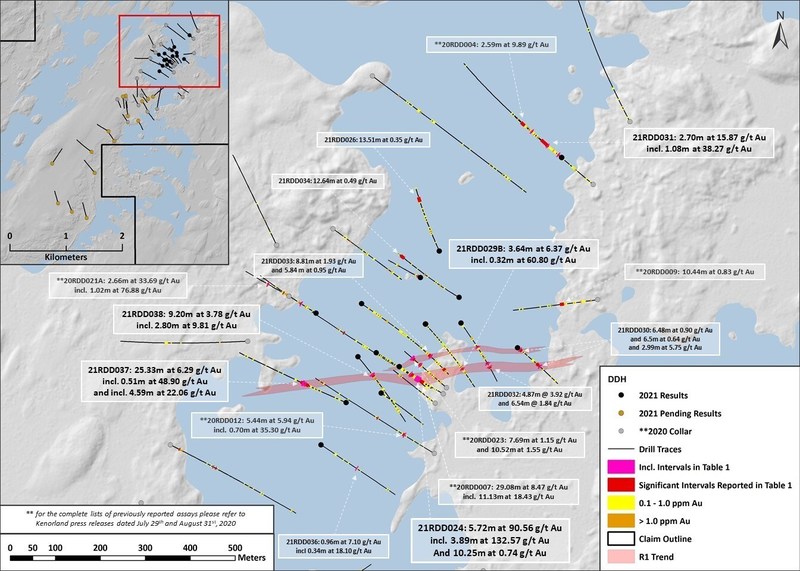

- The proceeds will be used to fund exploration activities on the company’s existing projects

- Kenorland Minerals is a mineral exploration company based in British Columbia

- Kenorland Minerals Ltd. (KLD) opened trading at C$0.69

Kenorland Minerals (KLD) has arranged a non-brokered $6.3 million private placement.

The company will issue 9,000,000 common shares at a price of $0.70 per share.

The company reserves the right to increase the number of shares issued by up to 2,000,000 for total gross proceeds of up to $7.7 million.

The proceeds will be used to fund exploration activities on the company’s existing projects and for general working capital.

The closing of the placement is subject to receipt of all necessary regulatory approvals, including the acceptance by the TSXV.

Kenorland Minerals is a mineral exploration company based in British Columbia. The company currently holds four projects in Quebec where work is being completed under joint venture and earn-in agreement from third parties.

Kenorland Minerals Ltd. (KLD) opened trading at C$0.69.