- VR Resources (VRR) has announced a non-brokered flow-through private placement for gross proceeds of up to $900,000

- The company will issue 5,000,000 units for $0.18 per unit

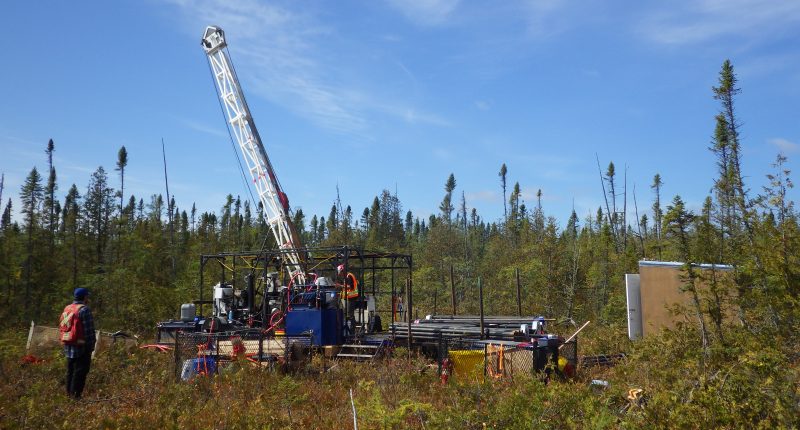

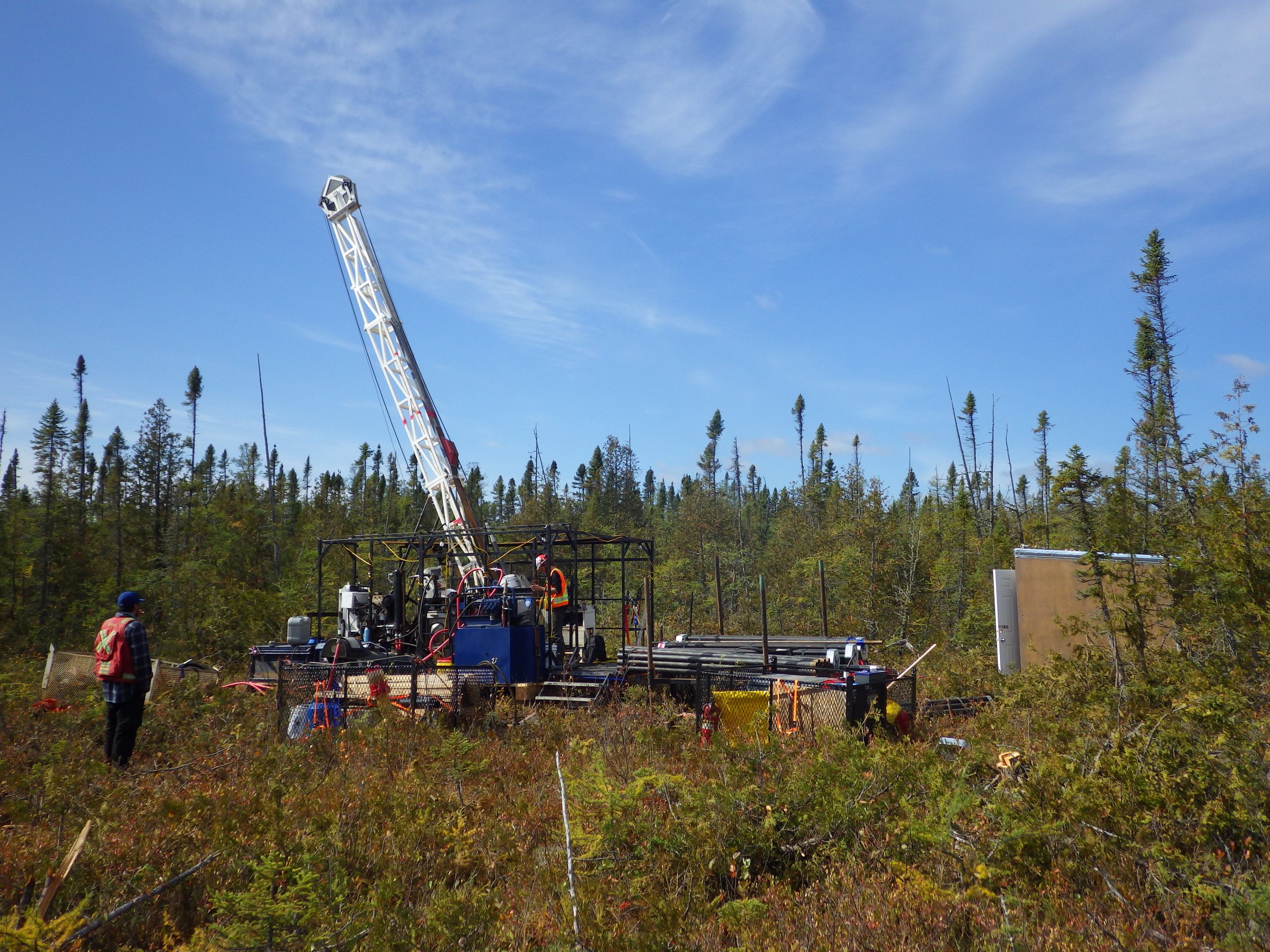

- VR will use the gross proceeds for a drill program planned for this fall on its Hecla-Kilmer critical metals discovery in northern Ontario

- The offering is expected to close on or before September 23, 2022

- VR is a junior exploration company focused on greenfield opportunities in critical metals, copper and gold

- VR Resources Ltd. (VRR) opened trading at C$0.15

VR Resources (VRR) has announced a non-brokered flow-through private placement for gross proceeds of up to $900,000.

The company will issue 5,000,000 units for $0.18 per unit.

Each unit will consist of one flow-through common share and one-half of a non-flow-through common share purchase warrant. Each whole warrant will entitle the holder to acquire one additional non-flow-through common share for a period of 18 months from the closing date.

VR will use the gross proceeds of the financing for mineral exploration on its Hecla-Kilmer property in northern Ontario and, more specifically, for a drill program planned for this fall on its Hecla-Kilmer critical metals discovery.

The offering is expected to close on or before September 23, 2022. All securities issued will be subject to a statutory four-month hold period.

VR is a junior exploration company focused on greenfield opportunities in critical metals, copper and gold.

VR Resources Ltd. (VRR) opened trading at C$0.15.