Stratabound Minerals Corp. has just released its PEA for the Company’s flagship Fremont Gold Project, located in California’s Mother Lode Gold Belt.

Economics for the Project are robust, even with conservative price assumptions. And this comes at a time that gold assets are very attractively priced for investors.

On February 15, 2023, Stratabound (TSXV:SB/OTCQB:SBMIF) released the PEA for its Fremont Gold Project, including the following highlights.

- After-tax net present value (NPV) of USD$210 million, discounted at a 5% rate

- An IRR of 21% and payback in 4.2 years, at an assumed gold price of USD$1,750/oz

- Average annual production of 118,000 ounces of gold over a projected 11-year mine life (1,303,000 ounces gold in total)

- Average annual cost of USD$872 per ounce (AISC of USD$1,082oz)

- Average feed grade of 2.4 g/t gold

- Initial cap-ex of USD$203 million

The Fremont Gold Project is 100%-owned by Stratabound Minerals, following its August 2021 acquisition of California Gold Mining Inc. Historically, the Mother Lode Gold Belt has yielded over 50 million ounces of gold.

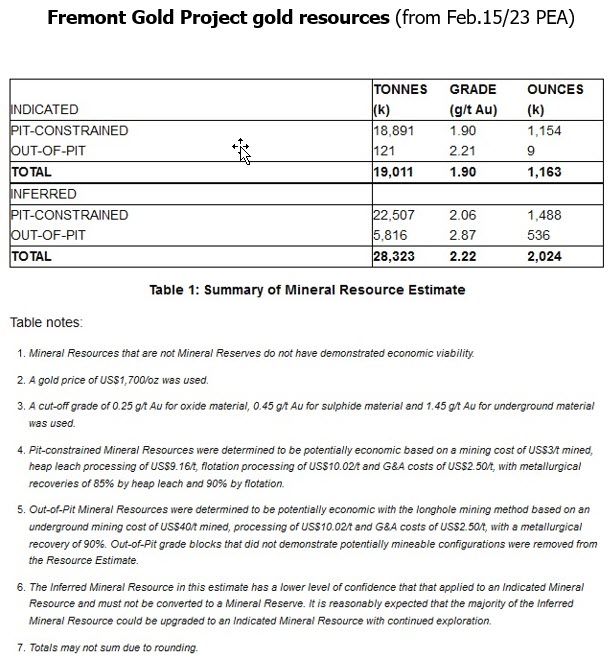

While the headline numbers from this PEA look solid, the investment opportunity becomes a lot more exciting if investors scratch below the surface. This starts with a look at the Project’s gold resources.

Kim Tyler, President and CEO of Stratabound, provided investors with greater details here.

“This PEA provides a solid conservative base case and a clear path forward with plenty of runway to build and improve upon. Only 35% of mineralized strike and two of four mineralized zones have been defined and evaluated to date. Most notably, the opportunity remains to expand the at-surface oxide/heap leach potential.”

Translation: not only are the economics for Fremont very likely to improve through significant resource expansion potential, the economic quality of this gold deposit could also improve.

Tyler explained this further in the PEA announcement.

“Oxide Heap Leach is a conventional cost-efficient processing method already proven and functioning at Equinox Gold’s successfully operating gold mines in California.”

Heap leaching is a highly efficient method of mining gold that also requires very low cap-ex to launch. And it’s already been proven in other gold mining in the district.

The mine plan for Fremont starts with three “small oxide starter pits and heap leach in year 1”. As noted above, these “small starter pits” could quickly become significantly larger.

The overall upside for gold production and mine life at the Fremont Project is massive.

Experienced mining investors know that while mining companies may not be able to (literally) bank on their Inferred resources that substantial mineralization underlies such estimates. Further in-fill drilling will significantly increase the Project’s Indicated Resource, the only variable is by precisely how much.

That’s “upside #1” for investors assessing the Fremont Gold Project. However, there is possibly even more blue-sky potential for investors in terms of the conservative base-price assumption of the PEA for the price of gold: USD$1,750 per ounce.

Today, the price of gold has been (temporarily) pushed back all the way down to ~$1,840 per ounce. But as recently as a year ago, gold was perched above $2,000 per ounce.

Had Stratabound’s PEA been released a year earlier, almost certainly the “assumed” price for gold would have been substantially higher. In turn, that would have significantly boosted both the estimated IRR for the Fremont Project and the NPV.

Are there reasons for investors to expect the price of gold to return to previous highs (and likely set new records)? Yes, pick your favorite.

- 2022 was record year for central bank gold buying, WGC confirms

- Chinese Gold Imports Hit Highest Level Since 2018

- GOLD REVALUATION: BRICS Currency Will Feature Significant Gold Backing

As the value of our central bank-created fiat currencies crumbles due to central bank-created inflation, these monetary witch doctors are dumping their own paper, and buying gold – at a record rate.

China has not only led the way in terms of national gold-buying, overall gold demand in China is once again spiking as China’s economy re-opens.

Meanwhile, as the USD increasingly falters in its role as (sole) “reserve currency”, we are quickly moving to a world of multiple reserve currencies – with gold expected to play a premier role in the first new reserve currency that is expected in the near future.

Today, however, gold assets are being priced in the marketplace based upon $1840/oz gold.

Throw in the fact that the global economy is teetering on recession and the world may (literally) be “on the brink” of World War III, and savvy gold analysts are expecting a major near-term rebound in the price of gold.

At a higher price of gold, Stratabound Minerals (and its Fremont Gold Project PEA) is a sleeper for investors: conservative economics, but with enormous upside potential.

DISCLOSURE: This is a paid article by The Market Herald.